The German DAX index continues its upward trend for the fourth consecutive session, recording 22,443 points yesterday — its highest level since April 2, 2025. The index has risen by approximately 21% since its low on April 7, 2025, when it reached 18,490 points, up to the peak recorded yesterday at 22,443 points. It has also posted a 12% gain year-to-date, outperforming other European indices such as France’s CAC 40 (3%), the UK’s FTSE 100 (3%), and the pan-European Stoxx Europe 600 (3%). Furthermore, it has also outperformed major U.S. indices like the S&P 500 (-6%) and the Nasdaq 100 (-8%).

Recent German economic data, however, highlight weaknesses in the country’s economic performance:

- Factory orders showed 0.0% monthly growth, falling short of expectations (3.4%).

- Industrial production contracted by 1.3% month-on-month, below both expectations (-0.9%) and the previous reading (2.0%).

- The ZEW Economic Sentiment Index declined to 14 points, below expectations (10.6) and the previous reading (51.6).

- The Producer Price Index (PPI) shrank by 0.7% month-on-month, lower than both expectations and the previous figure (-0.1%).

- The Services PMI fell to 48.8 points, underperforming expectations (50.3) and the previous reading (50.9).

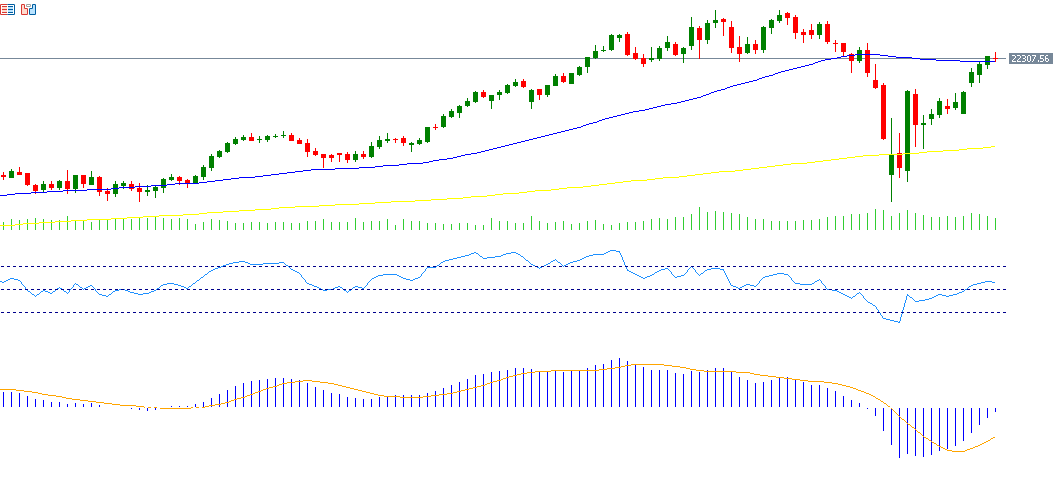

From a technical perspective, the DAX has broken above its 50-day moving average at 22,209 points. The major challenge ahead is to target the all-time high recorded earlier this year at 23,476 points.

- The Relative Strength Index (RSI) is currently at 58 points, indicating positive momentum for the DAX.

- The MACD shows a bullish crossover, with the blue MACD line crossing above the orange Signal Line, supporting the continuation of the DAX’s upward momentum.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.