By Camilo Botia

Microsoft has surpassed Apple as the world’s most valuable publicly traded company, ending the iPhone maker’s reign of over a year.

The software giant’s market capitalization reached $2.89 trillion at the close of U.S. trading on Friday, while Apple’s valuation slipped to $2.87 trillion. The milestone reflects Microsoft’s strong performance in the past year, driven by its focus on generative artificial intelligence (AI).

Analysts have praised Microsoft’s AI strategy, which has given it an edge over its rivals, such as Google and Amazon, in the cloud-computing market. Some analysts have said in a note that they were “encouraged by the momentum around the most mature AI products” and maintained a buy rating on Microsoft shares.

Apple, meanwhile, has faced headwinds in its core business as demand for its flagship product, the iPhone, has slowed down. The company has also faced increased competition from Chinese smartphone makers, such as Huawei, which has gained market share in key regions, such as Asia and Europe.

Apple became the most valuable public company in December 2020, surpassing Saudi Aramco, the state-owned oil giant. Microsoft briefly overtook Apple during intraday trading on Thursday, but the gap widened on Friday. The last time Microsoft was the most valuable company in the world was in April 2019, when it briefly surpassed Apple and Amazon. The company has seen its market value increase by more than $1 trillion in the past year, making it one of the biggest beneficiaries of the pandemic-induced digital transformation.

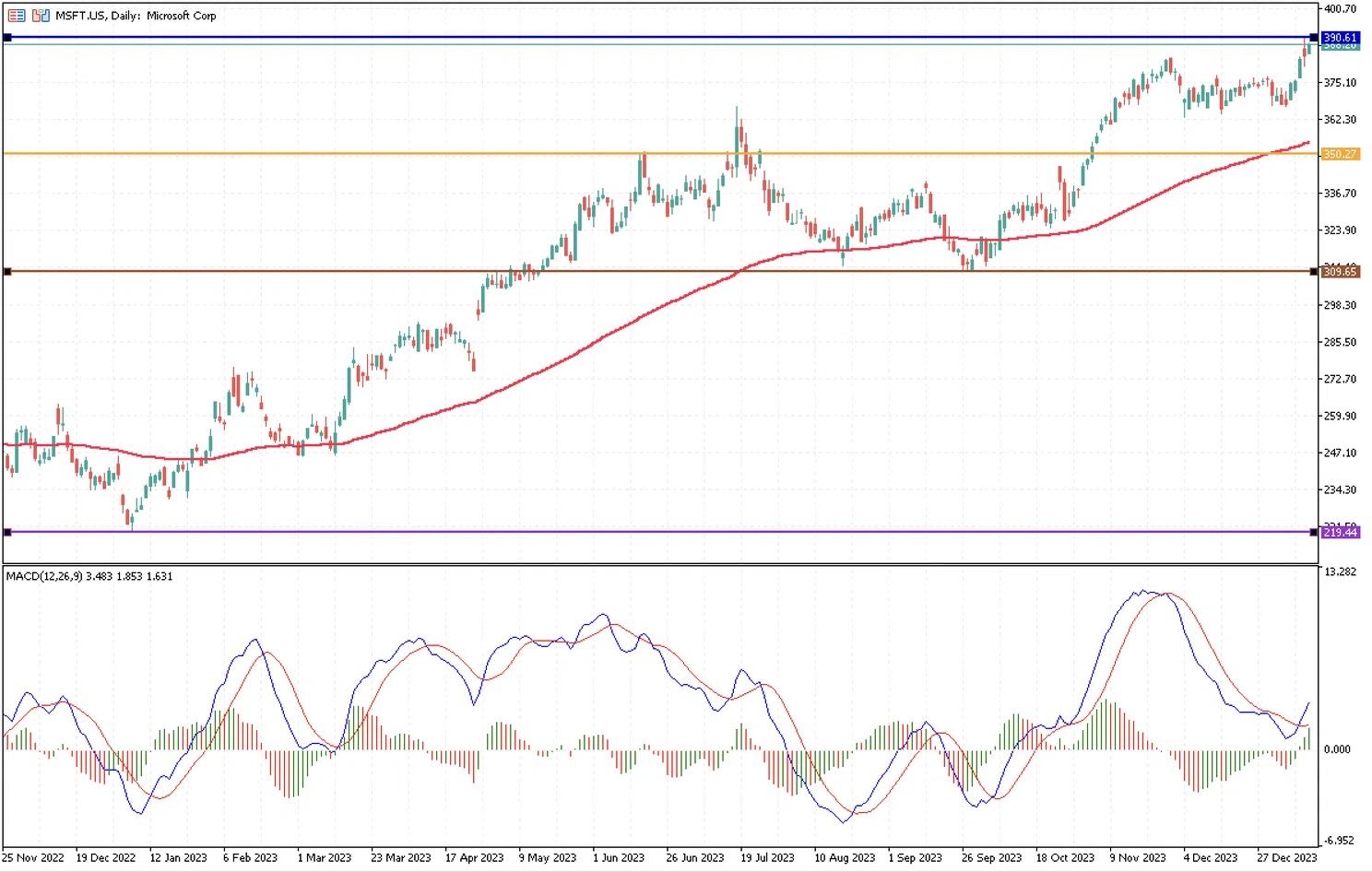

The stock has maintained a bullish trend since January 2023, benefiting primarily from Microsoft’s acquisition of OpenAI and the boom of AI last year. It has moved from $219.44 a year ago to $390.61 on Thursday last week. Additionally, the price has been trading above the 100-day moving average for the last 3 months at $354.59, which is its nearest support. Moreover, there is a second floor at $350.27, which is an important monthly support for Microsoft’s stock. The MACD indicator shows there is an ongoing bullish trend that could push the price higher, making it test the resistance of $390.61 before reaching $400.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk.