By Camilo Botia,

The Dow Jones Industrial Average has achieved a remarkable feat, soaring to the historic 40,000 mark. This is not just a number, but a significant milestone that underscores the strength of the stock market. This achievement is a testament to the confidence investors have in the resilience of corporate America, driven by the potential for rate cuts, a robust economy, easing inflation, and strong earnings.

The market’s optimism defies the traditional adage of “sell in May and go away,” with equities on track for their best month in 2024. The Dow last breached a significant milestone in November 2020, when it surpassed 30,000 during the pandemic.

This milestone is a psychological boost for the bulls, but it’s important to note that the market might be in an ‘overvalued territory.’ This term refers to a situation where the market price of an asset is higher than its intrinsic value, suggesting that the market may be overestimating the value of stocks. The rally has been supported by strong earnings reports, particularly from Walmart Inc., while meme stocks like GameStop Corp. and AMC Entertainment Holdings Inc. have experienced a decline.

Experts remain optimistic about the market’s potential for continued growth, citing positive factors such as strong corporate earnings, healthy consumer spending, and lower interest rates. However, some analysts suggest a short-term “breather” is likely after the recent rally.

While the Dow’s achievement is significant, it’s important to note that it is a narrower equity gauge than the S&P 500 or Nasdaq 100, and its price-weighted structure means that changes in high-priced stocks have a more significant impact on the index level.

The market is also paying close attention to Fed speakers who suggest that the central bank may keep borrowing costs high for extended periods, awaiting more evidence of easing inflation. JPMorgan Chase & Co. chief Jamie Dimon has expressed concerns about persistent inflationary pressures and their potential impact on interest rates.

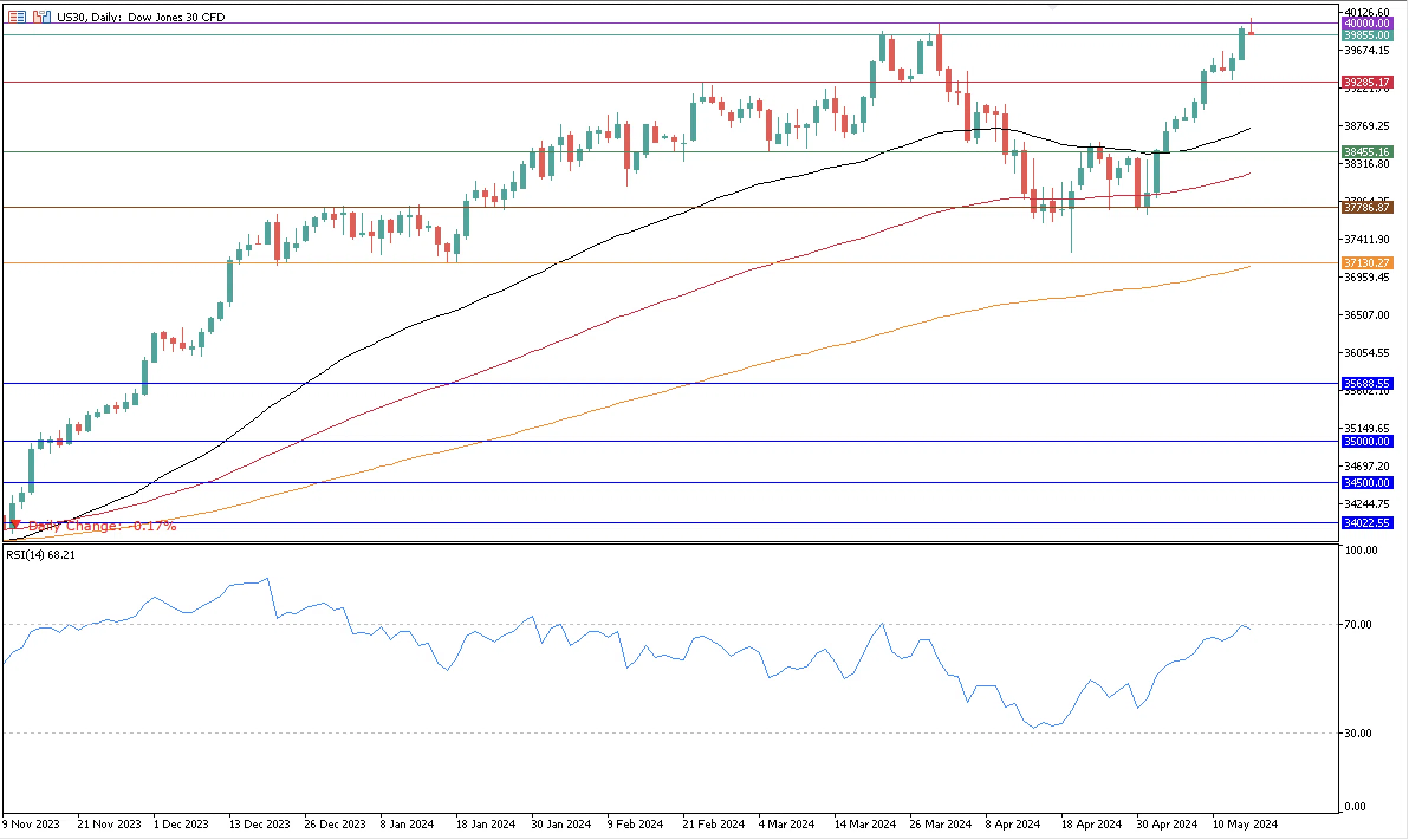

The RSI indicator shows the index has yet to cross an overbought condition but is really close to it. The 40,000 milestone is the most significant resistance for the price. There has been an impressive rally in May, with the index jumping from around 37,786 to above 40,000 briefly on Thursday. As a support, the closest floor to the price is around 39,285.17