By Camilo Botia

Japan’s stock market reached a significant milestone on Monday as the Nikkei 225, a key index that tracks the performance of 225 large Japanese companies, surpassed the 40,000 mark for the first time. This achievement extends the market’s historic rally, which has seen steady gains over the past year. The surge was driven by technology stocks, with Advantest Corp. leading the pack. This aligns with the year-long trend where tech companies have been a major force propelling the market upwards. Notably, both domestic and global investors contributed to the buying momentum. The surge in activity even caused a temporary crash of the stock-trading app of Japan’s biggest online broker.

Analysts hold a cautious optimism regarding the future. While the 40,000 level is seen as a potential point of resistance and potential volatility, many believe strong economic fundamentals and a weak yen will continue to bolster the market. The Nikkei’s recent surge comes after it surpassed its 1989 peak last month. This impressive feat was driven by several factors, including improved shareholder returns from Japanese companies, a weaker yen, strong corporate profits, and a confidence boost from Warren Buffett’s endorsement of Japanese trading houses last year. Additionally, concerns over China’s economic slowdown led many funds to shift their focus to Japan.

While some analysts express concerns about the pace of the rally, many foreign investors remain bullish. Major asset managers like BlackRock and Amundi anticipate continued growth fueled by earnings and positive changes in corporate governance. Positive economic data released on Monday, showing an increase in business sentiment and potential for an official end to deflation, adds to the overall positive outlook.

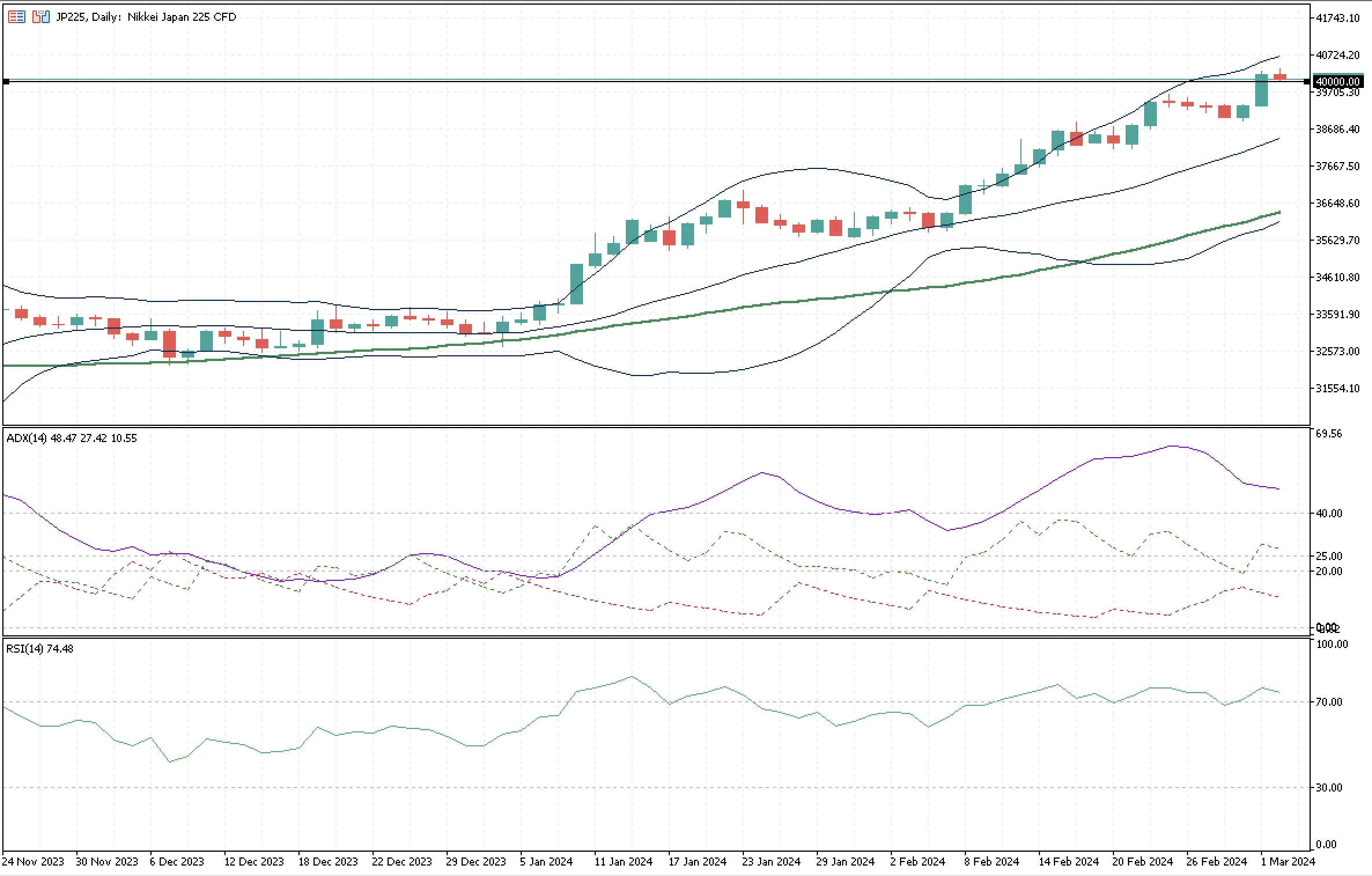

In conclusion, the Japanese stock market is experiencing a historic rally driven by a combination of positive factors. Although some concerns exist regarding the pace of the rise, many analysts remain optimistic about the future, citing strong economic fundamentals and ongoing support from global investors. The Index will likely keep trading around the key level of 40,000 as it is in an overbought condition, as shown by the ADX and RSI indicators, causing the Nikkei to get into a consolidation phase. If the bullish momentum remains, the upper boundary of the Bollinger Bands at around 40,688.86 can pose as the next resistance. As support, the 20-day and 50-day moving averages are two significant levels to monitor at 38,417.10 and 36,259.29, respectively.