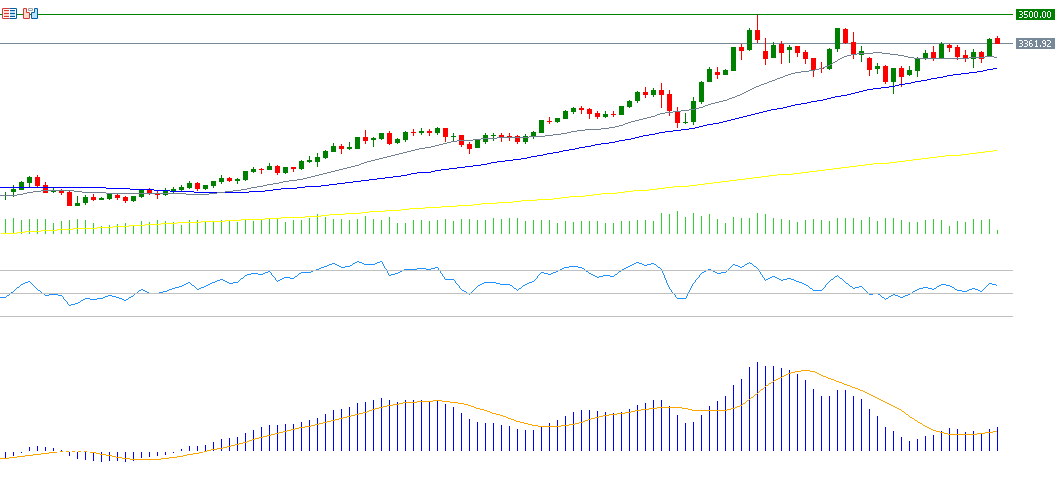

Gold prices continue to rise for the fifth consecutive month. On April 22, gold hit a record high of $3,500 before pulling back to $3,121 on May 15, 2025—an 11% drop. However, prices rebounded today to $3,392, marking an 9% increase from the May 15 low. Since the beginning of the year, gold has gained approximately 28%.

Both fundamental and technical factors appear to support a continued uptrend in gold prices going forward. Key drivers include:

- Escalating geopolitical tensions between Russia and Ukraine.

- Ongoing trade tensions between the Trump administration and China, along with the recent U.S. decision to double tariffs on steel imports from 25% to 50%, a move Trump says will further secure the American steel industry.

- Weakness in the U.S. Dollar Index, which fell to 98.58 today, its lowest level since April 22, 2025.

- Continued central bank purchases, with global central banks—most notably the People’s Bank of China—boosting their gold reserves, thereby supporting demand and prices.

From a technical standpoint, indicators also suggest further upside potential for gold, as highlighted by the following:

- A bullish crossover remains intact between the 20-day ($3,294) and 50-day ($3,242) moving averages, indicating sustained upward momentum.

- The Relative Strength Index (RSI) currently reads 57, reflecting continued bullish momentum.

- A bullish crossover on the MACD indicator is evident, as the MACD line (blue) has crossed above the signal line (orange), further reinforcing the positive trend.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.