Last week witnessed notable global economic events. In the United States, the Fed minutes indicated that inflation remains the biggest risk despite the resilience of the labor market, while Jerome Powell hinted at the possibility of a rate cut during Jackson Hole, amid mixed data that included a sharp drop in oil inventories, an increase in jobless claims, and a notable improvement in manufacturing and services PMI. In the Eurozone, inflation stabilized at 2%, while industrial indicators showed slight improvement against a slowdown in the services sector. In the UK, inflation rose above expectations to 3.8%, with a decline in industrial activity and improvement in services. In Australia and New Zealand, PMIs showed strong growth, while the Reserve Bank of New Zealand cut interest rates by 25 basis points to 3.00%. In Canada, inflation fell to 1.7%. In Japan, exports and imports slowed while the core inflation rate remained at 3.1%, and PMIs showed relative improvement in manufacturing and weakness in services. Finally, in China, the central bank left its main lending rates unchanged at 3.00% for the short term and 3.50% for the long term.

Market Analysis

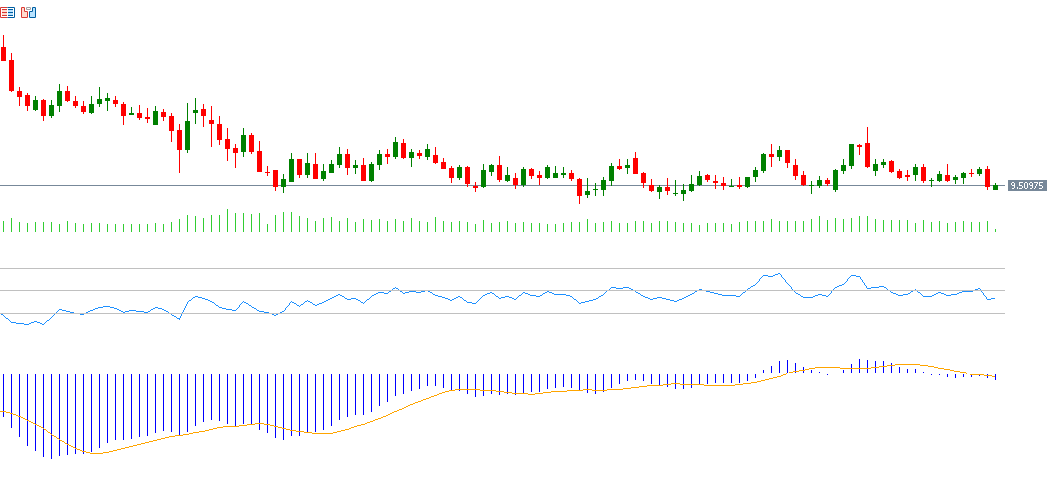

USD/SEK (U.S. Dollar / Swedish Krona)

The USD/SEK has been trading sideways for the past two months within the range of 9.3700–9.8500, searching for a clear upward or downward direction. The pair hit 9.3687 on June 12, 2025, its lowest level since April 21, 2022. It has declined about 14% year-to-date and is currently trading near 9.5500. The Swedish Krona continues to outperform G10 currencies against the U.S. dollar, followed by the euro, Swiss franc, Norwegian krone, British pound, Japanese yen, New Zealand dollar, Australian dollar, and finally the Canadian dollar. Recent Swedish economic data indicates resilience in the economy. The Relative Strength Index (RSI) currently stands at 42, reflecting bearish momentum, while the MACD shows a bearish crossover between the blue line and the orange signal line, supporting continued downside momentum.

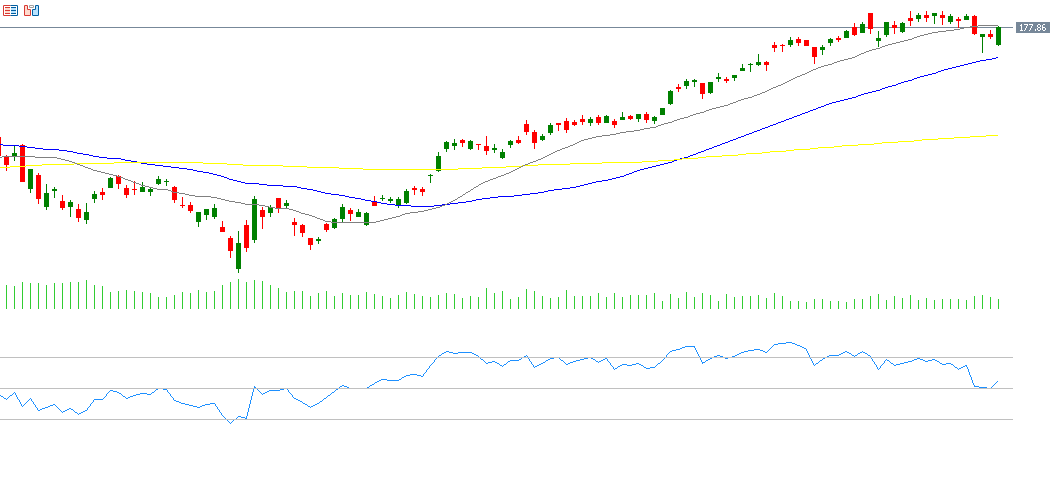

NVIDIA

NVIDIA’s stock has risen about 33% year-to-date. On Wednesday, August 27, 2025, markets await the company’s earnings release, with expectations of $1.00 EPS compared to $0.68 in the prior quarter. Revenues are forecast at $45.58 billion versus $30.00 billion previously. Attention will be on forward guidance, as estimates suggest continued positive momentum for the stock. The RSI currently reads 56, signaling bullish momentum.

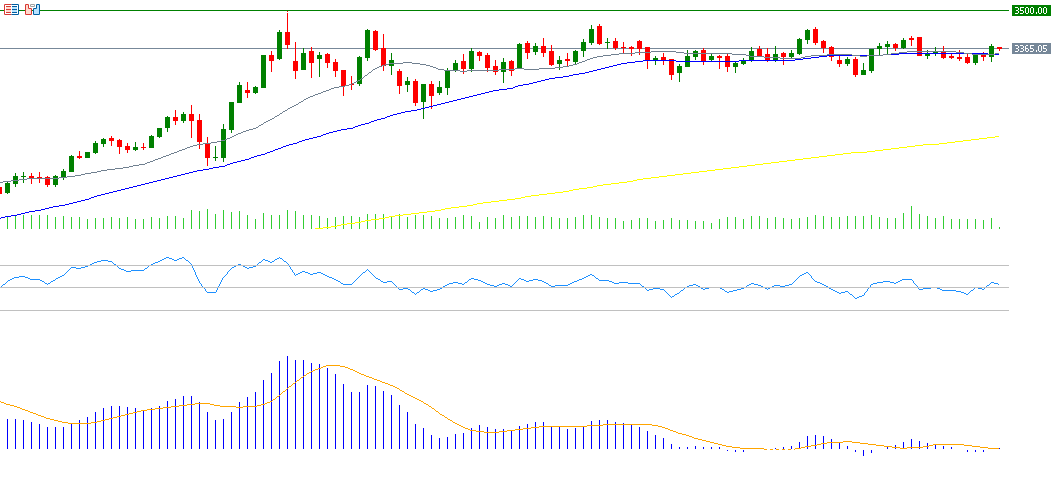

Gold

Gold prices rose around 1% last week, driven by Powell’s hint at potential rate cuts during Jackson Hole, increasing the appeal of the non-yielding metal. However, since reaching its all-time high of $3,500 on April 22, 2025, gold has been moving sideways within a range between strong support at $3,200 and solid resistance at $3,400, searching for direction. Despite this consolidation, gold remains up about 28% year-to-date. The RSI currently stands at 54, pointing to bullish momentum.

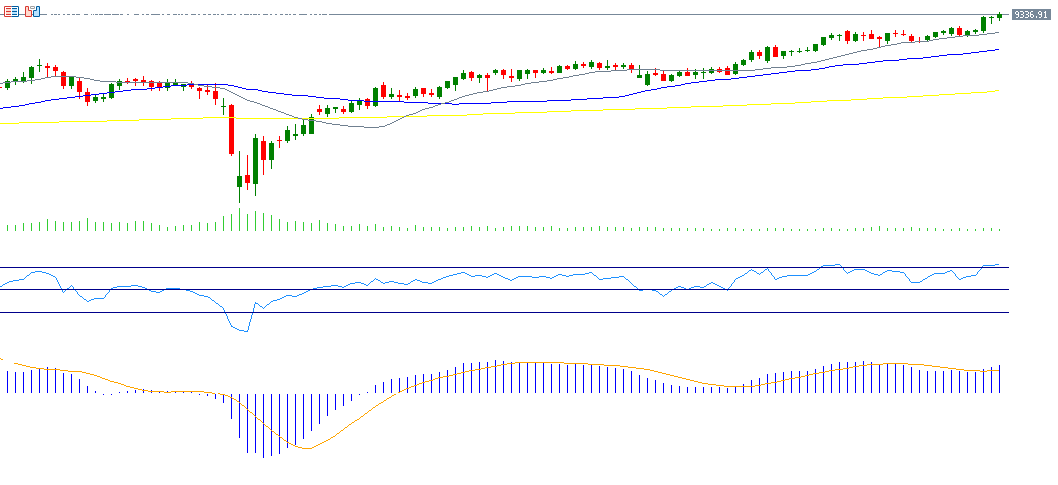

FTSE 100

The UK’s FTSE 100 index continues its rally, hitting 9,358 on Friday, August 22, 2025, its highest level ever. The index has climbed around 24% from its April 7, 2025 low of 7,533, reaching the new peak. It is up about 13% year-to-date, outperforming U.S. indices like the S&P 500 and Nasdaq 100 but still lagging behind Germany’s DAX (+22%). The RSI currently stands at 72, signaling overbought territory with strong bullish momentum, while the MACD shows a bullish crossover between the blue MACD line and the orange signal line, further supporting upward momentum.

Key Events This Week

Markets are awaiting several key economic indicators and data releases this week:

- Monday: Retail sales in New Zealand; U.S. new home sales.

- Tuesday: U.S. durable goods orders and consumer confidence.

- Wednesday: U.S. crude oil inventories.

- Thursday: Swiss GDP; U.S. GDP and jobless claims.

- Friday: Tokyo CPI (Japan); U.S. Core PCE inflation and Michigan consumer sentiment; Canadian GDP.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.