The U.S. economy experienced a data-heavy week, marked by mixed signals. The Federal Reserve held interest rates steady at the 4.25%–4.50% range, as widely expected. Meanwhile, GDP growth for Q2 came in stronger than anticipated at 3.0%. Consumer confidence also improved, rising to 97.2, while ADP reported a gain of 104K private-sector jobs. However, official labor market data was disappointing, with only 83K non-farm payrolls added and the unemployment rate ticking up to 4.2%. Job openings declined to 7.437 million. Inflation indicators remained stable, with core PCE holding at 2.8% year-over-year.

In the energy sector, U.S. crude oil inventories surged by 7.698 million barrels, well above expectations. The manufacturing sector showed continued weakness as the ISM Manufacturing PMI fell to 48.0, signaling contraction. Initial jobless claims came in at 218K, slightly below forecasts.

In the Eurozone, economic data indicated fragile stability. Q2 GDP rose slightly by 0.1%, and the manufacturing PMI slipped to 49.8, reflecting ongoing contraction. CPI inflation rose to 2.0% annually, above expectations, while the core reading remained at 2.3%.

In the UK, the manufacturing PMI dropped to 48.0, reflecting continued industrial slowdown.

In Australia, economic data was mixed. Annual inflation slowed to 2.1%, but retail sales grew strongly by 1.2% month-over-month. However, the manufacturing PMI declined to 51.3.

In Japan, the central bank held interest rates steady at 0.50%, as expected. Industrial production jumped by 1.7%, and retail sales rose 2.0%, though the manufacturing PMI dropped to 48.9.

China’s data continued to signal economic weakness. The official manufacturing PMI dropped to 49.3, while both the services PMI and Caixin manufacturing PMI remained below the 50 thresholds, indicating a slowdown in both sectors.

Market Analysis

USD/CAD

The Bank of Canada held its interest rate steady at 2.75% last week, marking the fourth consecutive pause, in line with market expectations. On Friday, the USD/CAD pair reached 1.3879 — the highest since May 22, 2025 — before closing at 1.3787. Despite this strength, the pair is down around 4% year-to-date. The Relative Strength Index (RSI) stands at 57, indicating positive momentum. The MACD shows a bullish crossover between the MACD line (blue) and the signal line (orange), suggesting continued upside potential.

Advanced Micro Devices (AMD)

AMD stock has surged approximately 42% year-to-date. Investors are awaiting the company’s Q2 earnings report, scheduled for Tuesday, August 5, 2025. Analysts expect EPS to come in at $0.58, down from $0.69 in the previous quarter. Revenue is forecasted at $7.40 billion, up from $5.84 billion. RSI currently reads 69, signaling strong bullish momentum. The MACD is also showing a bullish crossover, reinforcing the positive technical outlook.

Gold

Gold prices rose by 0.76% last week, closing at $3,363 per ounce. Year-to-date, gold has gained around 28%. The rally is being fueled by ongoing geopolitical and trade tensions, along with weakening U.S. economic data — particularly in the labor market and manufacturing — prompting markets to price in three potential Fed rate cuts this year. RSI currently stands at 53, indicating moderate bullish momentum.

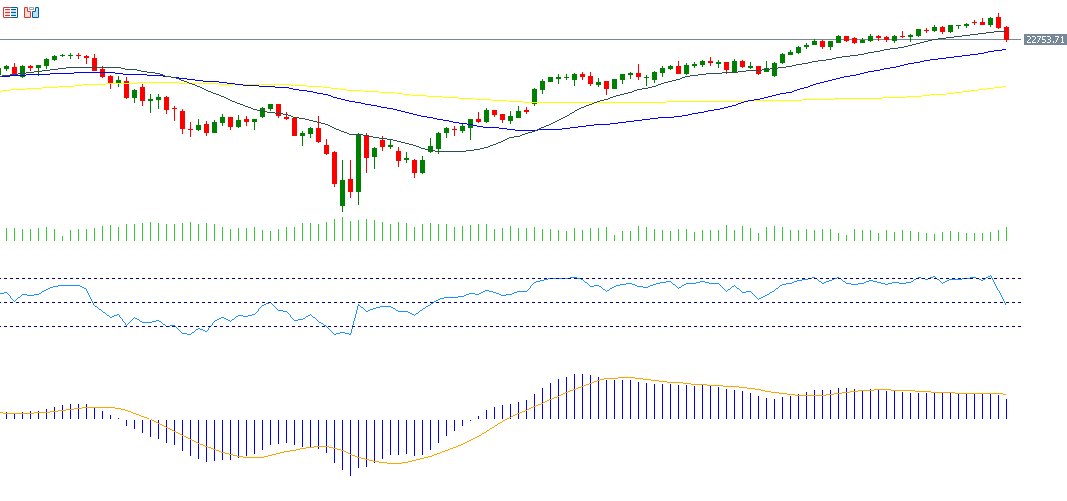

Nasdaq 100 Index

The Nasdaq 100 declined by 2% last week, closing at 22,763 on Friday, August 1, 2025. Despite hitting record highs recently, the index saw a notable drop due to two main factors: weaker-than-expected job market data and escalating trade tensions. RSI now stands at 48, pointing to slightly bearish momentum. The MACD shows a bearish crossover between the MACD line and the signal line, signaling downside pressure.

Key Economic Events This Week

- Monday: Switzerland will release CPI and PMI data, while the U.S. will publish factory orders.

- Tuesday: China’s Caixin Services PMI is due, alongside services PMI figures from Australia, Japan, the UK, the Eurozone, and the U.S. The U.S. ISM Non-Manufacturing and Services PMIs will also be released.

- Wednesday: New Zealand will report employment change and the unemployment rate. The UK will publish construction PMI, and the U.S. will release crude oil inventory data.

- Thursday: The Bank of England will announce its interest rate decision. China will publish export and import data. Canada will release the Ivey PMI, and the U.S. will publish weekly jobless claims.

- Saturday: China will release CPI and PPI data.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.