Crude oil prices rose sharply today, reaching $78.45 per barrel—the highest level since January 27, 2025—before retreating slightly to trade around the $75 mark. Prices have climbed approximately 34% from the low of $58.75 recorded on May 5, up to today’s peak. However, they remain down by roughly 1% year-to-date, as uncertainty continues to dominate the oil market, driven by a mix of conflicting factors keeping prices within this current range.

The key positive factors supporting oil prices include:

- Rising geopolitical tensions between Israel and Iran, with close monitoring of how the conflict may unfold.

- Iran’s decision not to participate in the upcoming nuclear negotiations with the United States, scheduled to take place in Oman on Sunday.

- Easing trade tensions and a newly reached trade agreement between the United States and China.

- Seasonal demand optimism as summer approaches.

- Weakness in the U.S. Dollar Index, which dropped yesterday to 97.60 points—its lowest level since March 3, 2022.

- A sharper-than-expected drop in U.S. crude oil inventories, down by approximately 3.644 million barrels, exceeding forecasts of a 2.4 million-barrel decline.

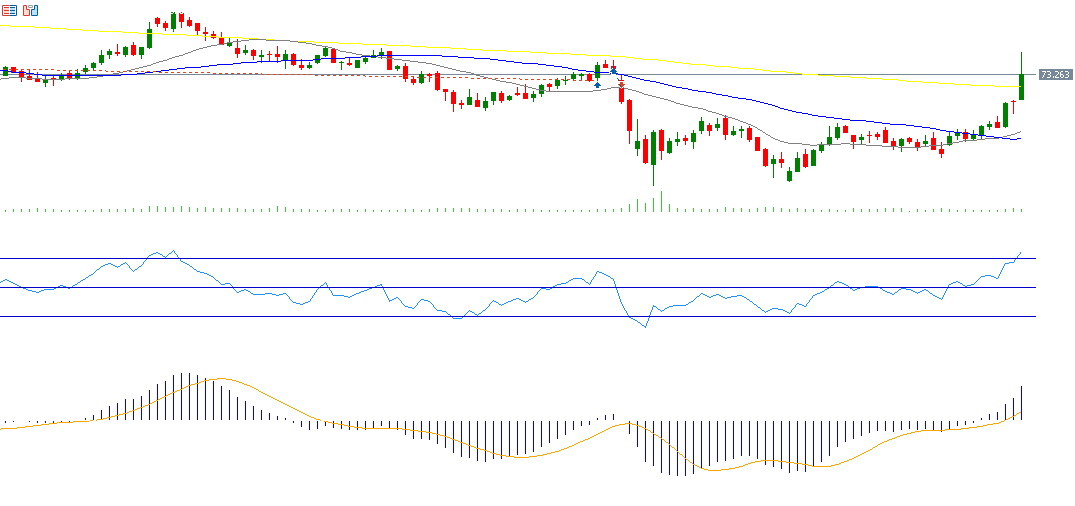

From a technical perspective, a bullish (golden) crossover was observed three days ago between the 20-day and 50-day moving averages, indicating a possible upward trend in oil prices. The Relative Strength Index (RSI) is currently around 73, placing it in the overbought zone—reflecting strong upward momentum. Additionally, the MACD indicator shows the blue line crossing above the orange signal line, further suggesting bullish momentum.

The main challenge now lies in breaking through the psychological resistance level at $80, followed by an attempt to reach $82.50, which was last seen on January 16, 2025.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.