By Samir Al Khoury,

How did the financial markets move after the Fed’s decision yesterday?

The Federal Open Market Committee decided at its meeting yesterday to maintain interest rates at levels between 5.25% and 5.50%, in line with analysts’ expectations. However, of greater significance were the expectations derived from the Dot Plot, indicating a potential reduction in interest rates by 75 basis points over the course of the current year. US Federal Reserve Chairman Jerome Powell underscored in his press conference that the federal monetary policy has likely peaked within this tightening cycle. It is anticipated that interest rates may commence a downward trajectory at some point this year, contingent upon economic data aligning with the Fed’s projections. Nonetheless, the economic outlook remains uncertain, warranting careful attention to any associated risks.

How did the Dot Plot forecast, and Jerome Powell’s speech affect the financial markets?

• The major US stock indices: the S&P500, the Dow Jones, the Nasdaq 100, and the Russell 2000 closed with strong gains.

• The VIX Fear and Volatility Index declined, recording 12.91 points today, its lowest level since February 9, 2024, which indicates stability and investor satisfaction in the US stock markets.

• Gold prices rose today, recording $2,222, its highest level ever.

• Most major foreign currencies rose against the US dollar.

What about US Treasury bonds?

Short-term and long-term US Treasury bond prices rose. The two-year US Treasury bond yield decreased to 4.58% today after reaching 4.79% yesterday, in addition to the 10-year US Treasury bond yield falling to 4.23% yesterday after reaching 4.35% on Monday this week.

So, who is the biggest loser?

The US dollar index is considered the biggest loser, as it recorded 103.17 points today after exceeding the level of 104 points yesterday.

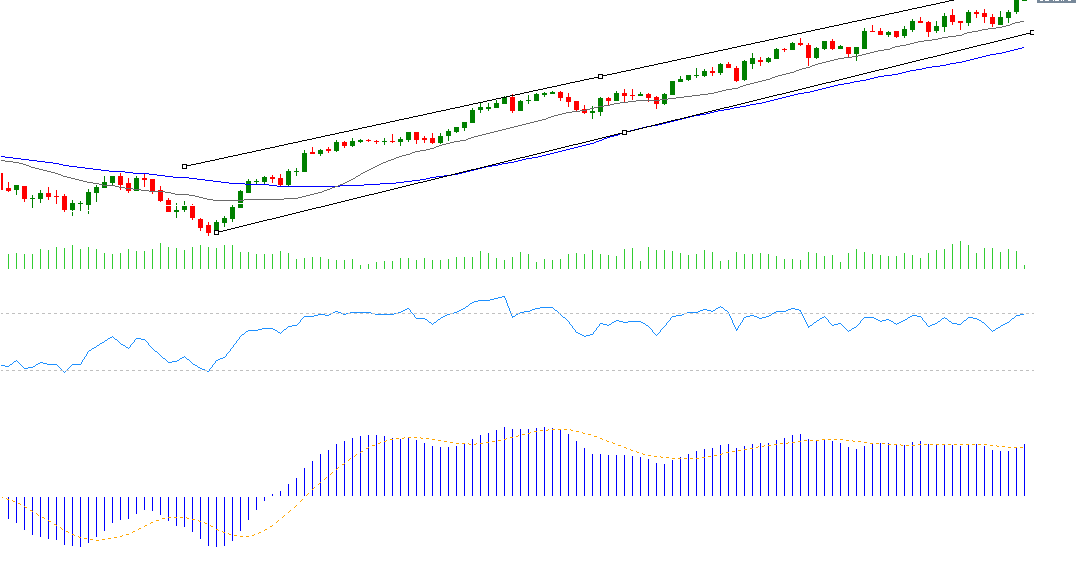

Technically, it seems that the upward trend for the Standard & Poor’s 500 index is prevailing at this stage, as it recorded 5226 points yesterday, which is its highest level ever, and closed at the level of 5224 points.

It seems that technical indicators may support the S&P 500 index in the next stage for several reasons:

First: The regularity of the moving averages for 20, 50, and 200 days and their upward trend.

Second: The Relative Strength Index (RSI), which is currently recording 68 points and is approaching the overbought area.

Third: The MACD indicator is depicted in blue, closely approaching the SIGNAL LINE in orange. The narrow gap between them suggests a potential upward intersection, which could provide positive momentum for the Standard & Poor’s 500 index.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk.