The USD/DKK exchange rate continues its downward trend, reaching 6.3068 two days ago — its lowest level since September 17, 2021. The pair has dropped approximately 6% from its peak of 6.7413 on May 12, 2025, to the recent low of 6.3068.

Recent Danish economic data indicates a notable improvement in the country’s economic performance:

- The Consumer Price Index (CPI) rose to 1.6% year-on-year, higher than the previous reading of 1.5%.

- Industrial production increased to 2.0% month-on-month, compared to the previous reading of -3.2%.

- Consumer confidence improved to -15.1, up from the previous figure of -18.4.

- The trade balance rose to 37.8 billion Danish krone, compared to the previous figure of 26.4 billion.

One of the key factors weighing on the USD/DKK pair has been the weakening of some U.S. economic indicators — notably in the labor market. According to the ADP report, the U.S. private sector lost 33,000 jobs, a figure well below expectations (99,000) and the previous reading (29,000). This marks the lowest level since January 2022.

Additionally, concerns over the widening U.S. fiscal deficit and soaring debt levels — coupled with ongoing uncertainty around trade tariffs — have added further pressure on the U.S. dollar against most foreign currencies.

Markets are now closely watching today’s release of the U.S. non-farm payrolls report at 16:30 UAE time, along with the unemployment rate and average hourly earnings. Expectations point to the addition of 120,000 new jobs in June, compared to 139,000 in May. The unemployment rate is projected to rise to 4.3%, up from 4.2% in May, while average hourly earnings are expected to show year-on-year growth of 3.9%, matching May’s figure.

As such, caution is warranted — any reading below expectations for jobs and wages, or higher-than-expected unemployment, could strengthen the Danish krone and other foreign currencies against the U.S. dollar.

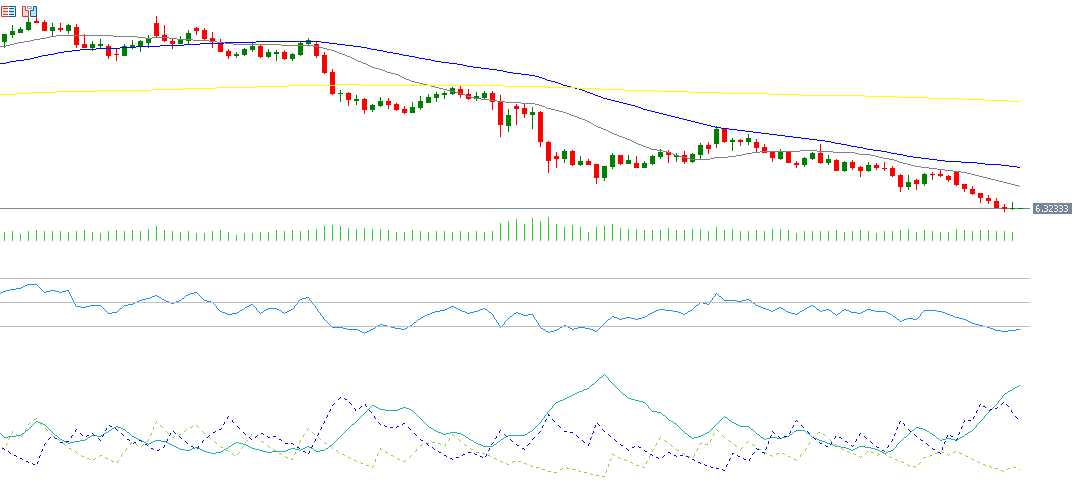

Technical Analysis:

If the pivot level at 6.3237 is broken, the pair may target the following support levels: 6.3030, 6.2860, and 6.2653. On the upside, if the pivot is breached, the next resistance levels are likely to be: 6.3407, 6.3614, and 6.3784.

The Relative Strength Index (RSI) currently stands at 29, indicating the pair is in oversold territory and reflecting negative momentum. The Directional Movement Index (DMI+) is at 12, while the DMI- is at 29, showing a wide gap that signals strong selling pressure on the U.S. dollar. Notably, the Average Directional Index (ADX) is at 26, confirming a strong bearish trend.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.