Recent German economic data continues to show signs of weakness in the country’s economy, as evidenced by the following indicators:

- The German ZEW Current Economic Conditions Index declined sharply in October, registering a contraction of -80.0, worse than both the forecast of -75.0 and the previous reading of -76.4.

- The ZEW Economic Sentiment Index for Germany recorded a 39.3 reading in October, below expectations of 41.2.

- Monthly exports fell by 0.5%, lower than the forecasted 0.3%.

- Monthly imports declined by 1.3%, worse than both the forecast (-0.5%) and the previous reading (-0.1%).

- Industrial production dropped significantly by 4.3% month-over-month, far below the expected -1.0% and the previous increase of 1.3%.

- Factory orders contracted by 0.8% on a monthly basis, falling short of the 1.2% forecast.

- Retail sales declined by 0.2% month-over-month, missing expectations of 0.6%.

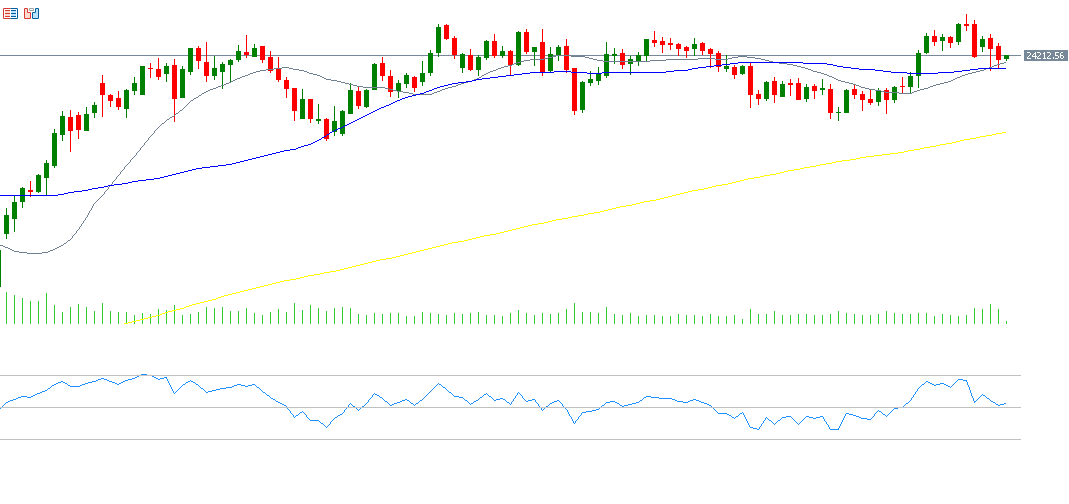

However, what stands out is that despite the economic downturn and the negative factors surrounding Germany’s internal economy, the stock market tells a very different story. The German DAX Index continues its upward trajectory, hitting an all-time high of 24,771 points on Thursday, October 9, and hovering now around 24,200 points. The index has surged by 22% year-to-date, outperforming other European equity indices and even U.S. stock markets — a surprising divergence from the economic trend.

Notably, one key factor has contributed to the bullish momentum in German equities: the continued decline in German 10-year government bond yields, which have fallen for four consecutive days, reaching 2.56% yesterday — their lowest level since July 7, 2025.

Moreover, technical indicators appear to support the possibility of further gains in the DAX index in the near term for several reasons:

- Golden Cross: A bullish crossover occurred on Tuesday, October 14, 2025, between the 20-day moving average (grey) and the 50-day moving average (blue), which may indicate the continuation of the DAX’s upward trend.

- Relative Strength Index (RSI): Currently stands at around 53 points, signaling positive momentum for the index.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.