By Camilo Botia,

Microsoft has announced a new lineup of PCs featuring advanced chips designed to seamlessly integrate artificial intelligence (AI) capabilities into the Windows software experience, all while prioritizing battery efficiency. The company revealed a Surface Laptop and a Surface Pro tablet equipped with Qualcomm chips capable of handling select AI tasks offline.

This move marks a significant step in Microsoft’s strategy to embed AI into its product ecosystem, following the success of OpenAI’s ChatGPT, which Microsoft has integrated into its Bing search engine, Windows operating systems, and Office productivity suite.

Microsoft is collaborating with other computer manufacturers, including Lenovo, Dell, HP, Asus, Acer, and Samsung, to launch AI-ready PCs powered by Qualcomm’s Snapdragon X Elite and X Plus processors. These partnerships aim to expand the availability of AI-powered PCs across the market.

Microsoft’s foray into AI-powered PCs is expected to have a significant impact on the PC market. Analysts predict a growing adoption of Arm-based Windows computers, with Morgan Stanley forecasting a 14% share of Arm systems in all Windows PC shipments by 2026.

Microsoft’s stock closed up 1.2% Monday afternoon.

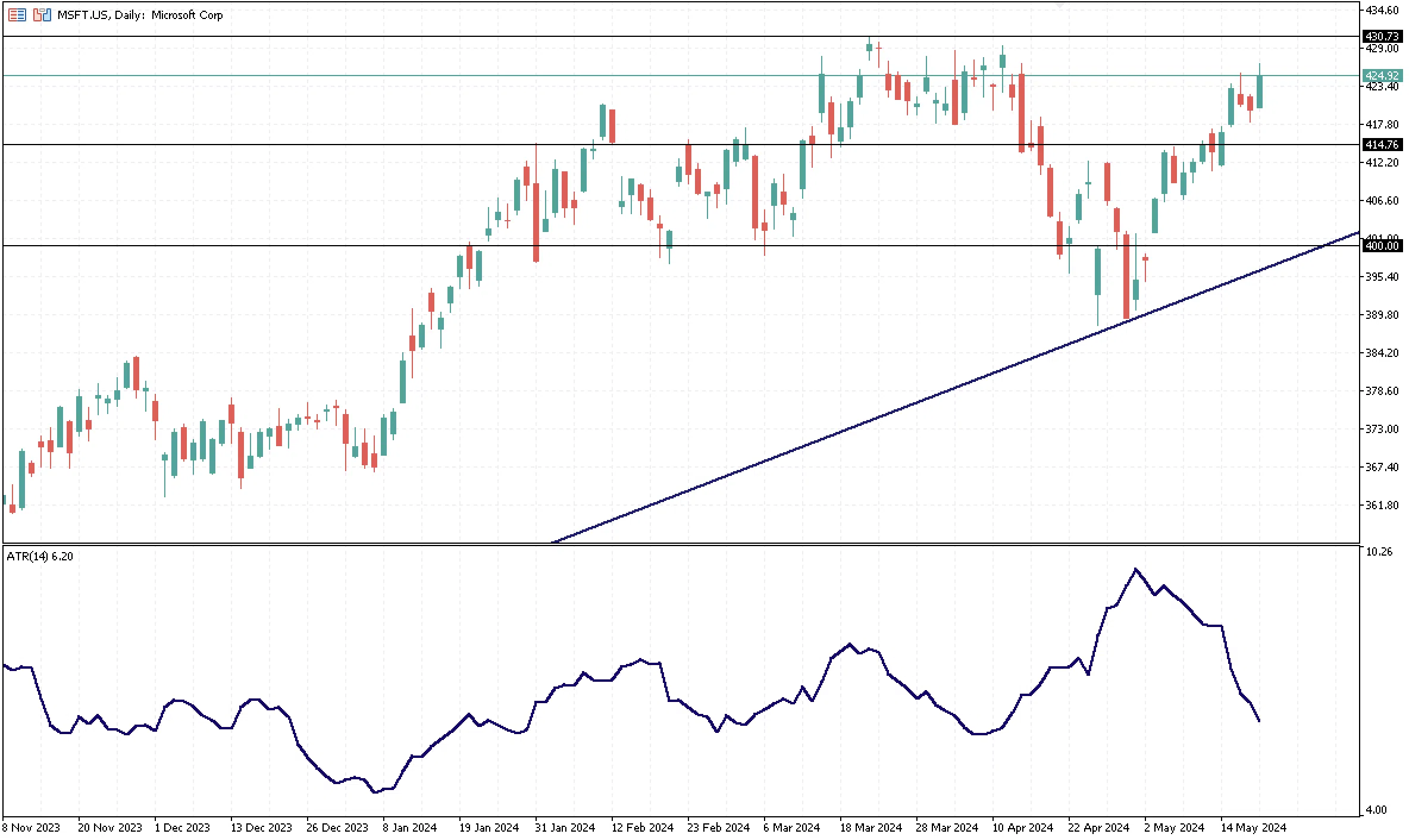

Microsoft’s stock has been bullish during May and has significantly recovered from April’s bearish trend. Volatility has been decreasing, as shown by the ATR indicator, and the stock price is getting closer to an all-time high of 430.73. As investors get more confidence in Microsoft’s new bet on AI, the stock could eventually reach higher highs. On the other hand, as support, the closest level is 414.76, which is a significant weekly floor for the price.