By Samir Al Khoury

CPI fell year-on-year in November in the Eurozone, registering 2.4%, which is lower than both expectations (2.7%) and the previous reading (2.9%). The core CPI, excluding food and energy, also declined on an annual basis, recording 3.6%, below expectations (3.9%) and the prior reading (4.2%).

The manufacturing and services purchasing managers’ indices in the “Old Continent” remain in the contraction category, posting 44.2 points and 48.2 points, respectively. These figures indicate the sustained weakness of European economies, with Germany, the largest economy in Europe, still grappling with a noticeable economic slowdown.

Isabel Schnabel, a member of the Executive Board of the European Central Bank, stated yesterday that inflation is experiencing a significant slowdown, eliminating the possibility of the bank resorting to an additional increase in interest rates.

Regarding European interest rate expectations for next year, markets are currently pricing in approximately a 90% probability that the European Central Bank will commence reducing interest rates in the first quarter of 2024. This pricing anticipates five cuts of 25 basis points and an 80% probability of a sixth cut, with the total reductions amounting to 150 basis points.

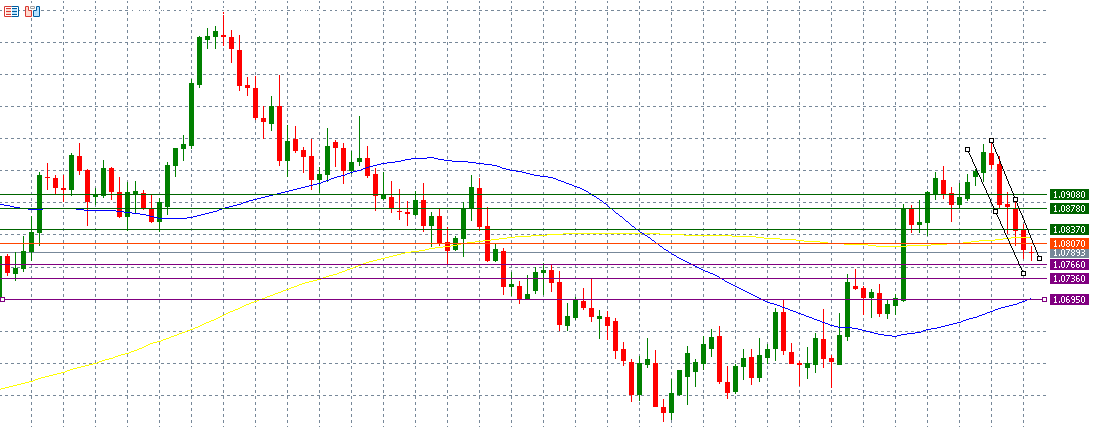

Technically, the outlook for the euro currency appears less promising. After reaching 1.1017 against the dollar on November 29 of this year, its highest level since August 10, 2023, the euro declined to 1.0775 today, reflecting a decrease of approximately 2.2%.

Furthermore, the EUR/USD pair broke the 200-day moving average at 1.0821, and the DEATH CROSS persists between the 50-day moving average at 1.0696 and the 200-day moving average, indicating negative momentum for the euro against the dollar.

However, if the pivot point of the EUR/USD at 1.0807 is breached today, it is likely to target support levels at 1.0766, 1.0736, and 1.0695. If it surpasses the pivot point, it may target resistance levels at 1.0837, 1.0878, and 1.0908.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk.