Last week brought a slew of important global economic releases. In the United States, Purchasing Managers’ Indices (PMIs) in both the manufacturing and services sectors declined, and consumer confidence and inflation expectations (via Michigan survey data) also softened. On the upside, new home sales, durable goods orders, and GDP came in stronger than expected, and the trade deficit in goods narrowed. In the Eurozone, PMIs in both sectors showed modest improvement. In Britain, industrial activity contracted more than forecast, while the services sector continued to grow, albeit at a slower pace. In Switzerland, the central bank held interest rates unchanged at 0.0%. In Canada, GDP growth beat expectations. In Australia, PMIs decelerated while the consumer price index rose year‑on‑year. In Japan, industrial activity remained in contraction and services growth cooled; Tokyo consumer inflation came in below expectations. In China, the People’s Bank left its one- and five-year lending rates unchanged, consistent with expectations.

Market Analysis

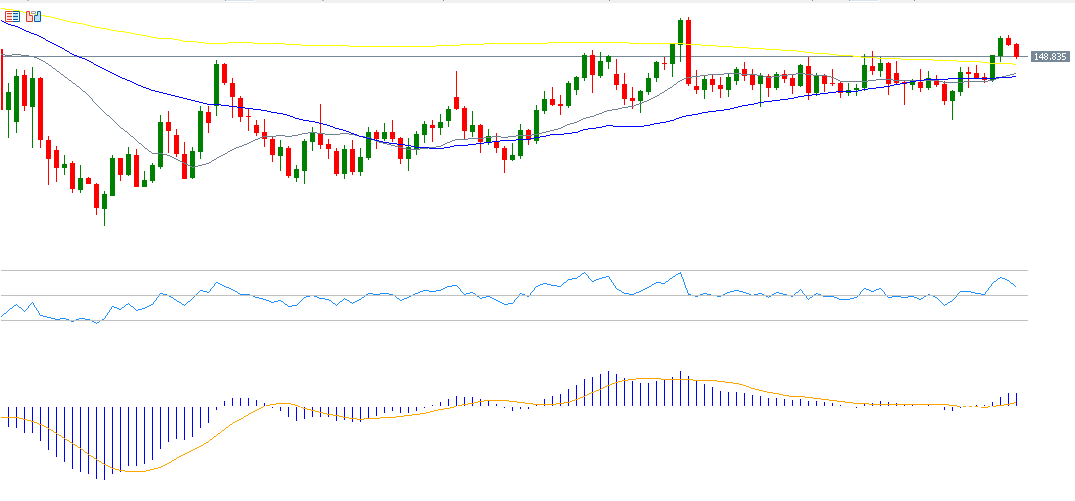

USD/JPY

On Friday, the USD/JPY pair climbed to 149.96, marking its highest level since August 1, 2025. From the low of 145.48 on September 17, it has rallied roughly 3 %, although it remains about 5 % below its level at the start of the year. Weakness in the yen is being driven by political uncertainty in Japan and a more hawkish U.S. monetary policy. The Relative Strength Index (RSI) currently sits at 62, signaling positive momentum. Meanwhile, the MACD line is crossing above its signal line, reinforcing the bullish technical tone for the pair.

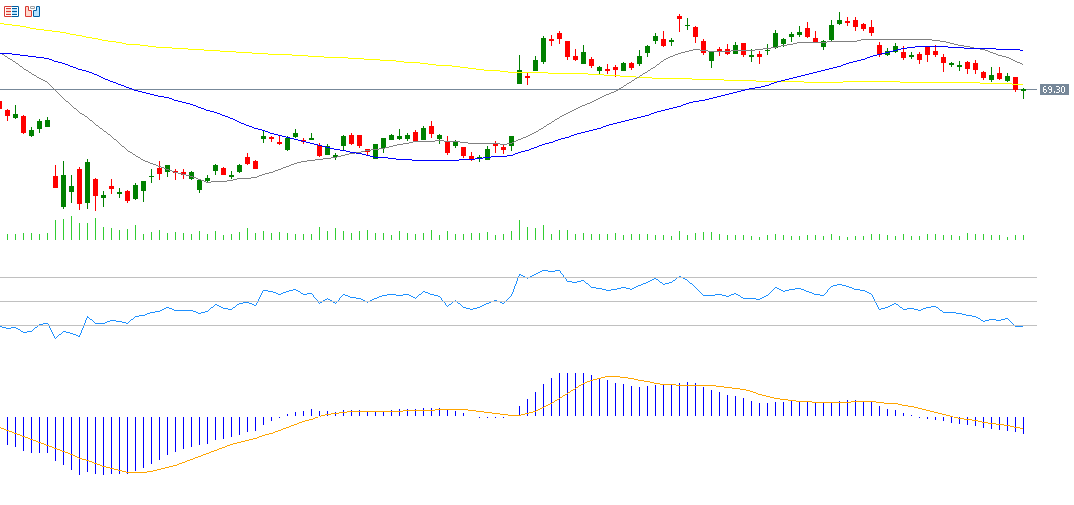

Nike

Nike’s share price has declined approximately 8 % year-to-date. Markets are closely watching Nike’s upcoming earnings report (expected on Tuesday, September 30, 2025). Analysts forecast EPS of $0.27, down from $0.70 in the previous period, and revenue of $10.96 billion, versus $11.60 billion previously. The RSI is around 30, placing the stock in oversold territory, and the MACD shows a bearish crossover, both of which suggest downward pressure.

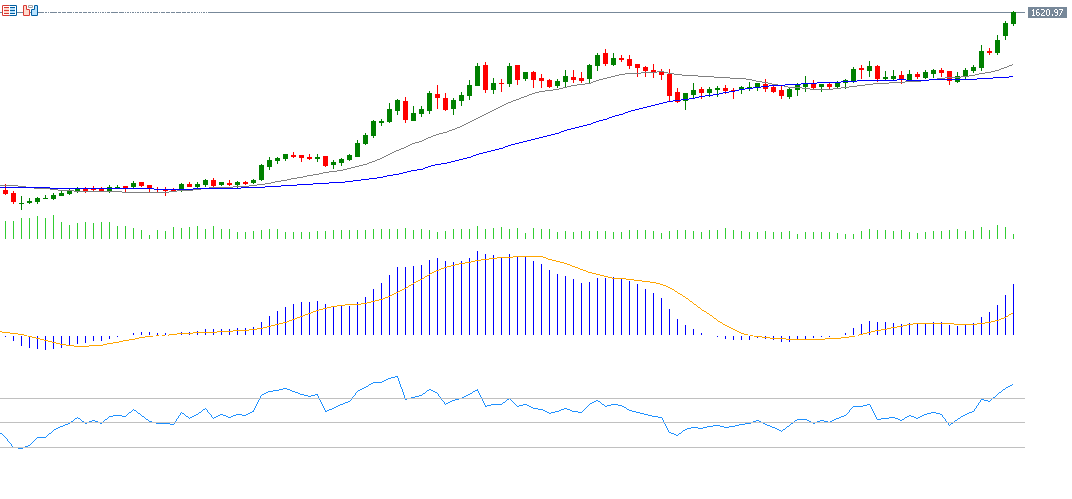

Platinum

Platinum continues its strong upward trajectory, reaching $1,587 on Friday—its highest level since 2008. It has gained about 74 % year-to-date, outperforming assets such as gold (≈ 43 %) and silver (≈ 59 %). The upside momentum is supported by persistent supply constraints, robust industrial demand, and investor inflows into platinum ETFs. The RSI now reads 78, hinting at overbought conditions, while a bullish MACD crossover supports further upside potential.

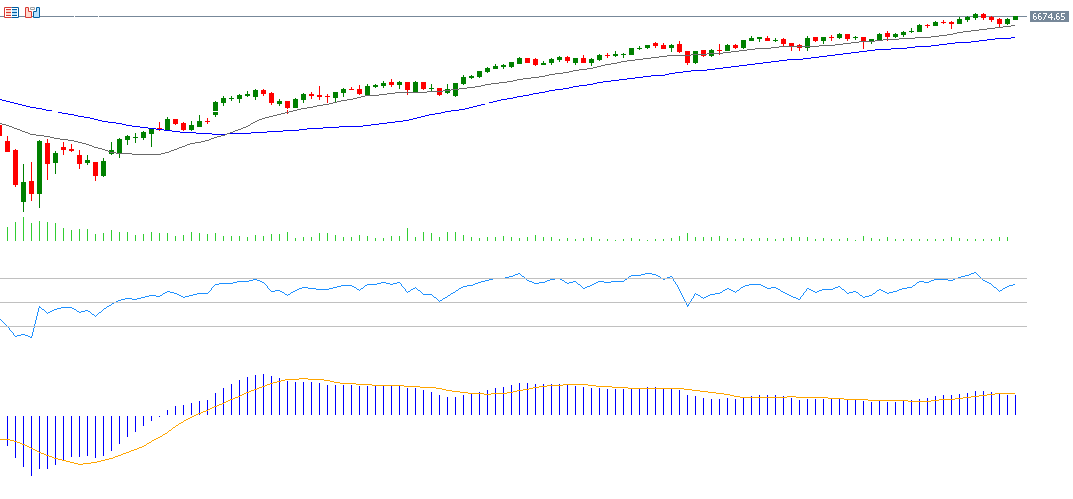

S&P 500

After three straight weeks of gains, the S&P 500 retreated 0.31 % last week. It had hit a record high of 6,700 on Tuesday, before closing at 6,644 on Friday. The index is up about 13 % year-to-date. The prevailing view is that U.S. equities can maintain upward momentum despite high valuations, aided by the Federal Reserve’s 25‑basis-point rate cut in its September meeting. Some forecasts suggest the possibility of another 50 bps in cuts this year. Mega‑caps (the “Magnificent Seven” / MAGS) reached fresh highs, rising ~18 % year-to-date, and the Philadelphia SOX index hit records with a ~27 % gain, driven in part by continued demand for AI-related infrastructure investments. The S&P 500’s RSI stands at 63, reflecting ongoing upward momentum.

Key Events to Watch This Week

- Tuesday: RBA interest rate decision (expectation: steady at 3.60 %), Japan’s industrial production, China’s official and Caixin PMIs, UK GDP, and U.S. consumer confidence & labor market data.

- Wednesday: PMIs across major economies (Australia, Japan, UK, Eurozone, U.S.), Eurozone CPI, U.S. ADP payrolls, ISM manufacturing, construction spending, and U.S. crude inventories.

- Thursday: Swiss CPI, Eurozone unemployment, U.S. factory orders, and initial jobless claims.

- Friday: U.S. ISM non‑manufacturing, nonfarm payrolls, unemployment rate, average hourly earnings, and services PMIs globally.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.