The German DAX index reached a new all-time high of 23,912 points two days ago, before closing yesterday at 23,639 points. The index has surged approximately 29% since its recent low of 18,490 points on April 7, 2025, up to the peak recorded earlier this week. Year-to-date, the DAX has risen by around 18%, outperforming other major European indices such as France’s CAC 40 (3%), the UK’s FTSE 100 (4%), and the STOXX Europe 600 (3%). It also outpaced major U.S. stock indices, including the S&P 500 (4%) and Nasdaq 100 (5%).

Recent German economic data show a notable improvement in the country’s economic performance:

- Factory orders rose by 3.6% on a monthly basis, exceeding both forecasts (1.4%) and the previous reading (0.0%).

- Industrial production grew by 3.0% month-on-month, beating expectations (0.9%) and rebounding from a previous decline of -1.3%.

- Exports increased by 1.1% on a monthly basis, slightly above expectations (1.0%) but below the previous reading (1.8%).

- The ZEW Economic Sentiment Index jumped to 25.2 points, well above expectations (10.7) and the previous figure (-14.0).

- The Manufacturing PMI rose to 48.4 points, exceeding both expectations (48.0) and the previous reading (48.3).

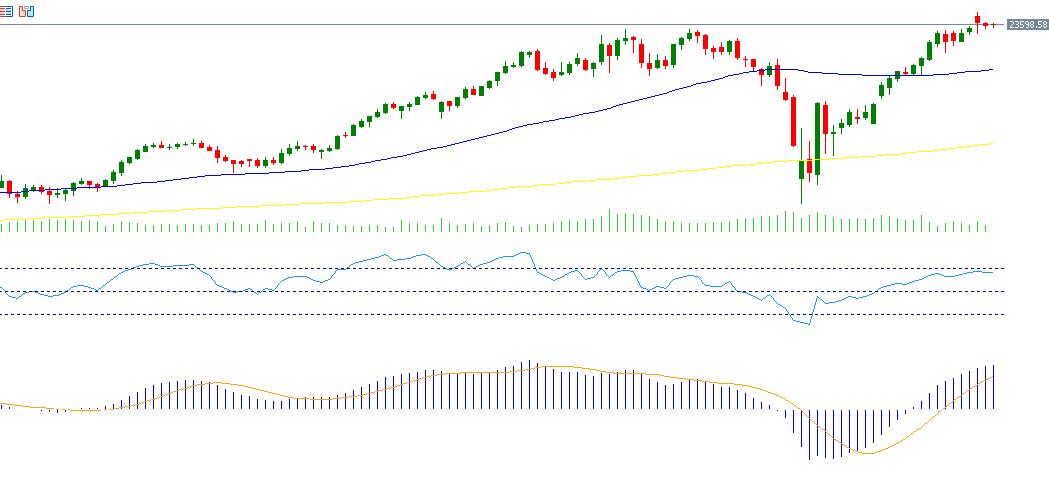

From a technical standpoint, several indicators suggest that the positive momentum for the DAX may continue:

- Golden Cross Formation: The 20-day moving average (grey), currently at 22,332 points, is nearing an upward crossover with the 50-day moving average (blue) at 22,335 points, which may signal a continuation of the bullish trend.

- The Relative Strength Index (RSI) is currently at 67, indicating strong positive momentum.

- The MACD indicator shows a bullish crossover, with the blue MACD line moving above the orange signal line, reinforcing expectations for continued upward movement.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.