The Federal Open Market Committee decided at its meeting yesterday to keep interest rates unchanged, in line with market expectations, within a range of 3.50% to 3.75%. The voting results showed that two out of the 12 members favored a 25-basis-point rate cut at this meeting, while the remaining members voted in favor of keeping rates unchanged.

During the press conference, Federal Reserve Chair Jerome Powell emphasized that inflation remains somewhat elevated compared to the target level, noting that this inflation largely reflects increases in prices of goods affected by tariffs. He stressed that it is too early to declare victory over inflation. Powell added that the Fed is now near the upper end of the reasonable range for the neutral interest rate, and that the baseline scenario is no longer one in which the next move would be a rate hike.

Powell also noted that the U.S. economy entered 2026 on solid footing, with the unemployment rate showing signs of stabilization. He reaffirmed that he and his colleagues at the Federal Reserve are strongly committed to the independence of the central bank and advised the next Federal Reserve Chair to stay away from politics.

How did Jerome Powell’s remarks affect financial markets?

U.S. equity indices closed mostly higher:

• The S&P 500 closed flat after hitting a new record high at 7,002 points.

• The Nasdaq 100 closed up 0.32%.

• The Dow Jones Industrial Average closed up 0.05%.

Gold prices closed higher by 4.60%, reaching a new record high at $5,598 today.

What about U.S. Treasury bonds?

Short- and long-term U.S. Treasury yields were broadly stable:

• The 2-year Treasury yield closed at 3.57%.

• The 10-year Treasury yield closed at 4.25%.

• The 30-year Treasury yield closed at 4.86%.

Meanwhile, the U.S. Dollar Index closed at 96.33, up 0.54% on the day.

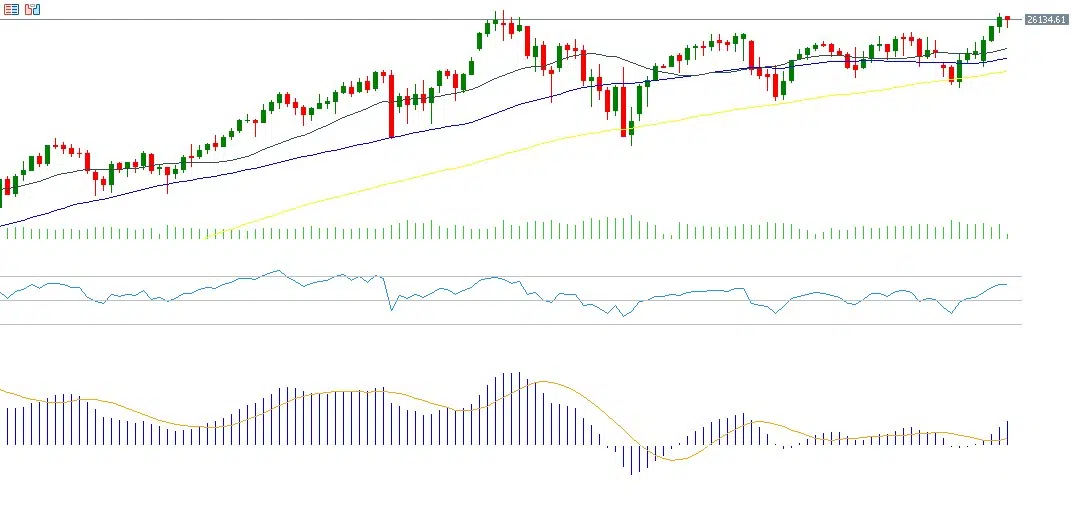

Technical outlook for the Nasdaq 100

The upward trend in the Nasdaq 100 remains intact. The index reached 26,165 points yesterday before closing at 26,023 points.

Technical indicators continue to support the bullish trend:

- The 20-, 50-, and 200-day moving averages remain aligned to the upside.

- The Relative Strength Index (RSI) is currently at 61, indicating positive momentum.

- A bullish crossover between the MACD line and the signal line further supports the continuation of positive momentum.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.