By Camilo Botia. Gold prices edged higher on Tuesday, buoyed by expectations of the Federal Reserve’s interest rate cuts. Investors are closely watching inflation data due later this week for clues on the timing of these potential cuts.

The price of Gold rose slightly to $2,178.67 per ounce after earlier gains of up to 1.3%. Analysts believe Gold could climb further towards summer as anticipation of rate cuts builds. Unless the Fed changes course, gold prices could rise based on rate cut expectations alone.

The key data point for investors is the Core Personal Consumption Expenditure Price Index (PCE), due on Friday. A higher-than-expected inflation reading could trigger a temporary pullback in gold prices, but the market expects any dips to be short-lived. Gold recently hit a record high after the Fed signalled plans to cut rates by the end of the year. Traders currently estimate a 71% chance of a rate cut in June. Lower interest rates make Gold, which offers no interest itself, a more attractive investment.

Solid physical demand from China, particularly from households, is another factor supporting gold prices. The record rally has not deterred Chinese buyers, and central banks continue to accumulate gold reserves, with China leading the charge. Analysts suggest this is a strategy to diversify away from U.S. dollars and other G7 currencies.

While gold prices advanced, other precious metals like silver, platinum, and palladium slightly declined.

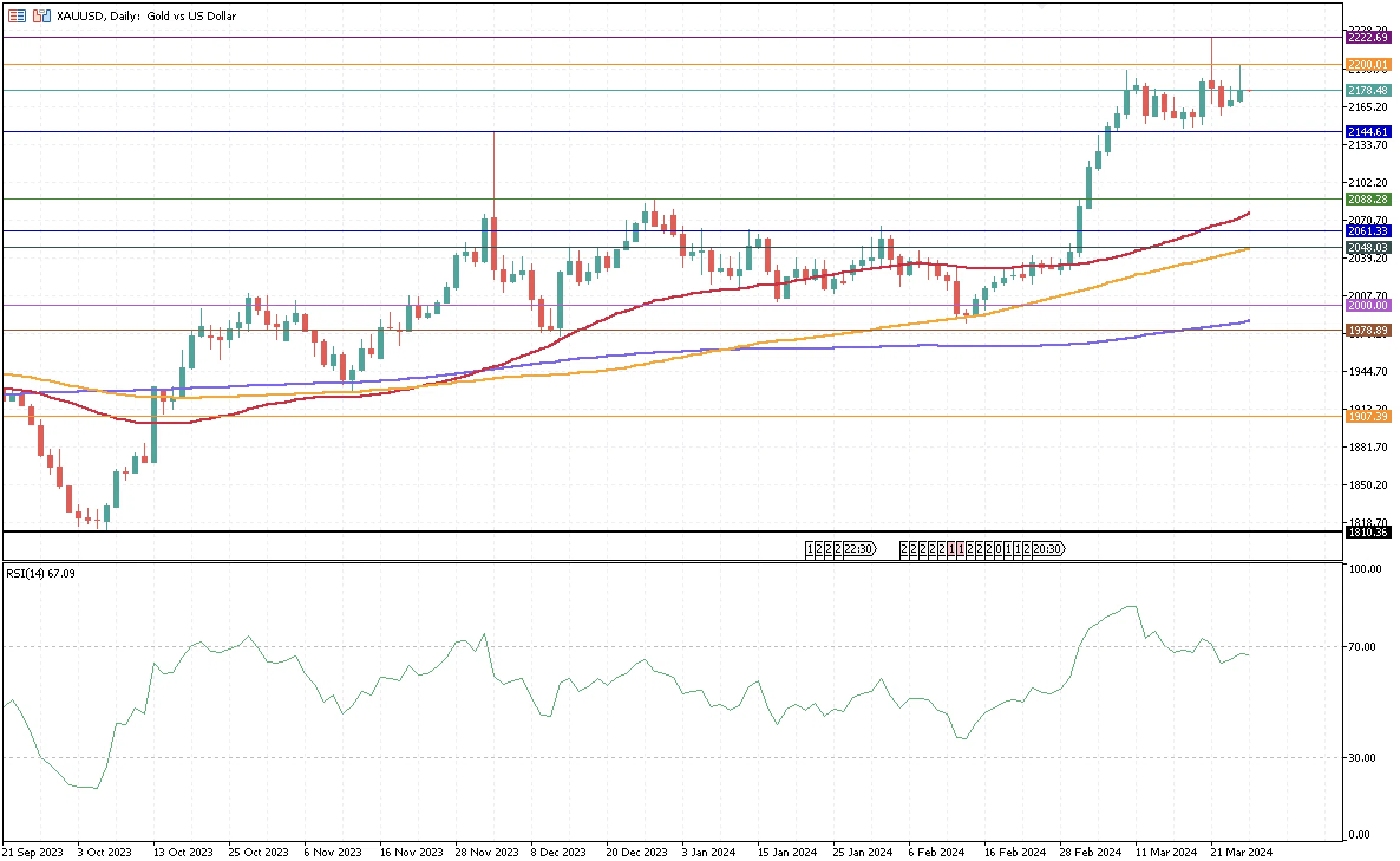

Gold is trading below $2,200 and has maintained a sideways movement during most of March after exiting an overbought market earlier in the month. It reached an all-time high last week on March 21, which is its second closest resistance at $2,222.69. As support, the most significant level for Gold is around $2,144.61, and below that is a second floor at $2,088.28, which is a significant weekly level to monitor.

The three simple moving averages of 50, 100, and 200-day keep showing a bullish trend on Gold after the golden cross of December last year, with the 100-day moving average working as the most significant support in the medium term.