Global markets experienced a mix of divergent economic indicators last week. In the United States, there was an increase in existing home sales and the job openings index, while consumer confidence and private sector job changes declined, alongside a rise in oil inventories. Purchasing Managers’ Index (PMI) data showed mixed performance across countries; the US saw moderate growth in some industrial and service sectors despite minor contractions, whereas the Eurozone and Germany experienced slight industrial contraction accompanied by falling confidence indicators. Meanwhile, the UK recorded moderate GDP growth but a decline in the services PMI. Switzerland and Australia reported mixed data in inflation and interest rates. In Asia, Japan and China presented contrasting signals, with industrial production contracting in Japan but some PMIs in China showing growth, reflecting regional economic uncertainty and varied recovery trajectories.

Market Analysis

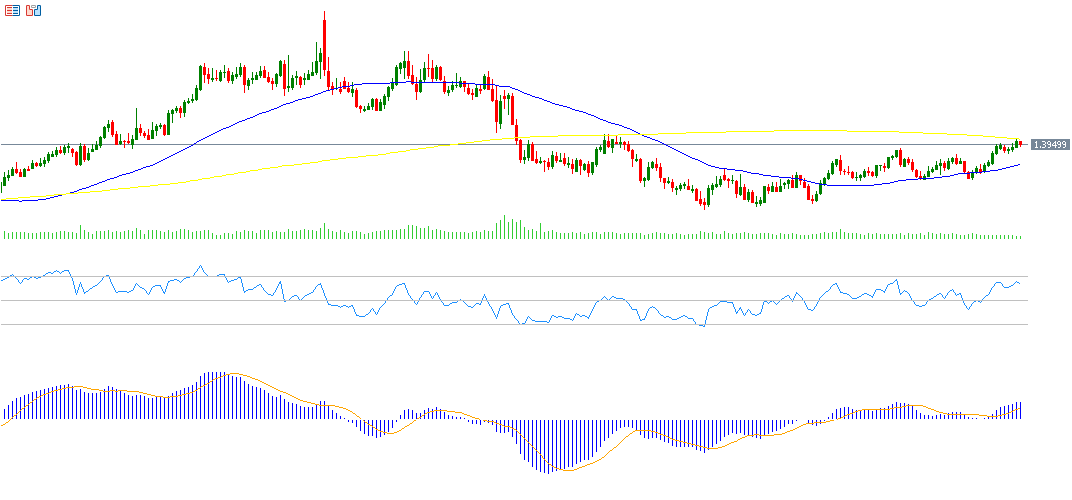

USD/CAD Pair

The Bank of Canada cut interest rates by 25 basis points at its September 17 meeting, lowering the rate from 2.75% to 2.50%, in line with market expectations. Recent Canadian economic data indicate a weakening economy.

The USD/CAD pair continues its upward trend, hitting 1.3986 on Thursday—the highest since May 16, 2025—and closing at 1.3944 on Friday. However, it remains down roughly 3% year-to-date. The Relative Strength Index (RSI) currently stands at 62, indicating positive momentum, while the MACD shows a bullish crossover between the blue MACD line and the orange signal line, supporting upward momentum for this pair.

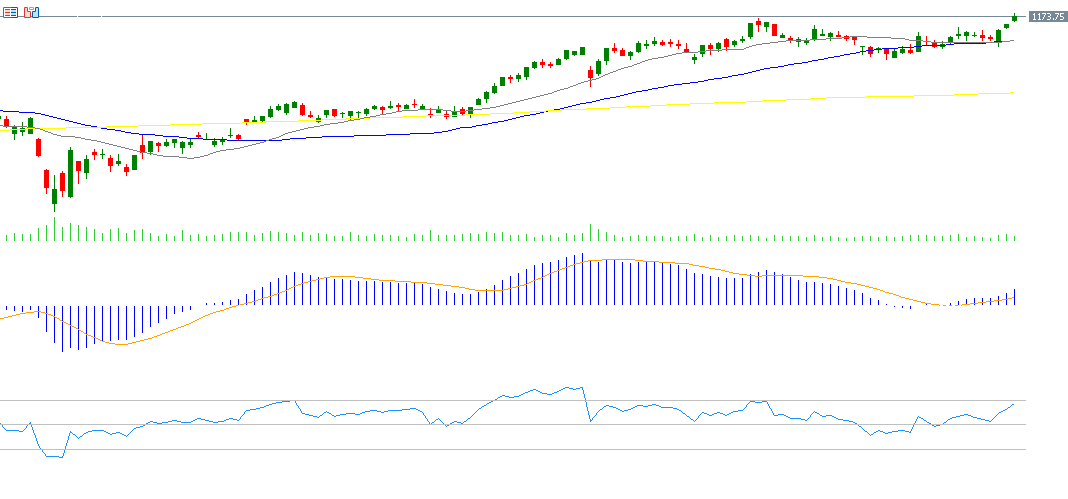

Blackrock

Blackrock’s stock has risen approximately 13% year-to-date. Markets are anticipating Blackrock’s Q3 earnings report on Friday, October 10, 2025, with expected earnings of $11.78 per share, up from $11.46 in the previous quarter. Revenue is forecast at $6.22 billion, compared to $5.20 billion previously. The RSI stands at 58, reflecting positive momentum, and the MACD shows a bullish crossover, indicating further upside potential for the stock.

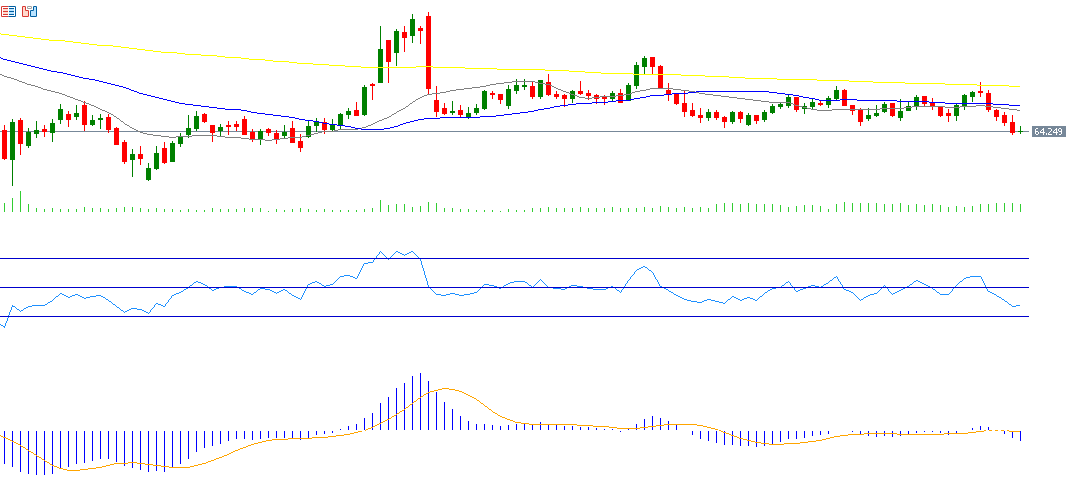

Crude Oil

Crude oil prices declined by 6.45% last week, closing at $64 on Friday—the lowest since June 2, 2025—down about 9% from the September 26 peak of $70. Key factors weighing on oil prices include US President Donald Trump’s announcement of a prospective Gaza ceasefire, reducing geopolitical risk premiums; OPEC+’s decision on October 5 to increase production by 137,000 barrels per day in November; abundant supply outside OPEC; and weakening economic data from major oil importers like China, dampening global demand. The RSI currently reads 37, indicating negative momentum, while the MACD shows a bearish crossover, confirming downward pressure on oil prices.

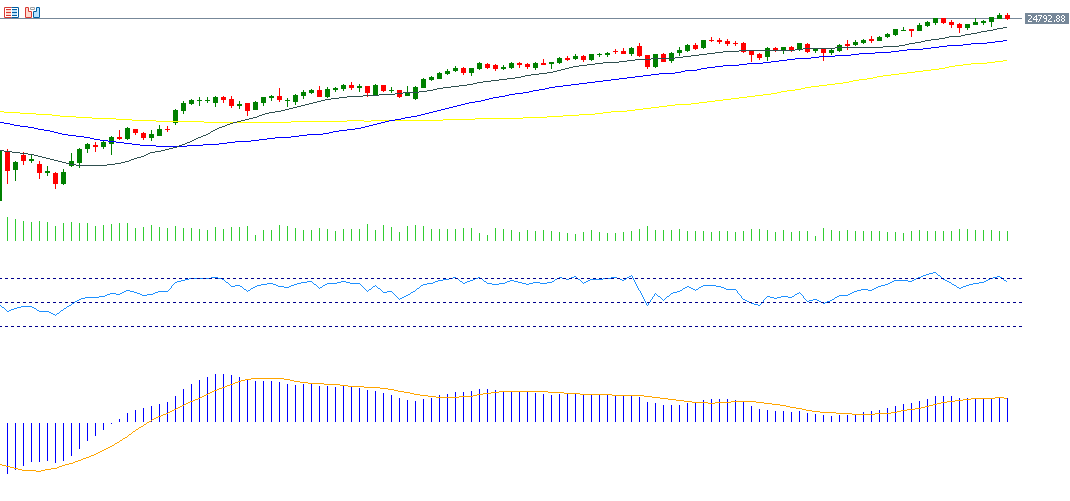

Nasdaq100 Index

The Nasdaq100 rose about 1.15% last week, closing at 24,786 on Friday, October 3, 2025, and is up roughly 18% year-to-date. The gains are largely driven by strong momentum in major tech stocks linked to artificial intelligence, led by Nvidia, which hit a new record high on Thursday with a market capitalization of $4.57 trillion. The “Magnificent Seven” (MAGS) stocks also increased about 18% year-to-date. The Philadelphia Semiconductor Index (SOX) hit record highs on Friday, rising approximately 32% since the start of the year, reflecting strong demand for AI-related products and substantial investment inflows into the sector’s infrastructure. RSI currently stands at 67, signaling bullish momentum, with the MACD showing a bullish crossover, supporting the positive trend.

Key Events This Week

Markets will closely watch several important economic indicators and events this week:

- Monday: UK Construction PMI and Eurozone retail sales.

- Tuesday: Japan household spending and Canada Ivey PMI.

- Wednesday: Reserve Bank of New Zealand interest rate decision (expected cut from 3.00% to 2.75%), FOMC meeting minutes, and US crude oil inventories.

- Thursday: Fed Chair Jerome Powell’s speech regarding the future path of interest rates, and US initial jobless claims data.

- Friday: New Zealand Business PMI release.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.