By Camilo Botia,

The US government is taking a major step against Apple. On Thursday, the Department of Justice (DOJ) sued Apple for abusing its dominant market position and harming consumers through its iPhone ecosystem. The lawsuit alleges that Apple operates a monopoly, driving up prices and limiting consumer choices.

The lawsuit could have a significant impact on Apple’s most profitable businesses. This includes iPhones, which generated over $200 billion in sales in 2023, the Apple Watch, which is part of the company’s $40 billion wearables business, and its services line, including the App Store, which brought in $85 billion in revenue last year. Apple strongly disagrees with the lawsuit and plans to fight it in court. The company argues that complying with such regulations would stifle innovation, hurt customer experience, and raise costs.

This lawsuit builds on previous antitrust investigations into Apple and similar cases against Google. The outcome of this case could set a precedent for regulating big tech companies and promoting open ecosystems. Apple already faces similar challenges in Europe with the EU Digital Markets Act, forcing them to open the App Store.

The US government’s lawsuit against Apple signals a new era of stricter enforcement against tech giants. The outcome of this case could significantly impact Apple’s business model and the future of smartphone technology, as well as its stock price and investors’ perception of the company in the near future.

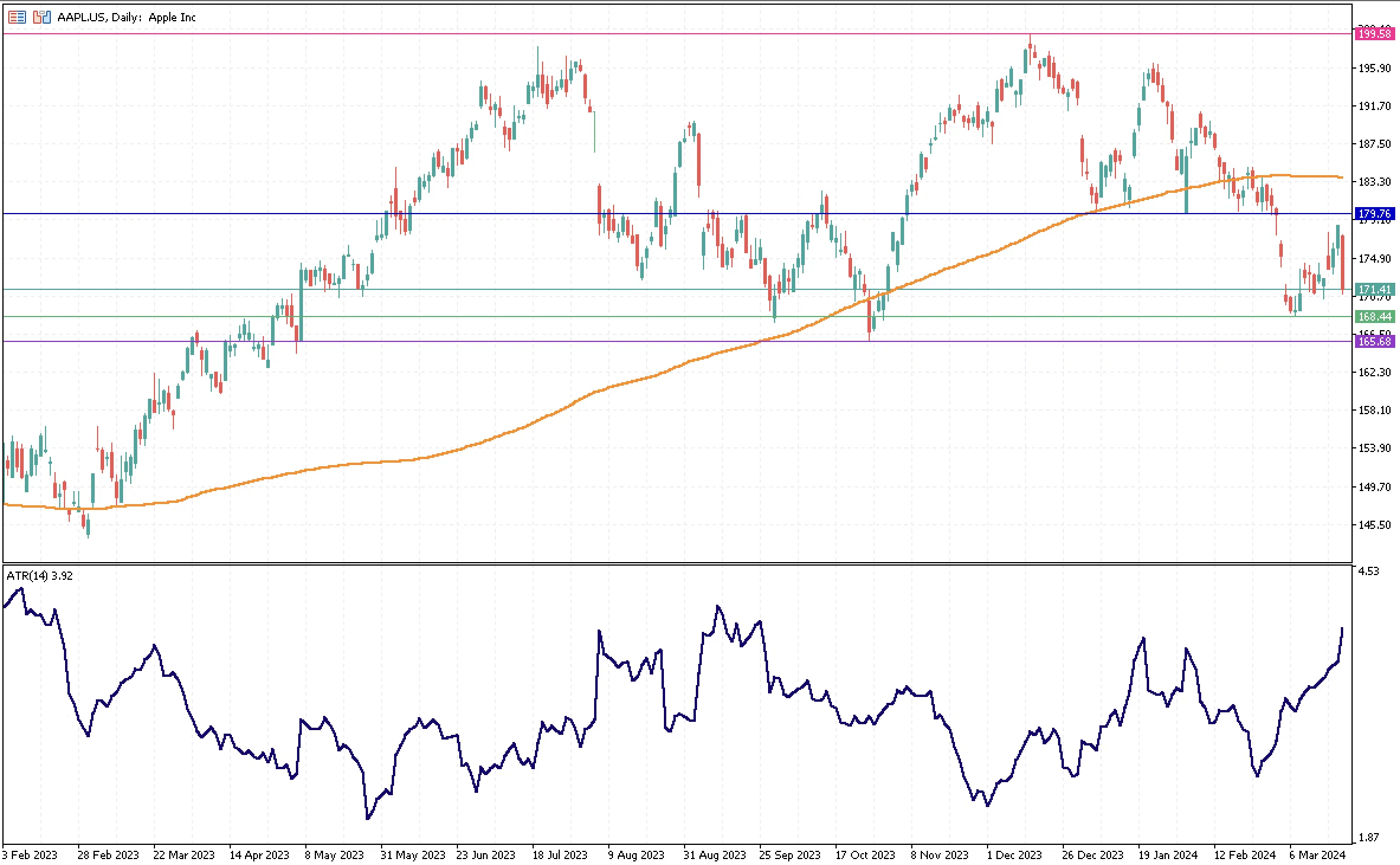

Apple’s stock has seen a significant decline in 2024. It is now trading at 171.41 and from 196.37 earlier in the year. There is a significant increase in volatility, as shown by the ATR oscillator, with a significant drop in the stock price on Thursday after the DOJ sued Apple. There are also mounting expectations about Apple’s AI strategy, and some investors perceive the company as lagging behind competitors such as Microsoft and Google. There are two significant resistances, the first at $179.76 and the second at the 200-day moving average at $183.80. At the bottom, there are two supports at 168.44 and 165.88.