The UK’s FTSE 100 index rose to a record high of 9,042 points on Tuesday, July 15, 2025. It has gained approximately 20% since the low recorded on April 7, 2025, at 7,533 points, reaching its recent peak. Since the start of the year, the index has risen by about 10%, outperforming major U.S. indices such as the S&P 500 and Nasdaq 100, though still lagging Germany’s DAX (22%).

Several factors contributed to the FTSE 100’s notable rise:

- Despite ongoing trade tensions and uncertainty—especially with the Trump administration continuing to impose tariffs on various sectors and countries (set to take effect on August 1, 2025)—the UK successfully signed a trade agreement with the United States. The strong relationship between the two nations has positively impacted the British market.

- Expectations of continued monetary easing or potential interest rate cuts by the Bank of England in the near term.

- The British pound has weakened against the U.S. dollar for six consecutive days, reaching 1.3365 yesterday—its lowest level since May 20, 2025—which tends to support the FTSE 100, as many of its companies earn revenue in foreign currencies.

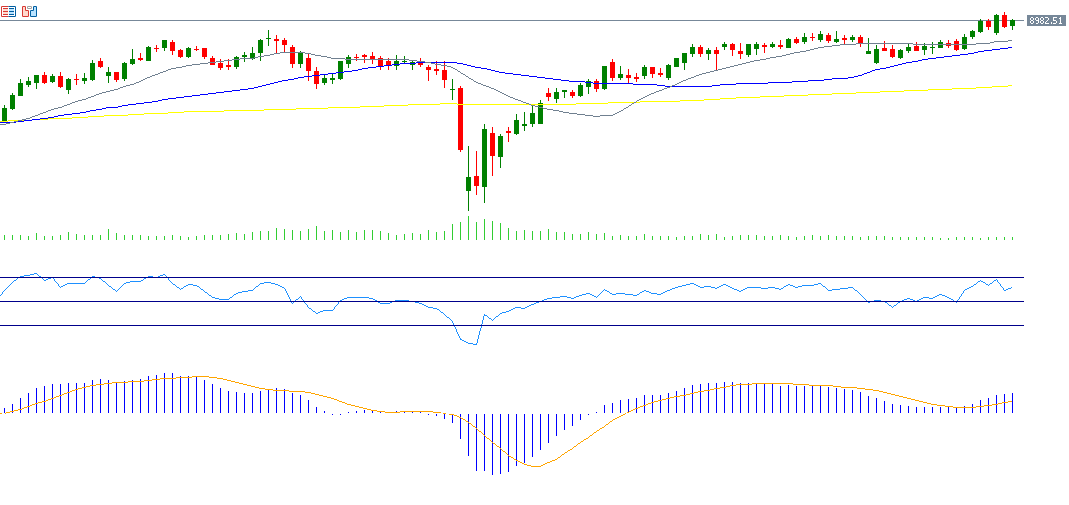

From a technical perspective, indicators point toward a continuation of the FTSE 100’s bullish trend:

- The 20-day, 50-day, and 200-day moving averages are aligned in an upward direction, with the 20-day MA above the 50-day, and the 50-day above the 200-day.

- The Relative Strength Index (RSI) is currently at 62, indicating positive momentum.

- The MACD shows a bullish crossover between the blue MACD line and the orange signal line, supporting continued upward momentum.

The main challenge for the FTSE 100 now lies in holding above the key psychological and record level of 9,000 points, which broke on July 15, 2025, and potentially setting new all-time highs in the coming sessions.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.