The U.S. dollar against the Japanese yen recorded 140.70 yesterday, its lowest level since December 28, 2023. This pair continues its downward trend, with the primary challenge being to reach and break through the psychological level of 140.00. It is currently trading near the 142 level.

Bank of Japan board member Junko Nakagawa stated yesterday that the central bank will continue to adjust monetary policy in the future, provided that the economic performance aligns with expectations. Board member Hajime Takata also indicated last week that it will be necessary to adjust the degree of monetary easing and raise interest rates if inflation trends align with expectations.

The year-on-year GDP growth rate for the second quarter of this year was 2.9%, exceeding the previous reading of -2.4%. The year-on-year Consumer Price Index (CPI) in Japan recorded a growth of 2.8% in August, surpassing expectations of 2.7%, though it is still below the Bank of Japan’s target rate of 2.0%.

These statements and figures suggest that the Bank of Japan may continue to raise interest rates in the near future, which could provide upward momentum for the Japanese yen.

It is noteworthy that a significant factor contributing to the negative momentum for the USD/JPY pair is the slowdown in the U.S. economy, combined with statements from most Federal Reserve members and Fed Chair Jerome Powell indicating a move towards monetary easing. Currently, the markets are pricing in a 86% chance of a 25 basis point cut and a 14% chance of a 50 basis point cut in the upcoming September 2024 meeting.

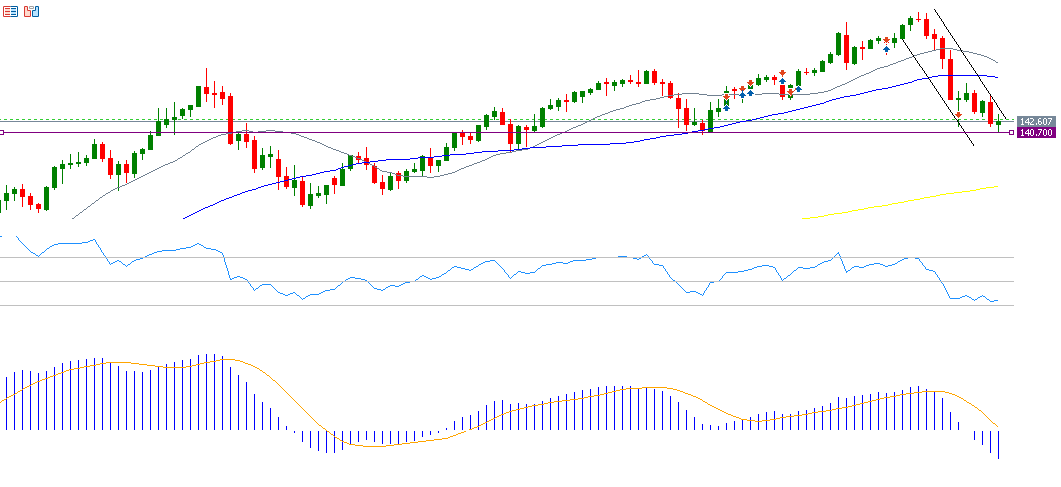

From a technical perspective, the downward trend for the USD/JPY pair appears to be prevailing, especially since it is trading below the 20, 50, and 200-day moving averages. The Relative Strength Index (RSI) is currently at 36, indicating negative momentum for the USD/JPY pair.

If the pivot point of 141.87 for the yen against the dollar is broken, there is a possibility that it will target support levels of 141.20, 140.04, and 139.36. Conversely, if the pivot point is surpassed, it may target resistance levels of 143.03, 143.70, and 144.86

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.