Bitcoin prices reached nearly $124,500 on Thursday, August 14, 2025, marking a new all-time high. However, they later fell to $107,300 on September 1, representing a 14% decline from that peak to the trough, before rebounding to trade currently around $112,000. Year-to-date, Bitcoin is up 21%, outperforming U.S. equity indices. Despite this volatility, Bitcoin remains attractive, particularly as it continues to trade above the key psychological level of $100,000, with the bullish trend expected to persist in the coming period.

The main factors supporting Bitcoin’s rally include:

- Weakness in the U.S. dollar index, which is currently trading near 97 points, its lowest level since July 24, 2025.

- Expectations of three U.S. interest rate cuts this year, which strengthen Bitcoin’s appeal as a non-yielding asset.

- Ongoing inflows into Bitcoin-linked exchange-traded funds (ETFs).

- Continued investment flows into cryptocurrency products (ETPs).

- Growing investor risk appetite, especially from public companies that rank among the largest holders of cryptocurrencies, in addition to private firms, governments, exchange-traded funds, and individuals, who increasingly add Bitcoin to their portfolios for diversification, amid strong optimism about the industry’s future.

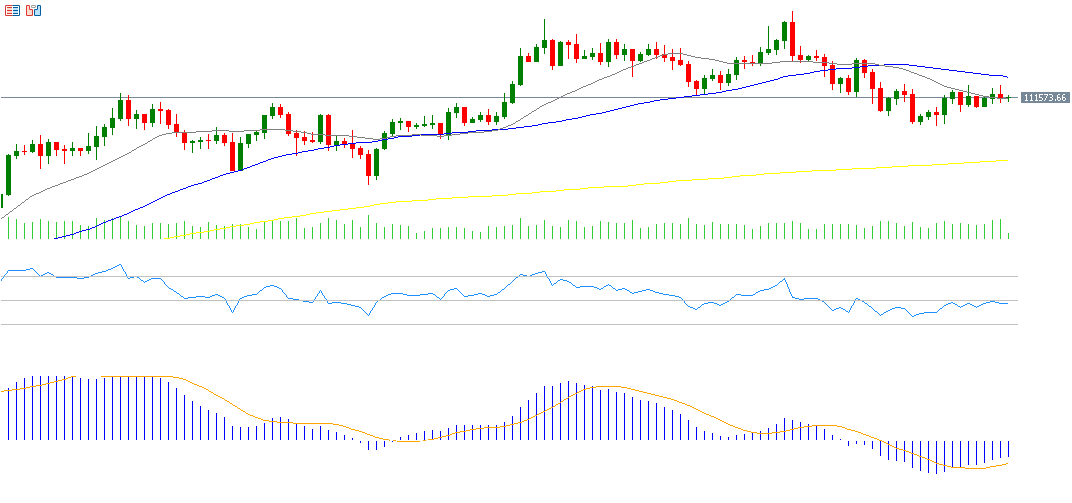

From a technical perspective, indicators support further upside in Bitcoin:

- The Relative Strength Index (RSI) has broken above the 50 level, currently standing at 51, pointing to bullish momentum.

- A bullish crossover has emerged between the MACD (blue line) and the Signal Line (orange line), confirming positive momentum.

Upcoming challenges:

The key challenge for Bitcoin lies in breaking above the $115,000 resistance level, which coincides with the 50-day moving average, followed by retesting the record high of $124,500 and holding above it. A sustained breakout could pave the way for new targets at $130,000 and $140,000 in the near term, provided supportive factors and investment inflows continue.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.