Gold prices gained about 1% last week and have extended their rise by 0.50% so far this week, supported by several key factors:

- Fed Policy Outlook: Federal Reserve Chair Jerome Powell hinted during his speech at the Jackson Hole Symposium on Friday at potential interest rate cuts. This boosted the attractiveness of gold, which offers no yield but benefits in a lower-rate environment.

- Political Pressure on the Fed: U.S. President Donald Trump has intensified pressure on Powell and other Fed members, particularly Lisa Cook, whom he dismissed over alleged fraud. Cook refused to resign, insisting she will continue performing her duties. Analysts note that Trump’s ultimate goal is to secure majority influence at the Fed to push for more aggressive rate cuts.

- Russia-Ukraine War: The conflict shows no signs of resolution, with a peace agreement between the two sides still considered highly unlikely at this stage.

- Trade Tensions with India: The Trump administration has imposed 50% tariffs on Indian exports to the U.S. in response to India’s continued purchases of Russian oil, adding to the backdrop of global trade friction.

Price Action and Market Context

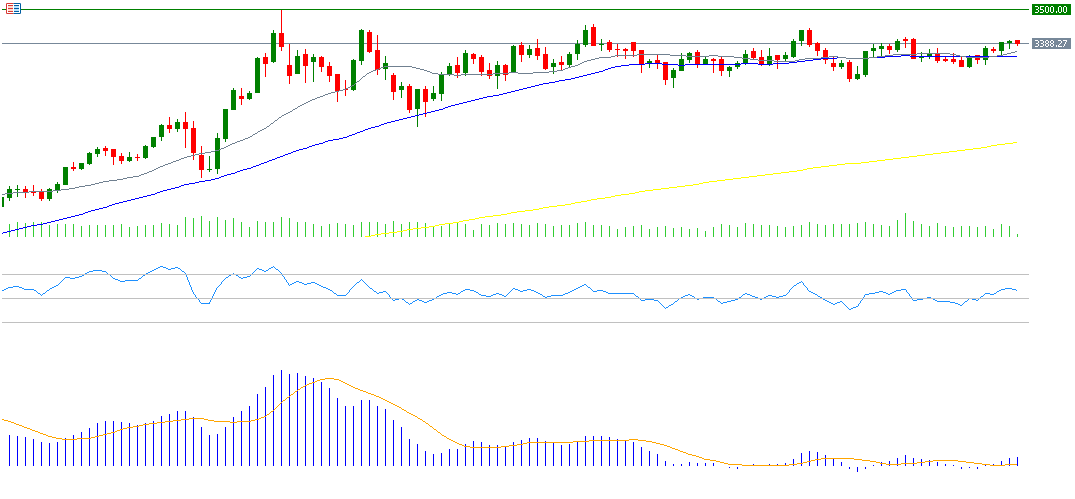

Since reaching an all-time high of $3,500 on April 22, 2025, gold has traded in a sideways range between strong support at $3,200 and solid resistance at $3,400. The market is consolidating, awaiting a clearer breakout direction. Despite this rangebound movement, gold remains up 29% year-to-date, significantly outperforming riskier assets such as U.S. equities and Bitcoin.

Technical Outlook

- The 20-day moving average (gray) near $3,363 acts as the first key support level.

- The 50-day moving average (blue) at $3,348 provides a secondary support zone.

- The Relative Strength Index (RSI) currently stands at 56, signaling ongoing bullish momentum.

- The MACD (blue) remains above its Signal Line (orange), reinforcing the positive momentum for the yellow metal.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.