Arabica coffee futures in New York continue their upward trend, recording $391 yesterday — the highest level since May 7, 2025 — and marking a 20% increase since the beginning of the year. Prices are currently hovering around the $380 level. These contracts also surged by approximately 70% over the past year.

The reasons behind these price increases are multiple, most notably the imposition of a 50% tariff by the U.S. administration on coffee imports from Brazil. This has disrupted supply chains and led to a sharp rise in global prices. Additionally, concerns over harvests in major producing countries — primarily Brazil and Vietnam, the two largest coffee producers in the world — have been growing. Both countries have been affected by climate change, including heatwaves and droughts, which raises fears of supply slowdowns. This, in turn, threatens to increase costs for coffee producers as well as consumers.

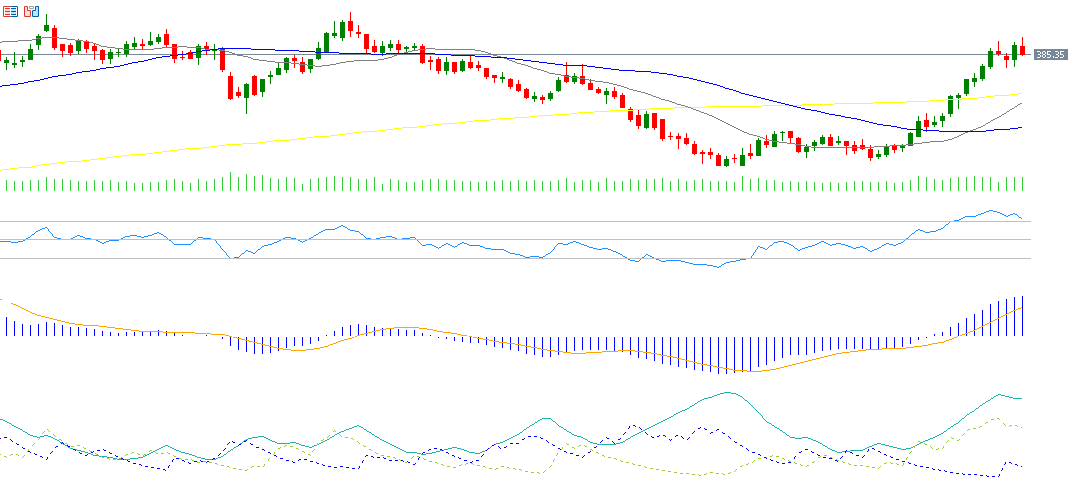

From a technical perspective, indicators appear to support the continuation of the upward trend in coffee futures for the following reasons:

- A bullish crossover has occurred between the 20-day and 50-day moving averages, which supports the bullish outlook for coffee futures in the upcoming period.

- The MACD line (blue) is above the signal line (orange), indicating positive momentum in coffee futures.

- The Relative Strength Index (RSI) currently stands at 76 points, placing it in the overbought zone — a sign of strong bullish momentum.

- The Positive Directional Index (DMI+) is around 40 points, while the Negative Directional Index (DMI−) is at about 11 points. The wide gap between the two suggests strong buying pressure. More importantly, the Average Directional Index (ADX) is around 41 points, indicating a strong trend momentum.

The next challenge for coffee futures lies in reaching the $431 level — the record high that was registered on February 10, 2025.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.