European stock indices have surged to record highs, posting significant gains since the beginning of the year. The CAC40 index in France has risen by 8%, the DAX in Germany by 10%, the FTSE100 in the UK by 7%, and the STOXX600 by 8%.

The positive momentum for these indices appears to be continuing in the coming period, driven by several key factors. Chief among them is the interest rate cuts by the Bank of England and the European Central Bank, with expectations of further reductions ahead, which supports European and British stocks. Additionally, the euro and the British pound have weakened against the US dollar due to three main factors:

- Weak European and British economies, as most economic data has fallen short of expectations.

- The strength and resilience of the US economy, with most economic indicators exceeding forecasts, alongside expectations that US interest rates will remain high for a longer period.

- The 25% tariffs imposed by the Trump administration on metal imports, such as aluminum and steel, with further tariffs expected on EU goods.

- Political tensions within the European Union, particularly with the rise of the far right.

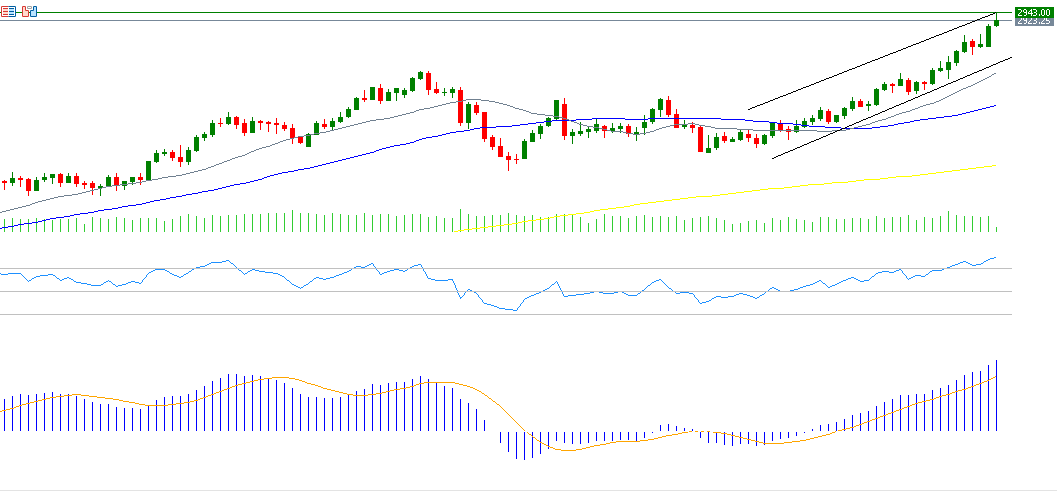

Technical indicators also support the bullish trend in European indices, especially the CAC40, for the following reasons:

- The Relative Strength Index (RSI) is currently at 69 points, signaling strong positive momentum.

- The MACD indicator shows a bullish crossover between the MACD line (blue) and the signal line (orange), reinforcing the upward trend.

- There is a convergence between the 50-day moving average (blue) at 7,550 points and the 200-day moving average (yellow) at 7,580 points. A bullish crossover between them could indicate further upside for the CAC40 index.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.