By Samir Al Khoury,

It seems that the upward trend of crude oil prices is prevailing in the next stage, with oil prices benefiting from several positive factors, the most prominent of which are:

• Continuing geopolitical tensions in the Middle East, the Red Sea, and the Russian-Ukrainian war

• Improved economic data from China, the world’s largest oil importing country. The manufacturing Purchasing Managers’ Index, according to Caixin, a non-governmental body, reached 51.8 points yesterday, exceeding expectations (51.5) and the previous reading (51.7), marking its highest level in 3 years.

• Expectations of increased oil demand in the summer, particularly from the United States of America, the largest oil-consuming country in the world.

• Natural concerns, including the hurricane season in the Atlantic Ocean.

• Dot plot expectations, suggesting a 25 basis point reduction in US interest rates this year. Markets currently anticipate the possibility of two cuts by the Federal Reserve.

According to Bloomberg Economics, it is expected that most central banks will reduce interest rates by a cumulative 155 basis points from globally agreed rates by the end of 2025.

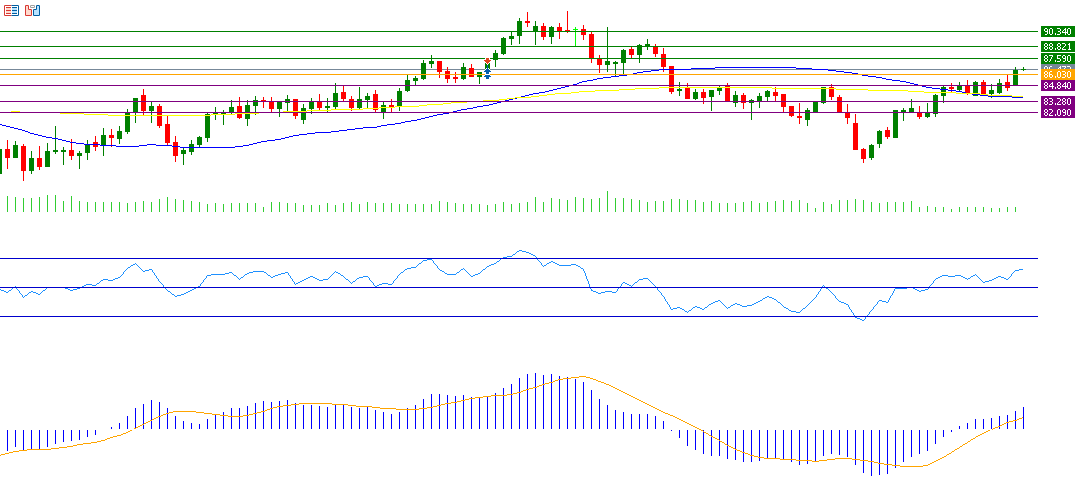

Technically, the price of crude oil has risen by about 13% since its low on June 4, 2024, at $76.79, reaching a peak of $86.88 today, and currently trading near $87. The primary challenge lies in surpassing the $92.14 level, the highest recorded this year on April 12, 2024.

Technical indicators suggest support for crude oil prices in the near term for several reasons:

First: A bullish or golden cross occurred today between the 20-day moving average (in gray), standing at $83.60, and the 50-day moving average (in blue), standing at $83.45, indicating an upward trend in crude oil prices.

Second: The Relative Strength Index (RSI) currently stands at 63 points, indicating upward momentum in crude oil prices.

Third: The MACD indicator (in blue) is above the SIGNAL LINE (in orange) in the positive zone, signaling positive momentum to crude oil prices.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk.