By Camilo Botia,

The Federal Reserve is expected to maintain interest rates at their current two-decade high for a fifth consecutive meeting next week despite signs of a slowdown in consumer spending. Recent data revealed a surprising uptick in inflation and a strong labour market, prompting policymakers to prioritize price stability before considering rate cuts.

New data showed that producer prices rose more than anticipated in February, while core consumer goods prices, excluding food and energy, climbed for the first time since May 2023. This data and rising energy costs suggest inflation may be stalling or even reversing its previous downward trend.

Economists predict the Fed’s preferred inflation metric, the core PCE price index, will remain robust in February’s upcoming release, following a strong January reading. This has led some economists to push back their forecasts for a rate cut until June or November.

The continued strength of the labour market adds to the Fed’s cautious stance. Recent revisions to unemployment data revealed fewer Americans are filing for benefits than previously thought, indicating a tight labour market that could put upward pressure on wages and contribute to inflation.

While inflation and job data suggest a potentially reheating economy, retail sales data tell a contrasting story. February’s retail sales figures came in lower than expected, indicating a slowdown in consumer spending. This data reinforces the view that the economy might be growing but slower.

The mixed economic signals suggest the Fed will likely maintain its current stance. With inflation remaining a concern and the labour market robust, policymakers are hesitant to loosen monetary policy. However, the weaker consumer spending data underscores the need to avoid keeping rates high for too long, which could stifle economic growth.

Financial markets will closely watch the Fed’s upcoming meeting, as its decision will impact interest rates, stock prices, and the overall economic climate.

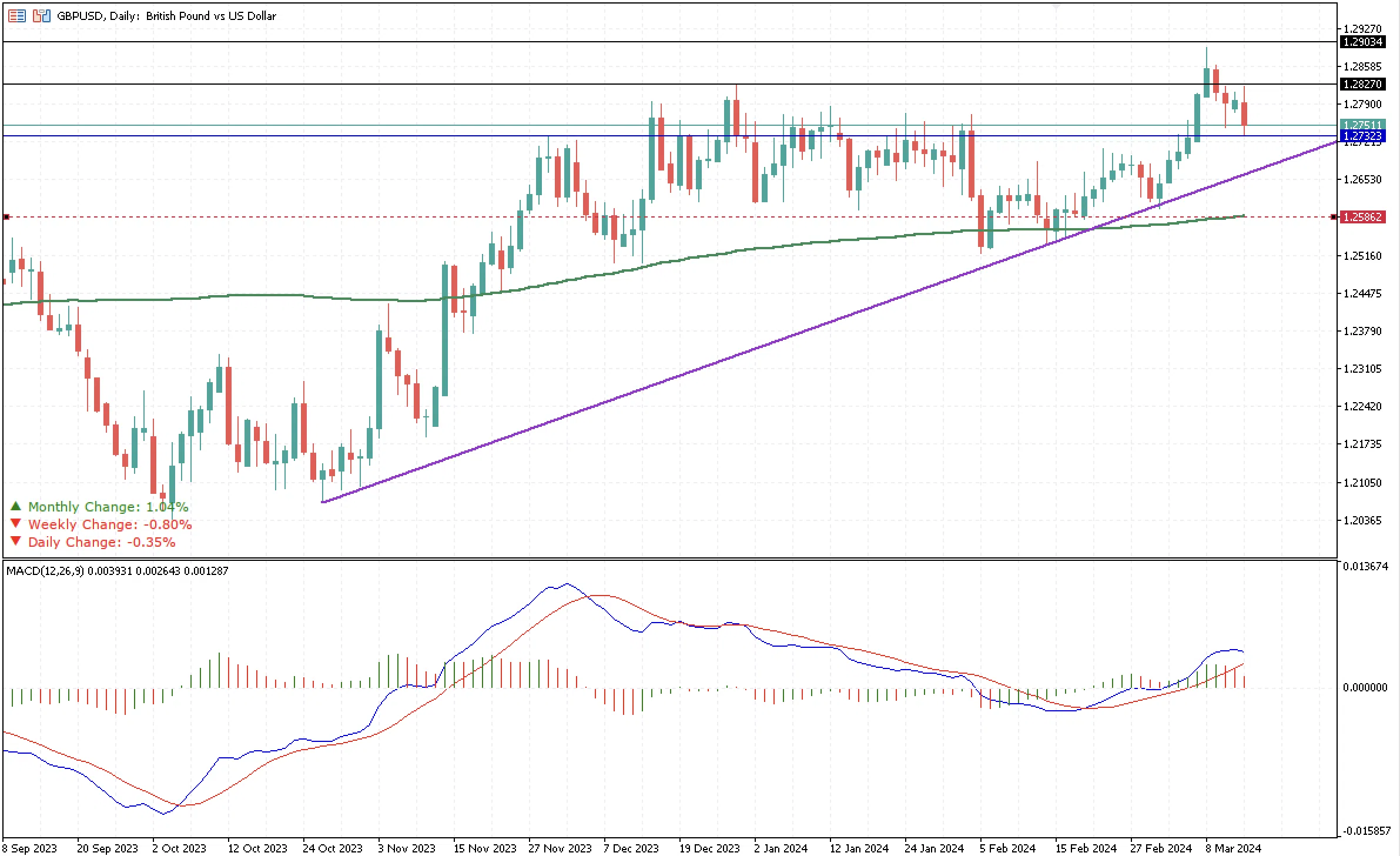

With the increasing expectation of interest rates remaining high for longer, forex pairs such as the GBPUSD have seen a more robust dollar with increasing bearish momentum after reaching $1.2892, its highest price of the year. The GBPUSD has already reached significant weekly support at $1.2732. However, it has yet to be successfully breached. The MACD indicator shows the previous bullish movement on the GBP has been losing pace.

The bullish trendline continues to be a significant level to monitor as a dynamic support. Further down the 200-day moving average is the last support at $1.2586. On the other hand, the next two resistances for the GBPUSD are $1.2827 and $1.2903.