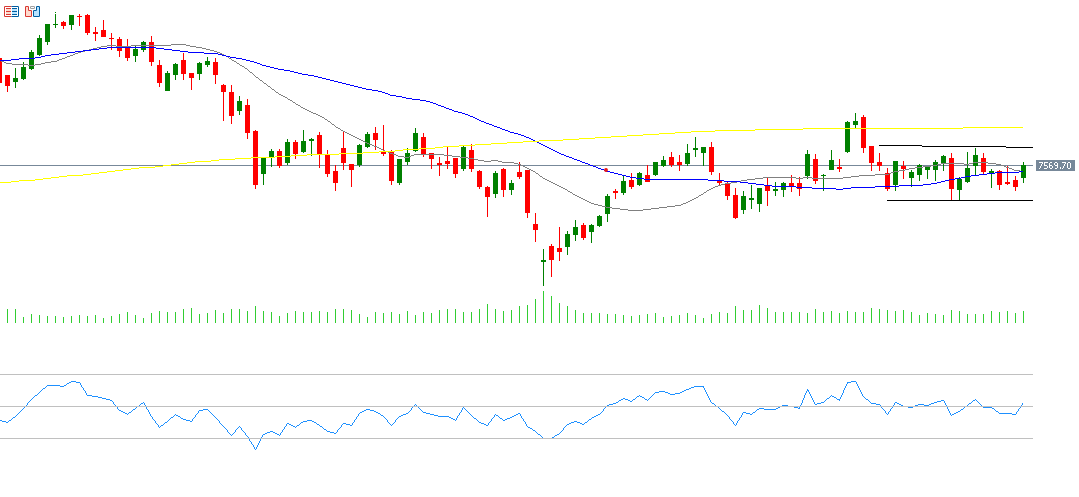

The French CAC40 index has been trading in a horizontal range since the beginning of October this year, between 7,420 and 7,655 points, without a clear direction. This index is still down by about 0.50% since the beginning of the year up to yesterday’s closing session, lagging behind both the German DAX index (which has risen by about 16%) and the British FTSE 100 index (which has risen by about 7%) as well as the European Stoxx 600 index (which has risen by about 9%).

Recent French economic data show that the French economy is facing weakness, as:

- The industrial purchasing managers’ index (PMI) for October fell to 44.50 points, which is below expectations (44.9) and the previous reading (44.60).

- The services purchasing managers’ index (PMI) for October fell to 48.30 points, which is below expectations (49.8) and the previous reading (49.60).

- The trade balance in August recorded a deficit of €7.40 billion, which is a larger deficit than expected (-€5.5 billion) and the previous reading (-€6.0 billion).

- The year-on-year consumer price index slowed down in September, recording 1.10%, which is lower than expectations (1.20%) and below the previous reading (1.80%).

- The ratio of French debt to gross domestic product continues to rise, reaching levels above 120%, posing a significant challenge for French authorities to reduce this high ratio.

Markets are awaiting the release of the French GDP index on a quarterly basis on Wednesday, with expectations for a growth rate of 0.3%, surpassing the previous reading of 0.2%. On Thursday, the consumer price index in France will be released on a year-on-year basis, with expectations for a rate of 1.0%, which is lower than the previous reading of 1.1%.

From a technical perspective, there is a convergence between the 20-day moving average (in gray) standing at 7,544 points, and the 50-day moving average (in blue) also at 7,540 points as of October 28, 2024. Any bearish crossover between them may indicate the beginning of a downward trend for the CAC40 index.

As for the Relative Strength Index (RSI), it is at a neutral level (50 points), indicating ambiguity and a lack of clarity in the direction of the CAC40 index, whether upward or downward.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.