The Reserve Bank of New Zealand (RBNZ) cut interest rates by 25 basis points in its meeting yesterday, lowering the official cash rate from 3.50% to 3.25%, as widely expected.

Despite the rate cut, the New Zealand dollar (NZD) has strengthened significantly. The NZD/USD pair has risen by about 3% since its low of 0.5846 on May 12, 2025, reaching a peak of 0.6032 on Monday, May 26, 2025. The pair is now up approximately 7% year-to-date and is currently trading near the 0.6000 level.

Recent economic data suggest that the New Zealand economy remains resilient, with several key indicators showing positive momentum:

- The monthly trade balance rose to NZD 1.426 billion, beating both the forecast of NZD 670 million and the previous reading of NZD 794 million.

- The Purchasing Managers’ Index (PMI) increased to 53.9, up from 53.2 previously.

- Producer Price Index (PPI) rose by 2.9% quarter-over-quarter, well above expectations (0.2%) and the previous figure (-0.9%).

- Electronic card retail sales were flat at 0% month-over-month, an improvement from the previous decline of -0.8%.

- The unemployment rate fell to 5.10%, lower than the expected 5.3%.

Markets are now awaiting the release of U.S. GDP data. Caution is advised, as a stronger-than-expected GDP reading could put downward pressure on the NZD/USD pair.

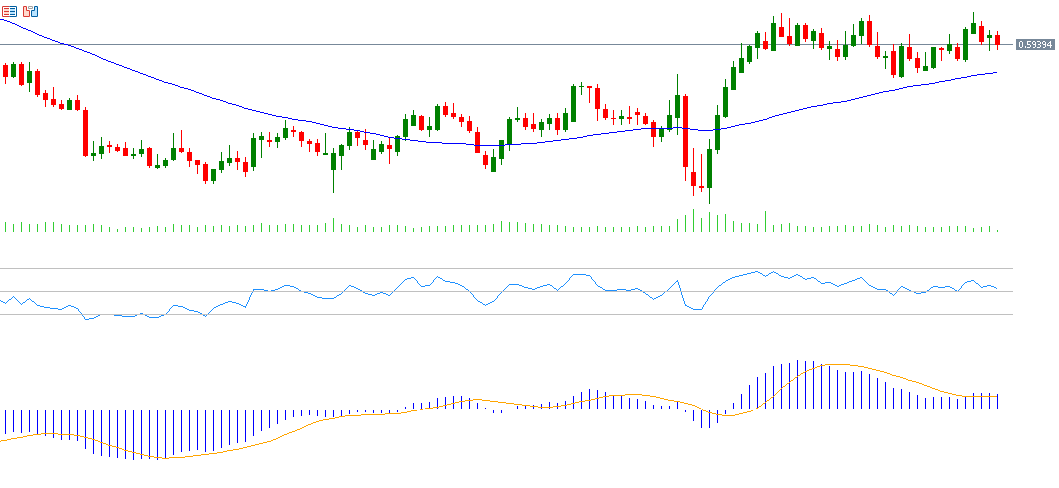

Technical Outlook:

- A break below the pivot point at 0.5953 may open the way for support levels at 0.5925, 0.5895, and 0.5867.

- Conversely, if the pair breaks above the pivot point, resistance levels may be targeted at 0.5983, 0.6011, and 0.6041.

- The Relative Strength Index (RSI) is currently around 52, indicating moderately positive momentum in favor of the New Zealand dollar.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.