By Samir Al Khoury,

Crude oil prices continue their upward trend for the fourth day in a row, today recording levels exceeding $84. However, these levels still represent a decline of about 8% year to date.

Geopolitical tensions in the Middle East and the Red Sea, in addition to the extension of the voluntary reduction in oil production expected to occur by the OPEC+ alliance at its meeting on Sunday, June 2, continue to support oil prices.

However, there are many factors that may limit this increase, the most prominent of which are:

• Abundance of supply from outside OPEC+: This includes countries such as the United States of America, Canada, and Guyana.

• Strength of the US dollar: This negatively affects oil prices. The recent hawkish statements of some Federal Reserve members regarding the course of US interest rates, in addition to the superiority of some US economic data to analysts’ expectations, indicate the continued strength and flexibility of the US economy. The consumer confidence index recorded 102 points yesterday, a percentage that exceeded expectations (96.0) and the previous reading.

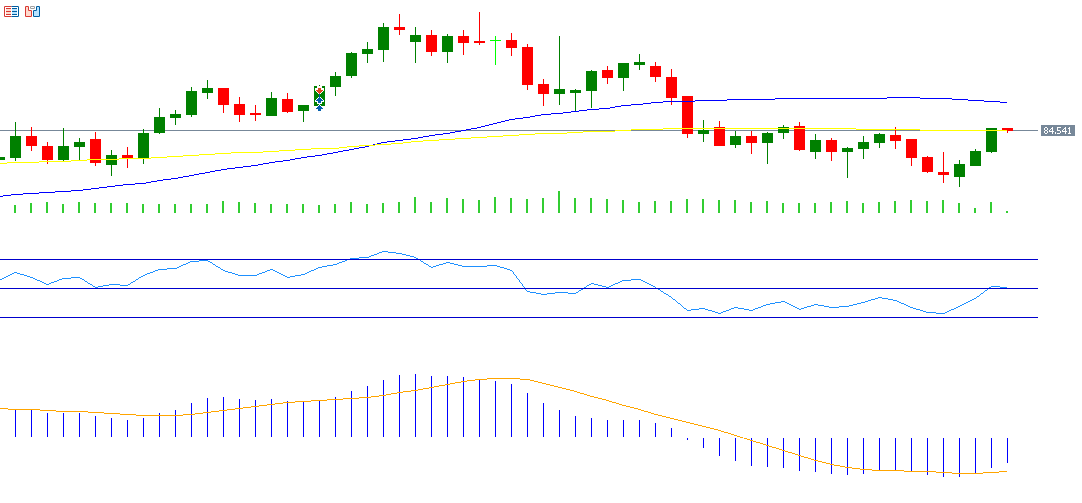

As for the technical picture for crude oil prices, it looks rather good, especially with oil prices today exceeding the important resistance barrier, which is the 200-day moving average in yellow, standing at $84.11. However, the next challenge lies in staying above this barrier and reaching the 50-day moving average level in blue, which stands at $86.01. As for the Relative Strength Index (RSI), it exceeds the 50-point level, currently recording approximately 51 points, which means somewhat positive momentum for oil prices.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk.