By Camilo Botia

The January consumer price index (CPI) report released by Statistics Canada showed a welcome decline, offering hope for a more manageable economic future.

This positive development comes after months of relentless price increases that strained household budgets and prompted the Bank of Canada to embark on an aggressive interest rate hike campaign. In January, however, the CPI rose by only 2.9% year-over-year, marking a significant slowdown from the 3.4% increase in December and falling below the Bank of Canada’s target range of 1-3% for the first time since June 2023.

This encouraging trend wasn’t limited to the headline figure. Core inflation measures, which strip out volatile components like food and energy, also showed improvement, averaging 3.35% compared to 3.6% the previous month. This suggests that the underlying price pressures driving inflation are finally easing.

Financial markets reacted swiftly to the positive report. Bonds jumped, reflecting investor confidence in the outlook for inflation and lower interest rates in the future. The Canadian dollar, however, weakened slightly, likely due to the reduced pressure on the Bank of Canada to continue raising rates aggressively.

The easing of inflation also raises the possibility of earlier interest rate cuts. Economists, who previously predicted cuts wouldn’t come until mid-2024, are now revising their forecasts. Some now see the Bank of Canada potentially lowering rates as early as June, while others are betting on a move as soon as April. This could cause the Canadian Dollar to continue to weaken against its US counterpart as the monetary policy of both Central Banks starts to diverge, with the BoC having a more dovish approach if they decide to start cutting rates by April.

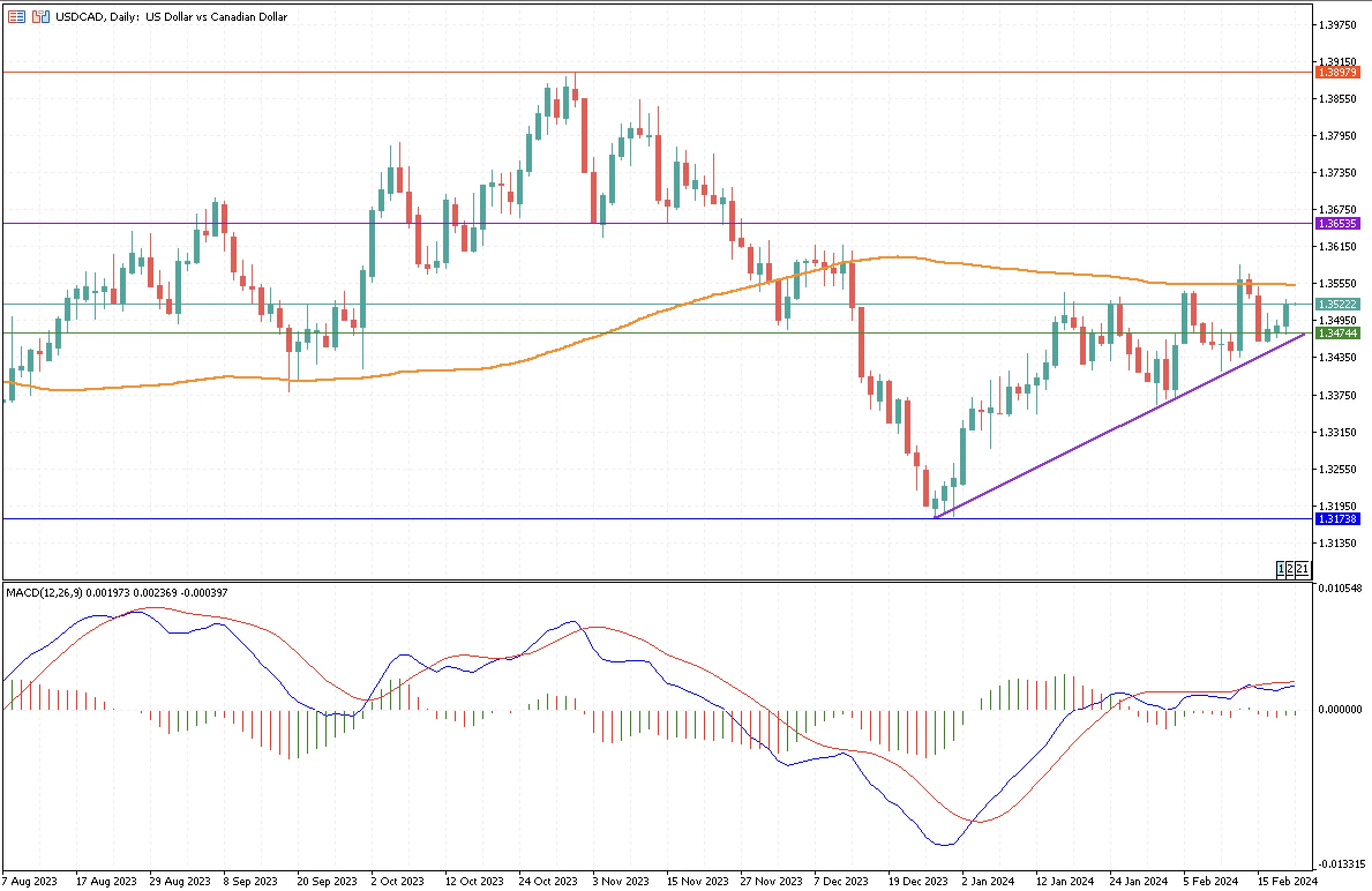

As a result, the Canadian dollar has weakened by around 2% during the year compared to the US dollar. The USDCAD has been experiencing an upward trend since December 27, pushing it closer to its 100-day simple moving average, which lastly traded last week and effectively resisted a bullish breakout. The closest support for the USDCAD is at around $1.3474, a significant monthly support. On the other hand, if the Loonie continues to lose ground to its American counterpart, it will eventually reach the 100-day moving average at around $1.3555 and break it, aiming for a second resistance at $1.3653.