Recent Turkish economic data shows that the Turkish economy is weakening, as:

- The manufacturing Purchasing Managers’ Index (PMI) for September fell to 44.30, indicating contraction, and was lower than the previous reading of 47.80, marking the lowest level since May 2020.

- The treasury cash balance for September recorded a deficit of 200.965 billion Turkish lira, a larger deficit than the previous reading of -194.62 billion lira.

- Exports declined to 22.00 billion Turkish lira in September, which is lower than the previous reading of 22.05 billion lira.

- The Consumer Price Index (CPI) on a year-on-year basis in Turkey slowed to 49.38% in September, exceeding expectations of 48.30% but lower than the previous reading of 51.97%.

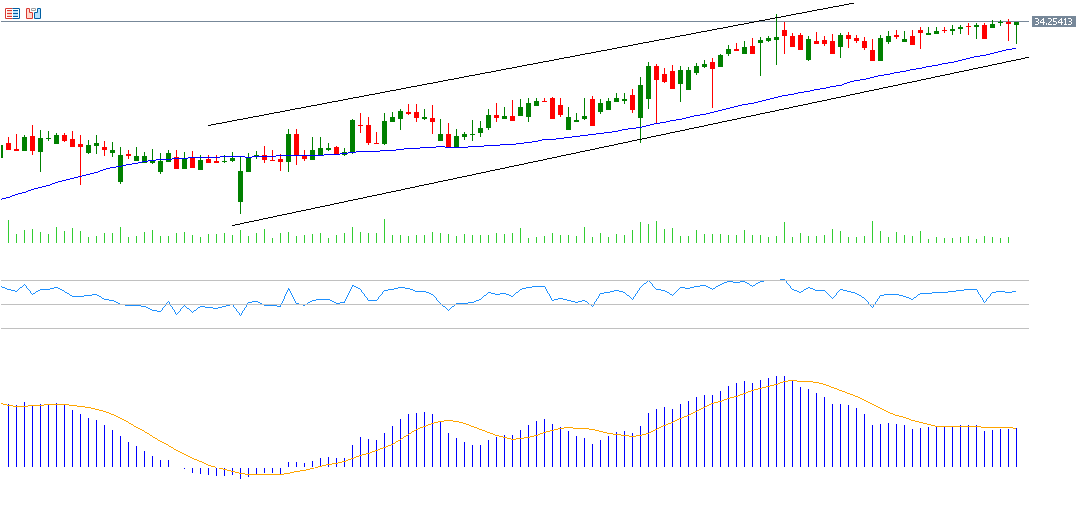

The exchange rate of the U.S. dollar against the Turkish lira reached 34.2784 yesterday, the highest level since August 28, 2024. The next challenge is to reach the record level of 34.3827 set on August 28. The rate is currently hovering around 34.2500 lira per dollar, having increased by approximately 17% since the beginning of the year.

Interest rates remain steady at 50%, as set by the Central Bank of Turkey for six consecutive months. Markets are now awaiting the Central Bank’s interest rate decision, scheduled for Thursday, October 17, 2024.

From a technical perspective, the upward trend of the USD/TRY pair appears dominant in the coming period, especially with the ongoing positive momentum. The Relative Strength Index (RSI) is currently at 66 points, approaching the overbought zone.

Additionally, there is alignment in the moving averages for 20, 50, and 200 days, all showing an upward trend, with the 20-day average surpassing the 50-day average, and the 50-day average surpassing the 200-day average. A bullish crossover occurred today between the MACD (blue line) and the Signal Line (orange line), further indicating upward momentum for the USD/TRY pair.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.