Gold prices reached an all-time high of $3,043 today, with forecasts pointing to a continued upward trend and the potential for new record highs.

Since the beginning of the year, gold has surged by approximately 16%, outperforming high-risk assets such as Bitcoin (-11%) and major U.S. stock indices like the S&P 500 (-5%) and Nasdaq 100 (-7%). This indicates growing investor concerns, prompting a shift toward the traditional safe-haven asset—gold.

Currently, gold stands as the only financial asset with a clear upward trend, unlike oil, currencies, stocks, bonds, and cryptocurrencies, where market directions remain uncertain.

Interestingly, when examining U.S. inflation, gold benefits in both scenarios—whether inflation rises or falls. Higher inflation increases demand for gold as a hedge, while a decline in inflation, as seen last week with slowing consumer and producer price indices, could encourage the Federal Reserve to cut interest rates more aggressively. Markets are currently pricing in three rate cuts this year, which would provide further momentum for gold, as it is a non-yielding asset. The lower interest rates go, the more attractive gold becomes.

Key Factors Supporting the Continued Rise of Gold:

- Trade Tensions: Ongoing trade disputes between the Trump administration and other countries, including China, Canada, Mexico, and the European Union, increase uncertainty, pushing investors toward safe-haven assets.

- Geopolitical Risks: Rising tensions in the Middle East, particularly between the U.S. and the Houthis in the Red Sea, have escalated concerns. Trump has stated that Houthi naval attacks are direct Iranian aggression, raising geopolitical risks and fears of a broader conflict. Additionally, the war in Gaza has resumed.

- Central Bank Purchases: Global central banks, particularly the People’s Bank of China, continue to increase their gold reserves, boosting demand and supporting higher prices.

- Weak U.S. Dollar: The dollar index has dropped to its lowest level in five months.

- Recession Fears: Concerns over a potential U.S. economic slowdown are adding to gold’s appeal.

- Gold Scarcity: There are 7.2 billion ounces of gold in circulation worldwide, with an estimated 2 billion ounces still in the ground.

Key Market Events to Watch:

Markets are closely watching the Federal Reserve’s interest rate decision today, with expectations of rates remaining steady at 4.25%–4.50%. Investors are also awaiting Fed Chair Jerome Powell’s speech, which could provide clues about future monetary policy. Additionally, the release of the Dot Plot (a chart showing interest rate forecasts) may offer insights into the Fed’s rate path for the rest of the year.

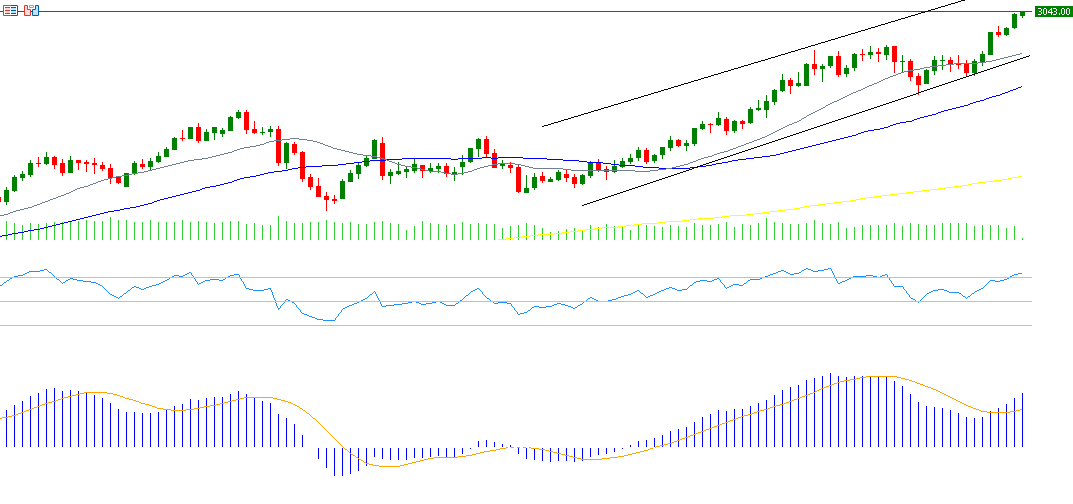

Technical Indicators Favor Further Gold Gains:

- Moving Averages: The 20-day, 50-day, and 200-day moving averages are in an upward trend, with the 20-day MA crossing above the 50-day MA, and the 50-day MA crossing above the 200-day MA.

- Relative Strength Index (RSI): Currently at 73, indicating strong bullish momentum.

- MACD Indicator: A bullish crossover has occurred between the MACD line (blue) and the signal line (orange), supporting a positive outlook.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.