The futures contracts for coffee in New York (Arabica) continue their upward trend, reaching $312 two days ago, the highest level since 1997. Currently, they hover near the $310 mark. These contracts have risen by approximately 65% since the beginning of the year to date.

The reasons for these price increases are attributed to several factors, most notably concerns about crop yields among major producers, particularly Brazil and Vietnam – the world’s two largest coffee producers – which have been affected by climate change through heatwaves and droughts, in addition to issues in the global supply chain. This raises concerns about a slowdown in supply, which threatens to increase costs for both coffee producers and consumers.

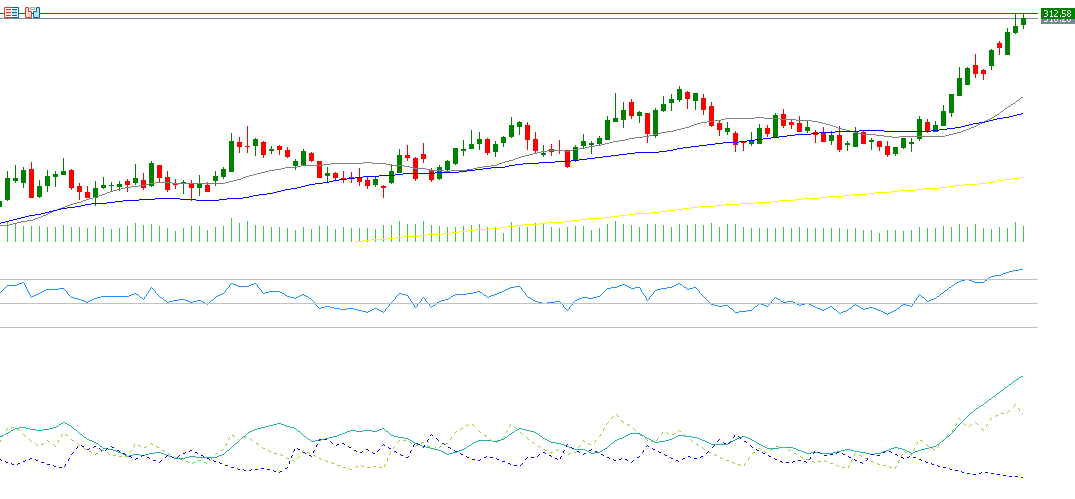

From a technical standpoint, the indicators suggest that the upward trend in coffee futures will continue for the following reasons:

- A bullish or “golden” crossover between the 20-day moving average (in gray), which stands at around $271, and the 50-day moving average (in blue), which stands at around $262, on November 19, 2024. This indicates a bullish trend in coffee futures.

- The Relative Strength Index (RSI) currently stands at 80, indicating an overbought condition, suggesting positive momentum for coffee futures.

- The Positive Directional Indicator (DMI+) stands at around 42, while the Negative Directional Indicator (DMI-) stands at around 6. The large gap between these two indicators indicates strong buying pressure on coffee futures. More importantly, the Average Directional Index (ADX) is around 42, indicating strong momentum in the upward trend.

But the question that arises is: Will people addicted to coffee continue buying it after these noticeable price increases?

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.