By Camilo Botia

Oil prices declined on Monday, pausing a multi-session rally fueled by the Israel-Gaza conflict. The easing geopolitical tensions stemmed from Israel’s troop reduction in southern Gaza and the initiation of renewed ceasefire negotiations with Hamas.

Brent crude futures dropped 0.9% to $90.84 a barrel, while U.S. West Texas Intermediate crude fell 0.6% to $86.75. Despite a Hamas official stating that talks continue to be stalled, Israeli Prime Minister Benjamin Netanyahu’s announcement of a planned invasion of Rafah added a note of uncertainty to the evolving situation.

Analysts attribute the oil price drop to the reduced geopolitical risk premium associated with Israel’s withdrawal and expectations of rising U.S. crude stockpiles. Further uncertainty lingers surrounding Iran’s expected retaliation for the bombing of its Syrian consulate, placing a potential floor on price declines.

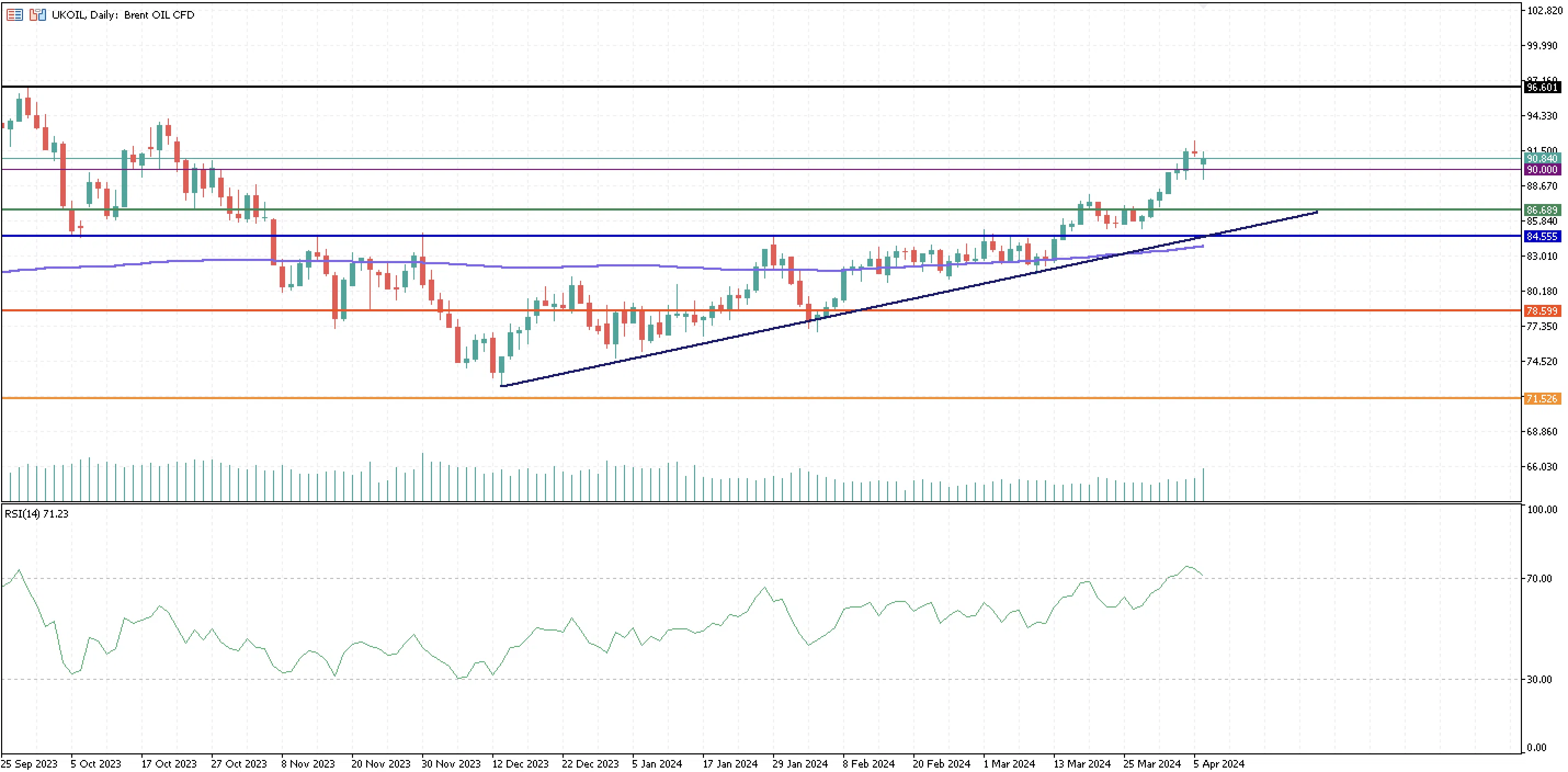

The $90 support is currently the most significant level for the price to beat. Even though we have had two consecutive closing prices above this level, oil resists reaching higher highs. The RSI oscillator shows an overbought market that weighs on oil prices, causing Brent to edge lower and pushing it below the $90 level in the upcoming days if the expectation of reduced geopolitical risk persists.

The overall trend since the beginning of the year has been bullish, and there are no signs yet for oil to break away from this since the trendline is at the $86.68 support. On the other hand, if the price were to break the $90 level confidently, the next significant monthly resistance would be at $96.60.