Silver continues its upward trend, reaching $32.55 two days ago, its highest level since November 6, 2024, and is currently trading near $32.

The biggest challenge lies in reaching and breaking through the $34.87 level, which was the highest recorded last year, specifically on October 22, 2024.

Notably, silver has gained approximately 11% since the beginning of the year, outperforming gold, which has risen by 9% over the same period. Forecasts suggest the continuation of the upward trend for both metals.

Factors Supporting Silver’s Rise:

Silver prices are currently benefiting from several factors, including:

- Gold price surge, which reached a new all-time high of $2,882 two days ago.

- Expectations of U.S. Federal Reserve interest rate cuts this year, which support silver as a non-yielding asset.

- Industrial demand for silver, as it is used in various industries such as pharmaceuticals, medical supplies, and electronics.

Performance of Other Commodities:

The prices of various other commodities, including palladium, platinum, copper, nickel, and aluminum, have also seen significant increases. This can be attributed to two key factors:

- Lower U.S. interest rates, which boost demand for commodities.

- Expected stimulus measures by Chinese authorities to support their economy, providing further upward momentum for most commodities.

Anticipation of U.S. Employment Data and Market Impact:

At 17:30 UAE time today, key U.S. employment indicators will be released, including:

- Non-farm payroll report

- Unemployment rate

- Average hourly earnings

Forecasts suggest that the U.S. economy added 154,000 new jobs in January, compared to 256,000 jobs in December. The unemployment rate is expected to remain steady at 4.1%, matching December’s reading. Analysts also anticipate a 0.3% monthly increase in average hourly earnings, the same as in December.

However, caution is advised—any employment and wage data that exceeds expectations, or an unemployment rate below forecasts, could negatively impact commodity prices and financial assets, strengthening the U.S. dollar as the primary beneficiary.

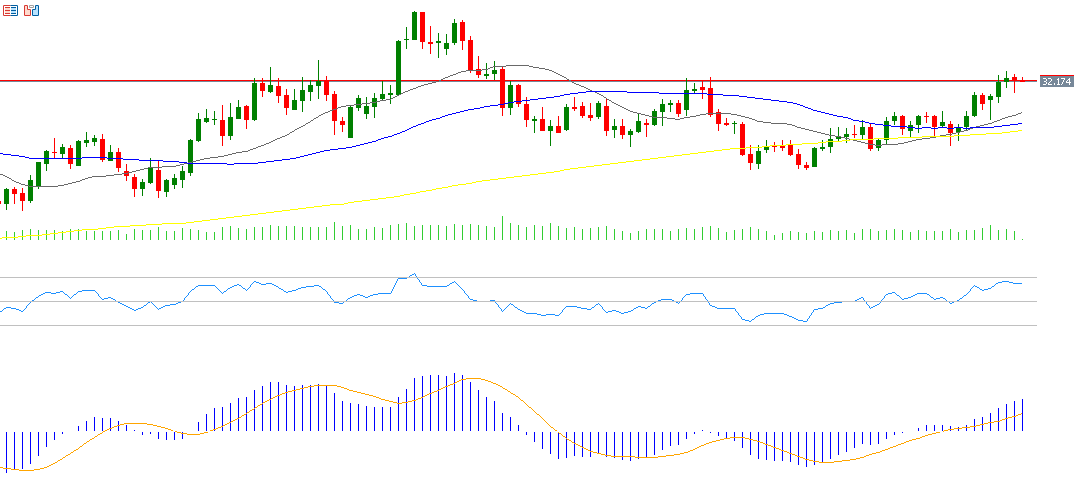

Technical Analysis of Silver Prices:

The upward trend for silver appears dominant in the near term, supported by the following technical indicators:

- Golden cross formation between the 20-day moving average (gray) at $30.97 and the 50-day moving average (blue) at $30.55, which occurred on January 30, 2025.

- Relative Strength Index (RSI) indicating positive momentum, currently at 65 points.

- Bullish crossover in the MACD indicator (blue) with the Signal Line (orange), which occurred on January 6, 2025, reinforcing silver’s upward trajectory.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.