Ethereum — the world’s second-largest cryptocurrency by market capitalization at $333 billion, following Bitcoin — reached $2,880 yesterday, marking its highest level since February 4, 2025. Prices have surged approximately 108% from the low of $1,383 recorded on April 9 to yesterday’s peak at $2,880. However, Ethereum remains down around 17% year-to-date and is currently trading near the $2,800 level.

Key factors supporting Ethereum’s rally include — but are not limited to — the following:

- Continued investment inflows into Ethereum-linked Exchange-Traded Funds (ETFs) for the ninth consecutive week — the longest streak since launch.

- Persistent inflows into crypto-related Exchange-Traded Products (ETPs) for eight straight weeks.

- A growing risk appetite among investors, especially large institutions, which are increasingly adding Ethereum to their portfolios for diversification and amid growing optimism about the crypto sector.

- The U.S. Core Consumer Price Index (CPI) came in at 2.4% yesterday — below expectations of 2.5% — which may encourage the U.S. Federal Reserve to cut interest rates in the near future. This would benefit Ethereum, a non-yielding asset, by providing additional bullish momentum.

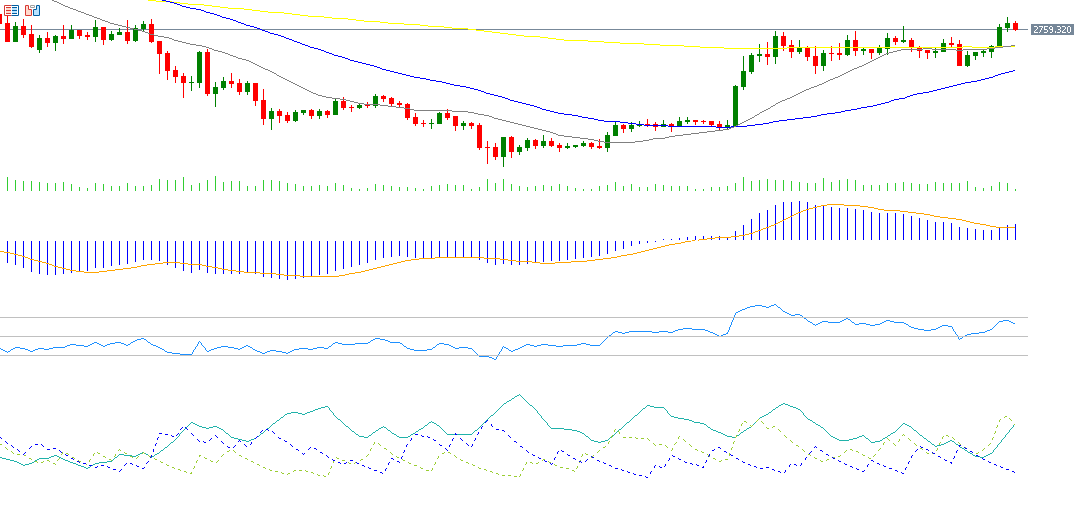

From a technical perspective:

- Key support levels lie at $2,651 and $2,600, corresponding to the 200-day and 20-day moving averages, respectively.

- A bullish crossover has occurred between the MACD (blue) and the Signal Line (orange), signaling positive momentum.

- The Relative Strength Index (RSI) is currently at 63, reflecting upward price momentum.

- The Positive Directional Movement Index (DMI+) stands at 30, versus 14 for the DMI−, indicating buying pressure outweighs selling pressure.

The primary challenge for Ethereum now is to break through the strong resistance at $2,800, and then target the key psychological level of $3,000.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.