U.S. markets are trading with extreme caution ahead of the much-anticipated speech by Jerome Powell, the head of the world’s largest central bank — the U.S. Federal Reserve — at the Jackson Hole Symposium today. Global attention from markets, investors, analysts, and economists is focused on Powell’s tone, especially regarding the path of U.S. monetary policy in the upcoming phase.

Market pricing currently indicates a 70% probability that the Fed will cut interest rates by 25 basis points at its upcoming meeting on September 17, 2025, down from over 90% last week.

Two days ago, the minutes from the Fed’s latest meeting were released, and the key takeaway was that most members still view inflation as the primary risk — outweighing concerns about the labor market.

This opens the door to questions about Powell’s likely tone. It is expected he will adopt a neutral stance, as usual, emphasizing a data-dependent approach to future rate decisions. Despite the weakness in the recent non-farm payrolls report, the 4.2% unemployment rate remains solid. Additionally, both the core Consumer Price Index (CPI) and Producer Price Index (PPI) figures are still above 3.00%, exceeding the Fed’s 2.00% target.

Moreover, yesterday’s data showed strength in both the Manufacturing and Services PMI figures, which supports the likelihood that the Fed will hold rates steady in September — contrary to current market expectations.

It’s also worth noting that several key economic indicators will be released before the September meeting. These include:

- Gross Domestic Product (GDP) on Thursday, August 28

- Core Personal Consumption Expenditures (Core PCE), the Fed’s preferred inflation gauge, on Friday, August 29 — currently at 2.8%

- Non-Farm Payrolls and the unemployment rate on Friday, September 5

Expectations are that the Core PCE may rise to 3% or higher, partly due to the impact of Trump’s tariff policies. If the labor market data is strong, I believe the Fed will refrain from cutting rates in September — despite ongoing political pressure from Trump on Powell and other Fed members to lower rates. However, if labor data comes in significantly weak, the Fed may proceed with a 25-basis-point rate cut in the September meeting.

U.S. Bond Markets

Treasury yields across all maturities have been trading sideways in a horizontal range since the start of August. Currently, 2-year yields are around 3.75%, 10-year yields are at 4.30%, and 30-year yields hover near 4.90%, with the market searching for a clear direction either higher or lower.

All eyes are on Powell’s speech today, which could have a significant impact on U.S. Treasury yields. A dovish (easing) tone would likely push yields lower, while a hawkish (tightening) stance with no hint of rate cuts would be bullish for yields.

U.S. Equity Markets

U.S. equity indices, particularly the S&P 500 and Nasdaq 100, continue to decline — with the S&P 500 falling for the fifth consecutive session and the Nasdaq 100 for the third, after hitting record highs last week.

S&P 500 reached 6,481 points on Friday, August 15, while the Nasdaq 100 hit 23,969 on Wednesday, August 13. Both indices closed lower yesterday, with the S&P 500 ending at 6,396 and the Nasdaq 100 at 23,250.

Meanwhile, the Volatility Index (VIX), also known as the “fear gauge,” rose to 17.24 points yesterday — its highest level in two weeks — signaling increased investor anxiety and market uncertainty.

Several factors are weighing on U.S. equities:

- Profit-taking and correction after the indices reached record highs — a natural market reaction

- Continued weakness in the “Magnificent 7” the major tech companies leading the AI boom

- Extremely high valuation ratios, such as Price-to-Earnings (P/E), Price-to-Book, and Price-to-Sales

- Summer holiday season in late August, which historically leads to weaker market performance

- Ongoing uncertainty surrounding U.S. monetary policy

Markets are also anticipating Nvidia’s earnings report, due Wednesday, August 27, 2025. The company is expected to post earnings of $1.00 per share, up from $0.68 previously. Revenue is forecasted at $45.58 billion versus $30.00 billion in the prior quarter. All eyes will be on the company’s forward guidance, with expectations pointing to continued strong momentum in Nvidia’s stock.

U.S. Dollar Index

The Dollar Index (DXY) has been trading sideways in a horizontal range between 98.00 and 100.00 since early August, awaiting a clear breakout direction.

Powell’s speech today will likely influence the dollar significantly across major currencies. A dovish tone signaling policy easing would be negative for the dollar, while a hawkish tone indicating tight policy and no rate cuts would be supportive of the dollar.

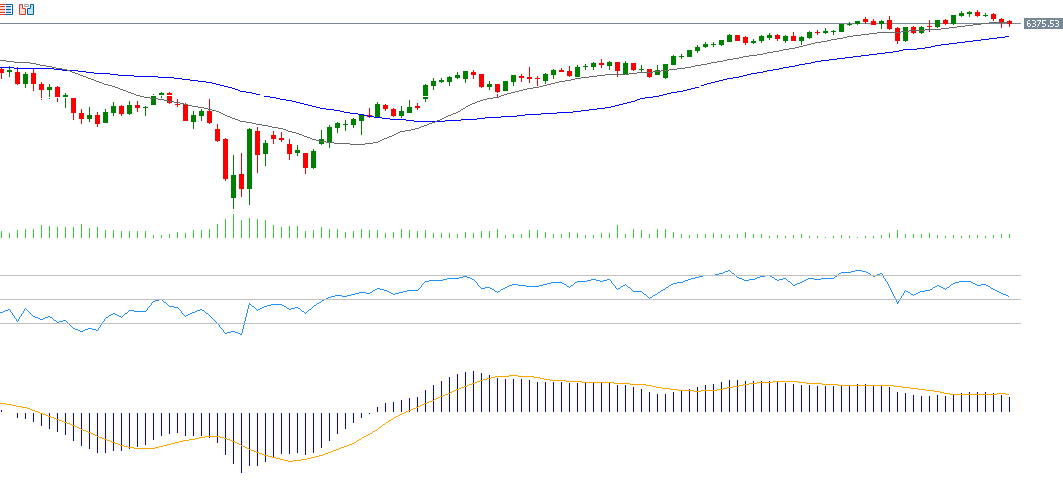

Technical Analysis

Technical indicators show mixed signals for the S&P 500 in the near term, due to the following:

- Relative Strength Index (RSI): Although it has declined, it remains around 53, indicating continued positive momentum in the index.

- MACD Indicator: The blue line is currently below the orange signal line, which reflects growing negative momentum in the S&P 500.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.