By Camilo Botia

Oil prices bounced back on Thursday, buoyed by a weaker dollar after disappointing U.S. retail sales data sparked hopes of Federal Reserve interest rate cuts. However, gains were capped by concerns about slowing global oil demand and rising supply.

Brent crude futures closed up 1.5% at $82.87 per barrel, while West Texas Intermediate (WTI) rose 1.8% to $77.83. This uptick followed a sell-off in the dollar after U.S. retail sales missed expectations, falling 0.8% in January compared to forecasts of a 0.2% decline. A weaker dollar generally makes oil cheaper for buyers using other currencies, increasing the price.

However, this optimism was tempered by the International Energy Agency’s (IEA) revised oil demand growth forecast for 2024. The agency downgraded its prediction from 1.24 million barrels per day (bpd) to 1.22 million bpd, citing concerns about slowing economic activity. Moreover, the IEA expects the oil supply to increase by 1.7 million bpd this year, exceeding their previous estimated 1.5 million bpd.

Adding to the uncertainty, news of two significant economies slipping into recession weighed prices. Japan and Britain, the world’s fourth and sixth most prominent economies, respectively, confirmed recessions in the latter half of 2023. These developments raise concerns about potential declines in future oil demand.

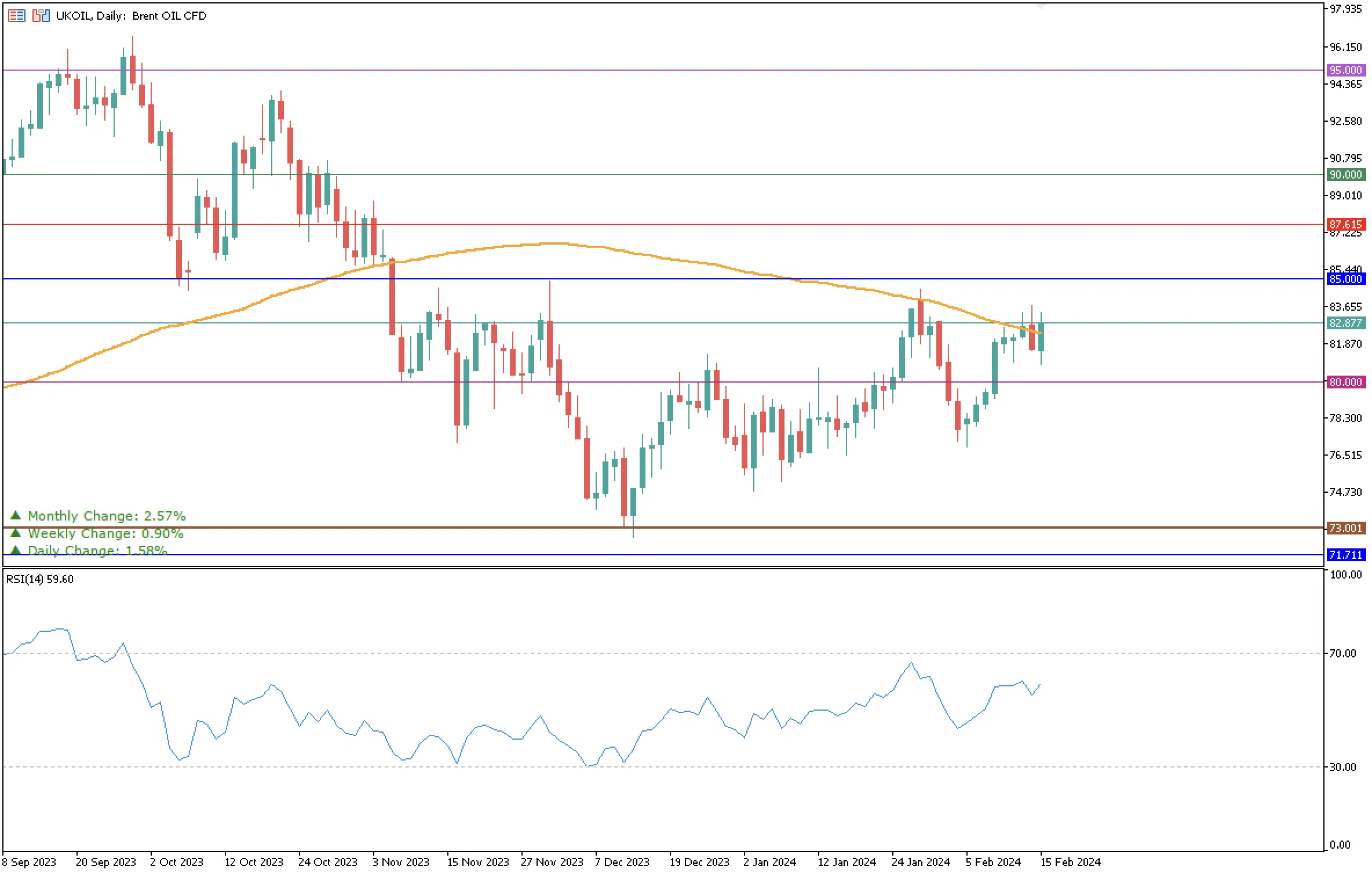

The oil market is a tug-of-war between bullish factors like a weaker dollar and bearish elements like declining demand forecasts and rising supply. Which side will prevail in the coming weeks and months remains to be seen. So far, the price of Brent has been testing its 100-day moving average almost all week, and so far, it has not been able to confirm a bullish breakout. The overall trend remains sideways with a resistance at $85, which has not been traded since November 7, and support at $73, last traded on December 13, both from last year. However, Brent has remained above $80 this whole week, which is its closest support and a significant technical level. The RSI remains in a neutral zone.