U.S. stock indices closed lower yesterday, with the S&P 500 dropping by (-0.38%) and Nasdaq 100 by (-0.85%), following a seven-day consecutive rise. Despite this, these indices are still up since the beginning of the year by approximately 26% and 24%, respectively. The Dow Jones also closed with a loss of (-0.31%) yesterday but remains up about 19% year-to-date.

It is important to note that several factors could provide positive momentum for U.S. stocks in the coming period:

- Seasonality: December and January are typically positive months for stock performance, a phenomenon also known as the “Santa Claus Rally.”

• Continued U.S. interest rate cuts: Markets are currently pricing in a 69% probability of a 25 basis point rate cut, and a 31% chance of a rate hold at the upcoming Federal Reserve meeting on December 18.

Deutsche Bank forecasts the S&P 500 to reach 7,000 points by 2025.

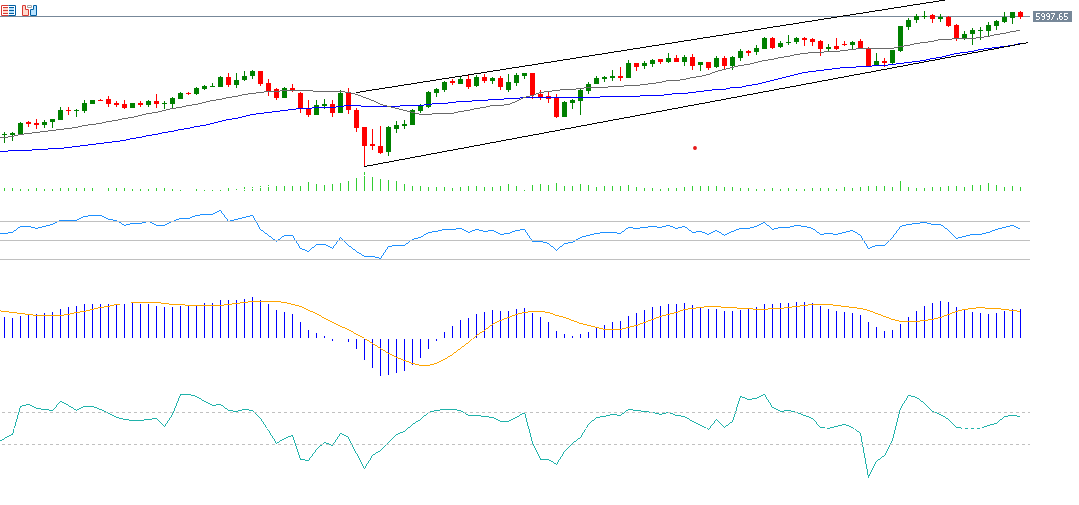

From a technical perspective, the indicators support the continued rise of the S&P 500 for the following reasons:

- The alignment of the 20, 50, and 200-day moving averages with their upward trends: The 20-day moving average is above the 50-day, and the 50-day moving average is above the 200-day.

- The Commodity Channel Index (CCI), which currently stands at about a positive 77, indicating the prevailing positive momentum of the S&P 500.

- The Relative Strength Index (RSI), currently at 62, suggesting a bullish momentum for the S&P 500.

- A bullish crossover between the MACD (blue line) and the Signal Line (orange line) in the positive zone for 2024, indicating the continuation of the upward trend for the S&P 500.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.