The USD/JPY pair recorded a low of 143.14 today — its lowest level in two weeks — and is currently trading near the 143.50 mark. The pair has declined by around 9% year-to-date. Negative momentum appears to be dominating in the near term, driven by both fundamental and technical factors.

Fundamental Factors:

- Flight to Safe-Haven Currencies: Investors are moving toward safe-haven assets such as the Swiss franc and the Japanese yen amid heightened uncertainty surrounding U.S. trade, monetary, and fiscal policy. Additionally, reports of a possible Israeli strike on Iran’s nuclear facilities have fueled risk aversion.

- Rising Japanese Government Bond Yields: Yields on long-term Japanese government bonds have surged. For example, the 20-year yield is around 2.59%, and the 40-year yield has reached approximately 3.68% — the highest level on record.

- Weakening U.S. Dollar: Recent U.S. economic indicators show signs of weakness, including a drop in the University of Michigan Consumer Sentiment Index and declines in both CPI and PPI figures, raising concerns about a potential U.S. recession.

- Interest Rate Expectations: The Bank of Japan is expected to continue raising interest rates, while uncertainty surrounds U.S. monetary policy. Markets anticipate two rate cuts in the U.S. later this year.

Technical Factors:

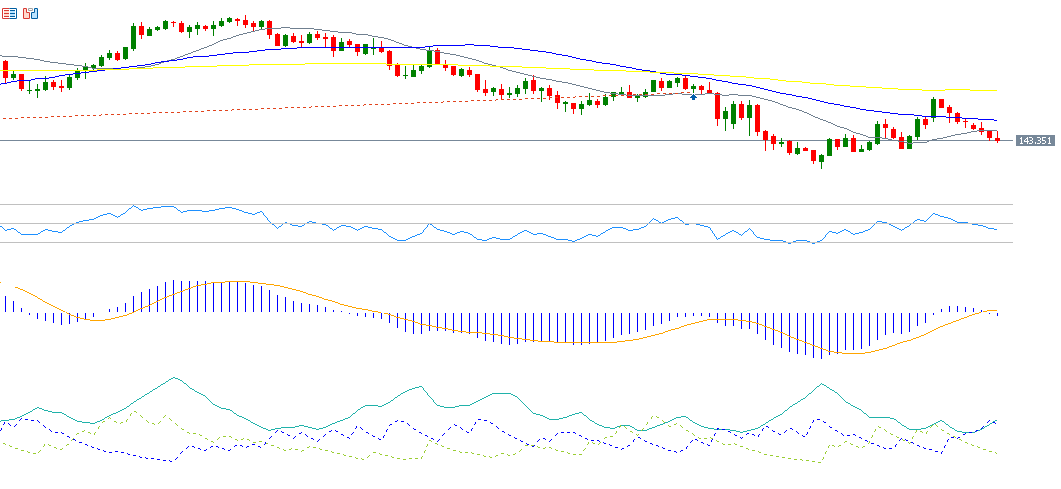

- MACD Indicator: The blue MACD line is positioned below the orange signal line, indicating continued bearish momentum for USD/JPY.

- Directional Movement Index (DMI): The positive DMI (+DI) is around 19 points, while the negative DMI (-DI) is around 24 points, reflecting strong selling pressure on the dollar against the yen.

- Relative Strength Index (RSI): Currently at 43 points, the RSI suggests ongoing bearish momentum.

Support and Resistance Levels:

- Support: If the pivot point at 143.86 is broken, the pair may target the following support levels: 143.12, 142.54, and 141.80.

- Resistance: If the price moves above the pivot point, potential resistance levels include 144.44, 145.18, and 145.76.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.