By Camilo Botia,

Jensen Huang, CEO of Nvidia, announced a new chip architecture designed to solidify the company’s dominance in the AI computing market. The Blackwell processor boasts significant performance improvements over its predecessor, Hopper, excelling in both training and running AI models. This translates to faster development and execution of AI applications and forms the foundation for upcoming computers deployed by major data center operators like Amazon, Microsoft, Google, and Oracle. Products featuring Blackwell are expected to hit the market later this year.

Following the success of Hopper, which fueled explosive growth for Nvidia, Blackwell has high expectations to meet. The H100, Hopper’s flagship product, has become a highly sought-after commodity, fetching premium prices. This growth has propelled Nvidia’s valuation to new heights, surpassing the $2 trillion mark and making it the third most valuable company globally.

While the announcement of new chips was highly anticipated, with Nvidia’s stock already soaring this year, the presentation details fell short of impressing investors, leading to a slight dip in after-hours trading. Huang, emphasizing AI’s transformative role in the economy, called Blackwell chips “the engine to power this new industrial revolution.” He highlighted Nvidia’s collaboration with leading companies to realize the potential of AI across various industries.

Despite its success, Nvidia’s revenue heavily relies on a few cloud giants: Amazon, Microsoft, Google, and Meta. These companies are heavily investing in data centers, striving to outcompete each other with innovative AI services. Nvidia’s challenge lies in expanding its customer base. Huang aims to achieve this by simplifying AI system implementation for corporations and governments, offering a comprehensive solution encompassing software, hardware, and services.

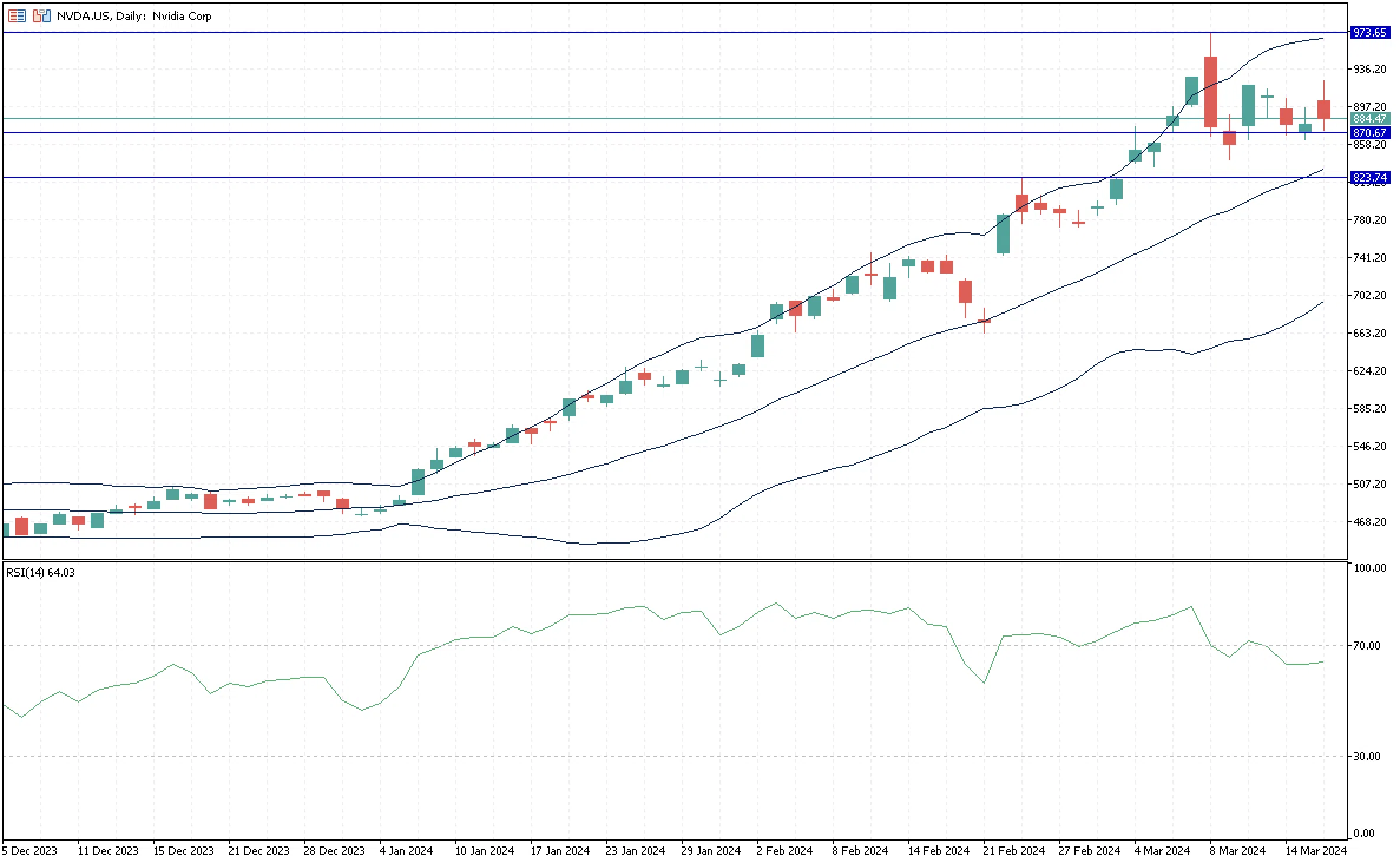

With its stock up 79% at Monday closing since the beginning of the year, Nvidia is now in a consolidation phase after being in an overbought condition as shown by the RSI indicator and reaching an all-time high earlier in the month at $973.65, which is now the closest resistance to the price. Volatility has been increasing, as shown by the Bollinger Dands, and the price keeps hovering above the weekly technical level of $870.67. As a second and third support, the stock has its 20-day moving average at $831.90 and $823.74, respectively.