Last week in the United States witnessed several important economic developments. On September 17, the Federal Open Market Committee decided to cut interest rates by 25 basis points, bringing the range to 4.00%–4.25%, in line with market expectations. A key highlight from the “dot plot” forecast was the indication of a possible additional 50 basis points cut in interest rates during this year. Federal Reserve Chair Jerome Powell, in his press conference, stated that the main driver behind the rate cut was the risks facing the labor market, while also noting that prices could rise due to tariffs over the current and coming years. He further explained that future interest rate decisions would depend on incoming economic data, which markets interpreted as a cautious rather than highly dovish tone.

Regarding economic data, unemployment claims declined better than expected, alongside a sharp drop in crude oil inventories. The New York industrial activity index contracted less than anticipated. Industrial production showed slight growth, and retail sales increased monthly, surpassing expectations, with a notable rise in core retail sales. Finally, the Philadelphia manufacturing index registered strong growth, exceeding prior forecasts.

In the Eurozone, the consumer price index showed moderate growth with mixed industrial production results. The Bank of England kept interest rates unchanged amid stable unemployment and moderate retail sales growth. Switzerland experienced a contraction in the producer price index, while Canada saw limited consumer price growth alongside declining retail sales. Australia reported a drop in employment with stable unemployment rates, and New Zealand recorded a contraction in GDP. Japan maintained interest rates with declines in import/export indicators and consumer prices. China showed declines in industrial production and retail sales, a slight rise in unemployment, and a decrease in fixed investment, reflecting a slowdown in global economic growth.

Market Analysis

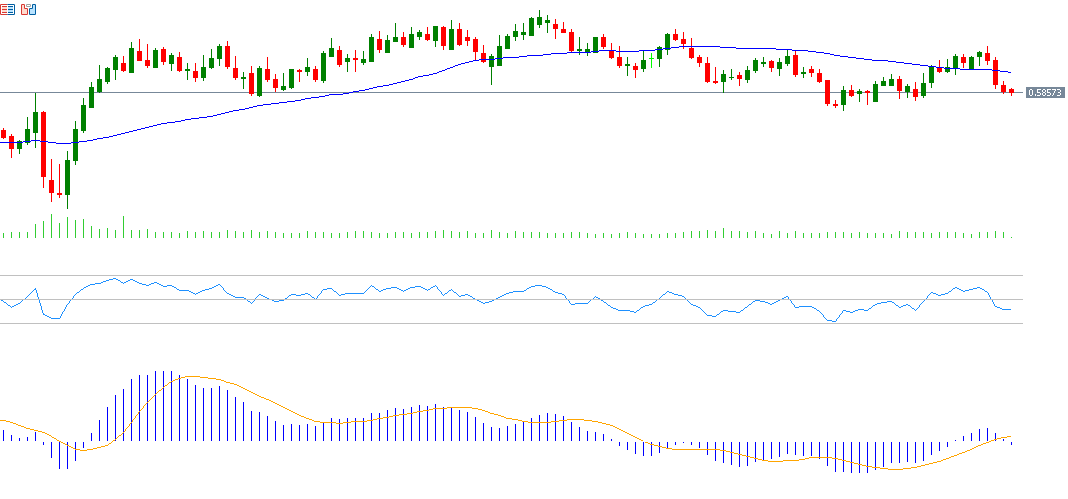

NZD/USD Currency Pair

The New Zealand dollar weakened against the U.S. dollar, falling to 0.5854 today—its lowest level in two weeks—down about 2% from the September 17 high of 0.6008. However, it remains approximately 5% higher since the start of the year. Recent New Zealand economic data reveal weakness, including a GDP contraction in Q2, declining business PMI, and weakening consumer confidence. A key factor pressuring NZD/USD was the broad strength of the U.S. dollar despite the Federal Reserve’s 25 basis point rate cut as expected. The “dot plot” forecasts a possible additional 50 basis point cut this year. Fed Chair Jerome Powell’s comments hinted that prices might rise due to tariffs over the next two years, and that future rate decisions will be data-dependent, which the market viewed as a somewhat cautious stance rather than fully dovish. The Relative Strength Index (RSI) currently stands at 41, indicating bearish momentum for NZD/USD. The MACD shows a bearish crossover between the blue MACD line and the orange signal line, signaling negative momentum.

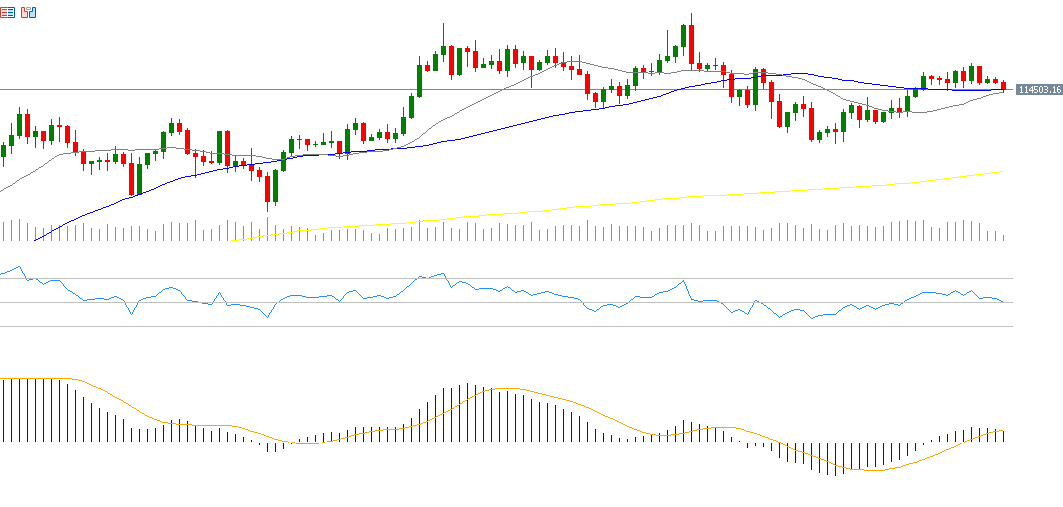

Bitcoin

Bitcoin prices reached an all-time high of approximately $124,500 on Thursday, August 14, 2025, before retreating to $107,300 on September 1. Since the beginning of the year, Bitcoin has gained about 24%, outperforming U.S. stock indices, and currently hovers around $116,000. Despite price fluctuations, Bitcoin remains attractive, especially since it is trading above the key psychological level of $100,000. The upward trend appears likely to continue. Supporting factors include the Fed’s recent 25 basis point rate cut as expected, projections of an additional 50 basis point cut this year, continued inflows into Bitcoin-related ETFs, and increasing risk appetite among investors—particularly large public companies holding crypto assets, as well as private firms, governments, ETFs, and individuals adding Bitcoin to portfolios for diversification amid strong optimism about the industry’s future. The RSI currently reads 56, indicating bullish momentum for Bitcoin. The MACD shows a bullish crossover between the MACD line and signal line, supporting the upward trend.

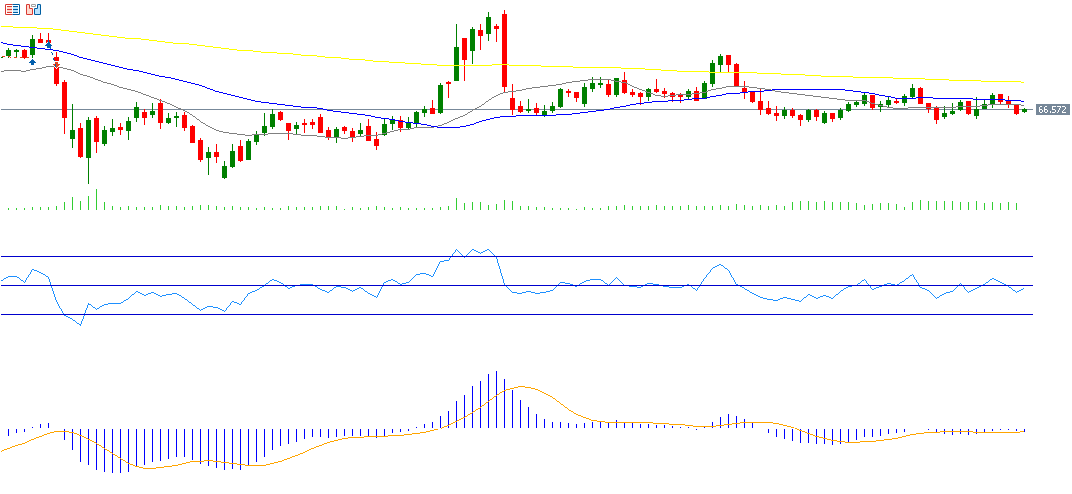

Crude Oil

Since early August, crude oil prices have traded between $65 and $70 per barrel, closing Friday below $67. The market appears range-bound, given the current uncertainty affected by mixed factors keeping prices stable at these levels. Oil prices have declined about 11% year-to-date. Positive factors include market expectations of two more Fed rate cuts this year, ongoing geopolitical tensions between Russia and Ukraine with continued Ukrainian strikes on Russian energy infrastructure, U.S.-Venezuela tensions, and the escalating Israeli-Gaza conflict with a ground offensive, raising fears of supply disruptions. Conversely, bearish pressures include abundant supply from non-OPEC+ producers and weak recent economic data from major oil importers like China, which dampens global oil demand. The RSI stands at 46, indicating bearish momentum in crude oil.

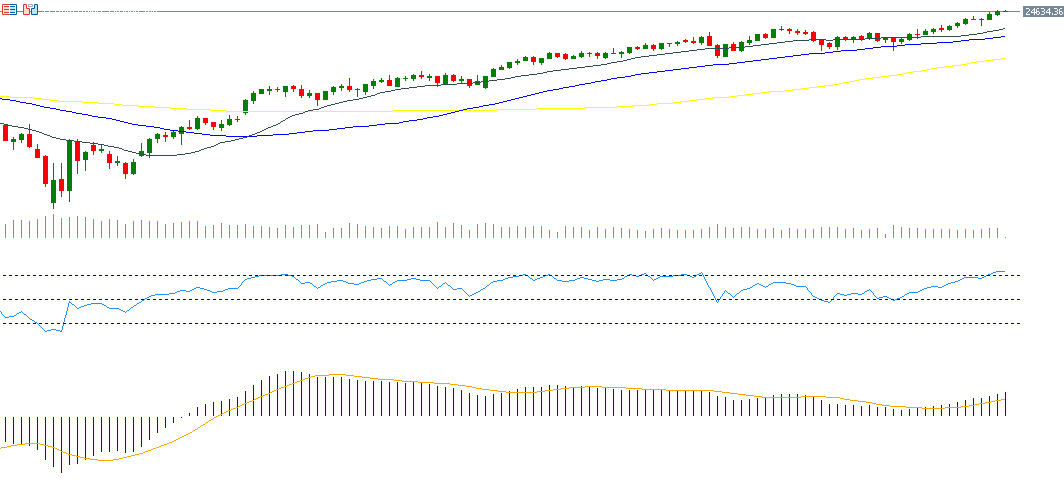

Nasdaq 100 Index

The Nasdaq 100 rose for the third consecutive week, hitting a new record high of 24,642 points on Friday and closing at 24,626. This was driven by last week’s Fed rate cut of 25 basis points, as expected. The dot plot suggests a potential further 50 basis point cut this year. Tech giants (the “Magnificent Seven” or MAGS) pushed the index to record highs, up about 20% year-to-date. The Philadelphia Semiconductor Index (SOX) also reached record levels on Thursday, up roughly 25% since the start of the year, reflecting strong demand for AI-related products and massive investments in infrastructure for the sector. The RSI is currently 74, indicating overbought conditions but strong bullish momentum. The MACD shows a bullish crossover, supporting the Nasdaq 100’s upward trend.

Key Economic Events This Week

- Monday: Consumer Confidence Index in the Eurozone.

- Tuesday: Manufacturing and Services PMI in Australia, the Eurozone, the UK, and the U.S.

- Wednesday: Manufacturing and Services PMI in Japan, along with U.S. new home sales and crude oil inventories.

- Thursday: Swiss National Bank interest rate decision (expected to hold at 0.0%), U.S. durable goods orders, GDP, existing home sales, and unemployment claims.

- Friday: Tokyo Consumer Price Index, U.S. Core Personal Consumption Expenditures (Core PCE) inflation (Fed’s preferred measure), Michigan Consumer Sentiment Index, and Canadian GDP.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.