Last week was marked by several key economic developments globally. In the United States, data indicated improvements in the labor market and a sharp drop in oil inventories, alongside positive momentum in both manufacturing and services PMI. Housing indicators showed mixed results, while consumer spending declined, despite increases in core PCE inflation and durable goods orders. The GDP contracted slightly, reflecting some underlying weakness. In the Eurozone, manufacturing activity remained in contraction territory, while services showed slight improvement. The UK posted modest gains in both sectors, whereas Australia and Japan saw continued economic expansion. Meanwhile, Canada recorded a decline in GDP, though inflation remained stable. Overall, global economic performance continues to vary, with divergent signals around growth, inflation, and consumer confidence.

Market Analysis

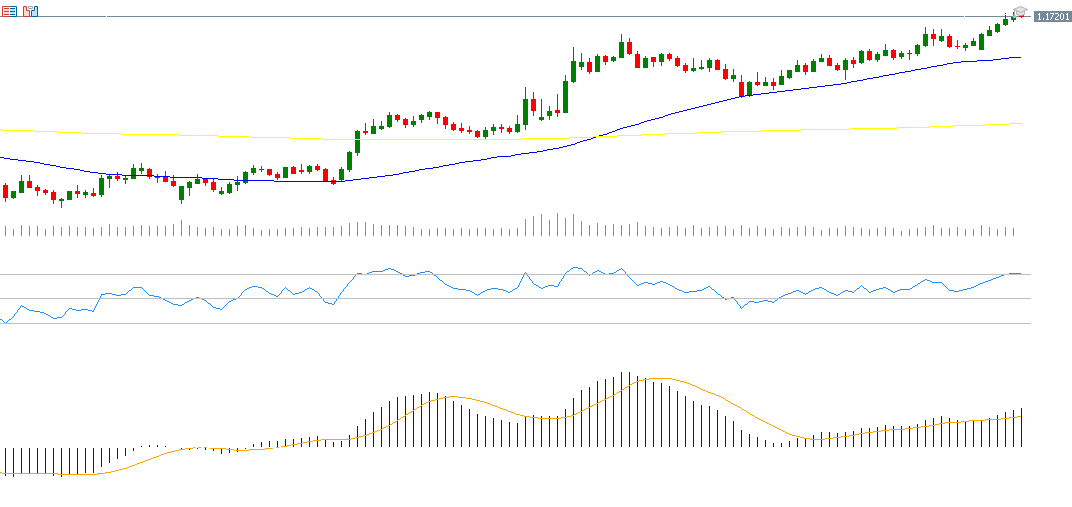

EUR/USD

The EUR/USD pair reached 1.1754 on Friday, its highest level since September 24, 2021, rising approximately 6% from its May 12, 2025, low. It has gained nearly 13% year-to-date. Despite ongoing weakness in the Eurozone economy, the Euro has maintained strong upward momentum. This strength is largely attributed to a weakening U.S. dollar, which recently hit its lowest point since March 2022, and political uncertainty following President Donald Trump’s comments on expediting the replacement of Fed Chair Jerome Powell, raising concerns about central bank independence. Additionally, weak U.S. data, such as Q1 GDP contraction, has weighed on the dollar. Technically, the RSI currently stands at 33, signaling bearish momentum, supported by a bearish MACD crossover.

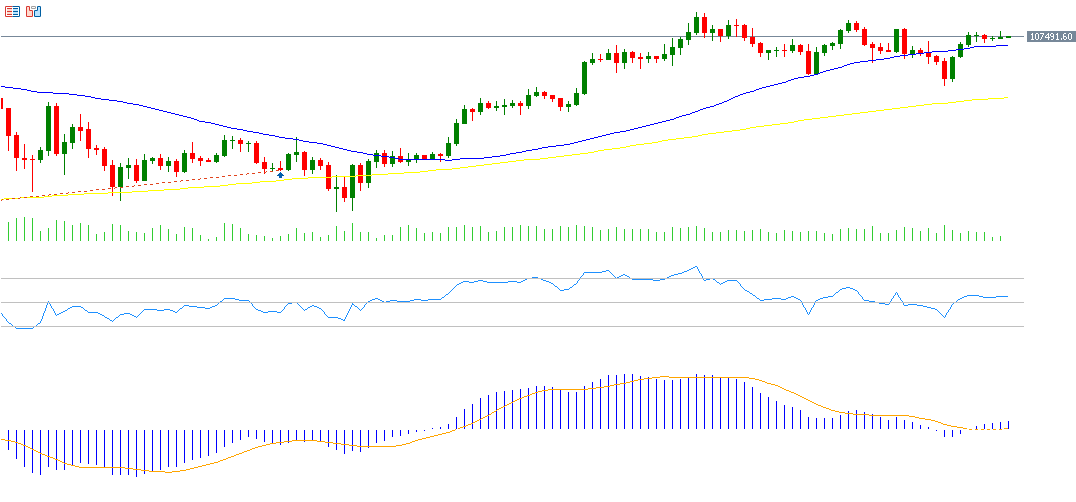

Bitcoin

Bitcoin dropped to around $98,000 on Sunday, June 22, 2025—its lowest level since May 8—amid rising geopolitical tensions and a shift away from riskier assets. However, prices rebounded sharply by 10% to around $108,500 as tensions eased. The key challenge now lies in breaking the resistance at $110,000 and surpassing the all-time high of $112,000 set in May. Bitcoin has outperformed U.S. equities this year with a 15% YTD gain. Supportive factors include easing geopolitical tensions, Texas launching the first state-funded Bitcoin reserve with a $10 million budget and growing institutional interest—including pension funds—amid positive sentiment and strong ETF inflows. The RSI stands at 58, reflecting bullish momentum, with a bullish MACD crossover confirming this trend.

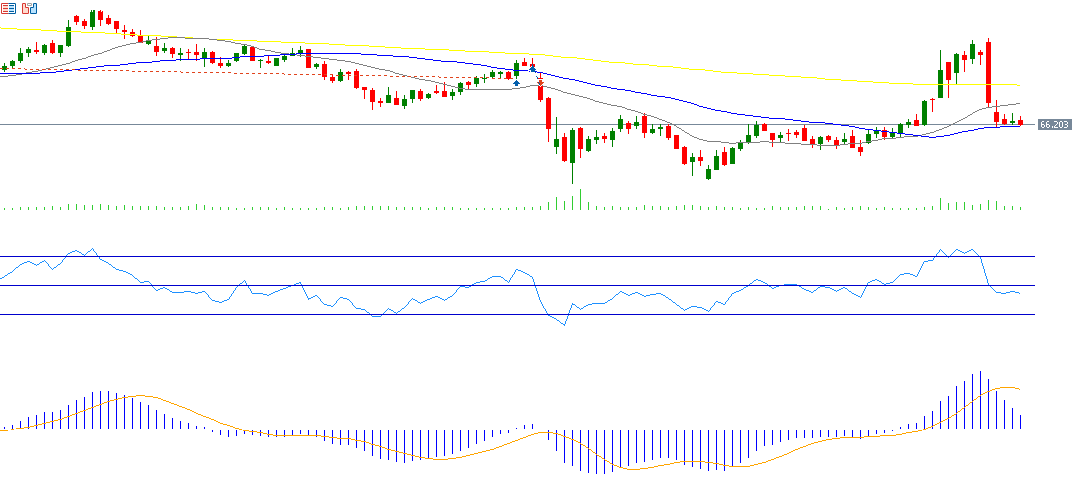

Crude Oil

Oil markets experienced sharp volatility, spiking above $80 on Monday (a high last seen in January 2025), then plunging below $67 on Tuesday before closing the week near $68. The decline was driven by easing geopolitical tensions and anticipation of the upcoming OPEC+ meeting on July 6, where a production increase is expected. Additionally, President Trump stated that China could continue purchasing Iranian oil and expressed hope that China would buy significant volumes of U.S. oil. Technically, the RSI at 47 signals weak momentum, while the MACD shows a bearish crossover, indicating downside pressure on prices.

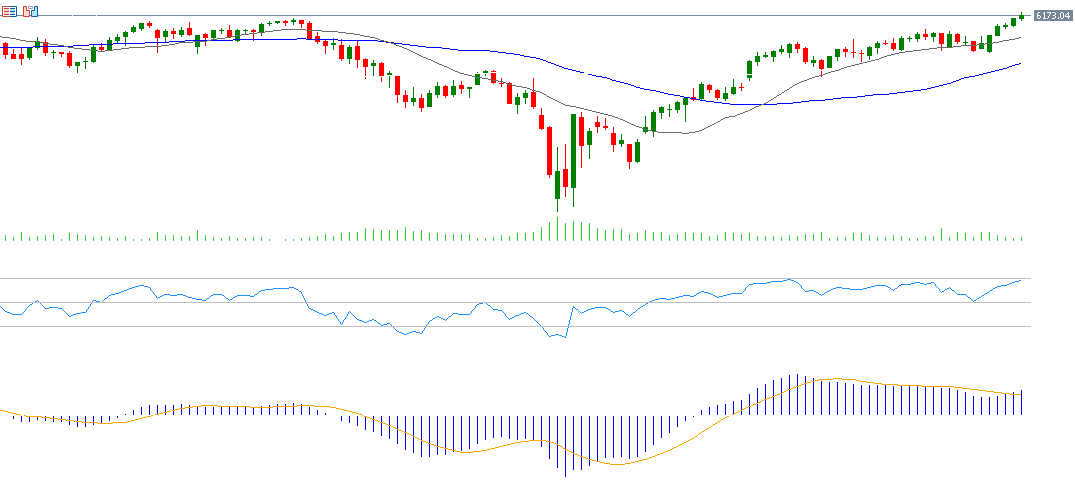

S&P 500

The S&P 500 rose 3.44% last week to a new all-time high of 6,188 points, supported by improved risk appetite, easing geopolitical and trade tensions, and falling U.S. Treasury yields. The index has gained approximately 5% YTD. The RSI currently sits at 70, suggesting strong bullish momentum, with a bullish MACD crossover reinforcing the likelihood of continued gains.

Key Events This Week

- Monday: China’s manufacturing and non-manufacturing PMIs; UK GDP data.

- Tuesday: Caixin manufacturing PMI in China; manufacturing PMIs in Australia, Japan, the UK, Eurozone, and U.S.; U.S. job openings, construction spending, and a speech by Fed Chair Jerome Powell.

- Wednesday: U.S. ADP non-farm employment change and crude oil inventories.

- Thursday: Caixin services PMI (China); services PMIs in Australia, Japan, the UK, Eurozone, and U.S.; Swiss CPI; U.S. ISM non-manufacturing PMI, factory orders, average hourly earnings, non-farm payrolls, and unemployment rate.

- Friday: Household spending (Japan); UK construction PMI; Eurozone PPI.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.