By Samir Al Khoury

The price of the dollar against the Japanese yen reached 151.97 last week, marking its highest level since 1990.

It’s worth mentioning that in 2022 and 2023, the maximum limit for the dollar against the yen was recorded at 151.91 and 151.95, respectively. The persistent resistance level of 152 yen per dollar suggests a higher probability of intervention in the currency market by the Japanese Ministry of Finance to bolster the Japanese currency.

We last saw this happen in October 2022 at the levels of 151.95, when the Japanese Ministry of Finance intervened to curb the deterioration of the yen against the dollar, buying approximately 9.2 trillion yen ($60 billion). Subsequently, the dollar declined to 127.22 by January 2023.

The price of the dollar against the yen is currently hovering near the 152 level, and the question arises: Will we witness further intervention from Japanese authorities to bolster the domestic currency? And if so, would such intervention be sufficient?

Looking back historically, specifically from 1996 until the last intervention by the Japanese government in October 2022, we observe that the primary focus of intervention was in favor of the dollar. This involved purchasing the dollar against the yen with the aim of bolstering the dollar and consequently weakening the yen. This strategy was pursued because the Japanese economy heavily relies on exports. A weakened yen typically benefits Japanese exports, but it concurrently exerts negative pressure on imports, leading to increased costs for importing raw materials from abroad. Consequently, we’ve witnessed the import index falling short of expectations for six consecutive months, signaling weak domestic demand. This trend suggests that significant weakening of the yen is not in the interest of Japanese authorities.

It is worth noting that there is a very important factor that is putting pressure on the Japanese yen, which is the continued large difference between Japanese and American bond yields. For example, the yield of 10-year Japanese government bonds records 0.75%, while the yield of US Treasury bonds records 4.40%, so the gap is approximately 3.65%, and this is what Encourages interest trading or carry trade.

Moreover, the resilience and adaptability of the US economy, coupled with reduced speculation on the timing of US interest rate cuts, further bolster the dollar against major currencies worldwide.

There seems to be a prevailing pessimism regarding the Japanese currency within financial derivatives markets, as sales in futures and options contracts significantly outweigh purchases.

Japanese Finance Minister Suzuki has affirmed his readiness to implement bold measures, emphasizing that he is open to exploring all options to support the yen. Bank of Japan Governor Kazuo Ueda has also stated his close monitoring of the currency market and its various impacts on the economy and inflation.

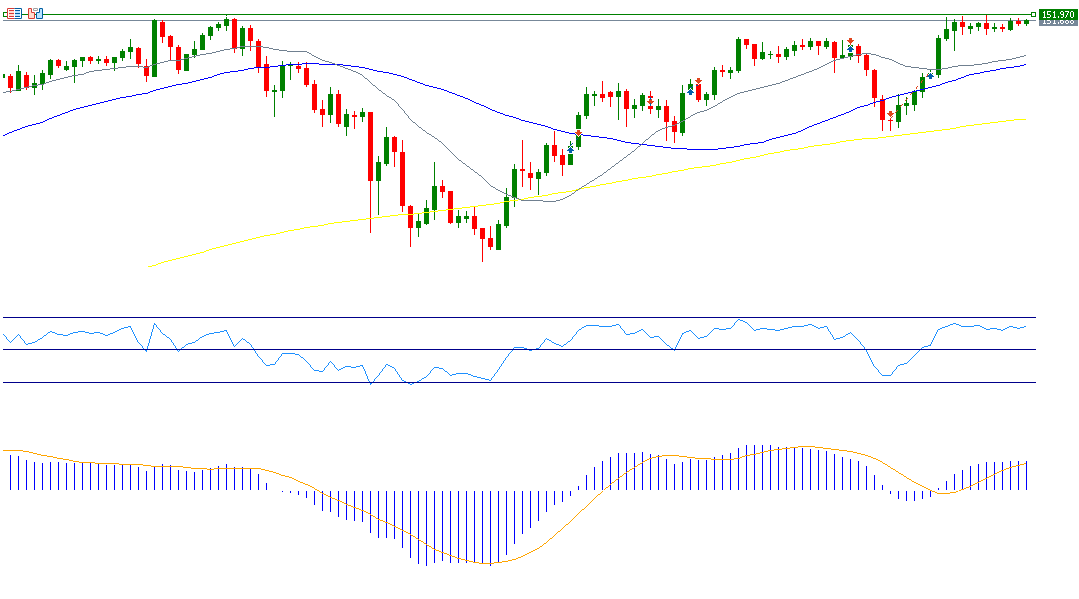

From a technical perspective, there’s a consistent pattern in the moving averages over 20, 50, and 200 days, indicating an upward trend for the dollar against the yen. Specifically, the 20-day average surpasses the 50-day average, and the 50-day average surpasses the 200-day average. However, the primary challenge remains breaking through and surpassing the persistent resistance level of 152 yen per dollar. The Relative Strength Index (RSI) currently stands at 65 points, which indicates upward momentum in the price of the dollar against the yen.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk.