The EUR/USD pair reached 1.1830 yesterday, Tuesday, marking its highest level since September 15, 2021. It has risen by nearly 7% from the low recorded on May 12, 2025, at 1.1065 up to the peak reached yesterday at 1.1830. The pair is currently trading near the 1.1800 level and has increased by about 14% year-to-date.

Despite the ongoing weakness in the Eurozone economy and the continued underperformance of German bond yields compared to U.S. Treasury yields, the euro against the U.S. dollar continues to show positive momentum for several reasons:

- Weakness in the U.S. Dollar Index, which dropped to 96.66 yesterday, its lowest level since February 24, 2022.

- U.S. President Donald Trump’s hints at accelerating the selection of a successor to Federal Reserve Chairman Jerome Powell. Trump stated that he is considering three or four possible candidates to replace Powell amid significant disagreements, especially due to Trump’s insistence on cutting interest rates by 2% or 3%. Meanwhile, Powell has repeatedly expressed a preference for caution and not rushing rate cuts, closely monitoring the impact of tariffs on the economy, particularly on inflation—raising questions about the Fed’s independence.

- Expectations of two to three U.S. interest rate cuts this year.

- Uncertainty regarding trade agreements between the Trump administration and other countries such as Japan, South Korea, and the European Union, considering the upcoming expiration of the tariff suspension deadline set by the Trump administration next week on July 9.

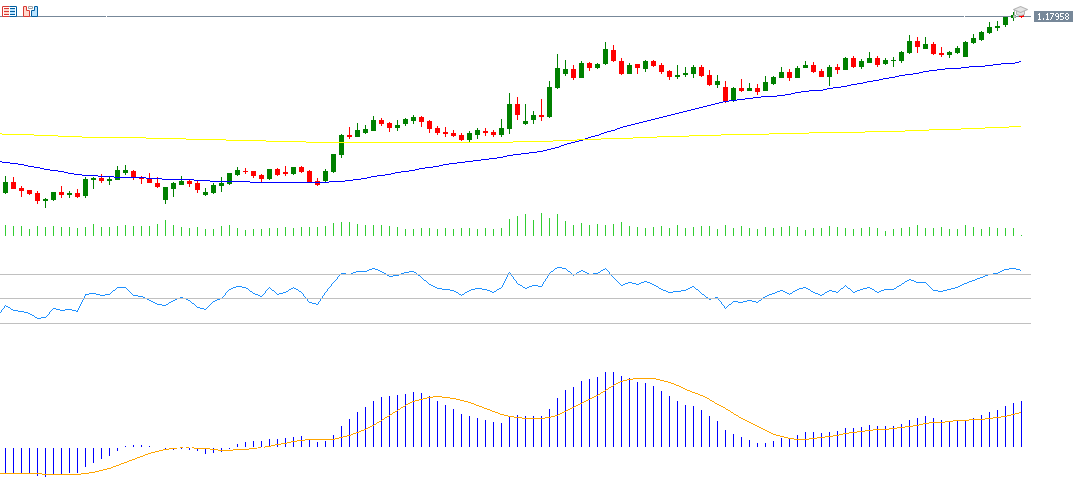

The Relative Strength Index (RSI) currently stands at around 74 points, indicating strong bullish momentum for EUR/USD. The MACD indicator also shows a bullish crossover between the blue line and the orange signal line, reinforcing expectations of continued upward momentum.

Regarding EUR/USD, if the pivot point at 1.1800 is broken downward, the pair may target support levels at 1.1769, 1.1730, and 1.1700. On the other hand, if it breaks above the pivot point, it may aim for resistance levels at 1.1839, 1.1870, and 1.1909.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.