By Samir Al Khoury,

Crude oil prices have risen by approximately 9% since the low on 5 August this year, which recorded $75.10, to current levels of about $82. This marks an increase of about 6% since the beginning of the year.

Yesterday, OPEC lowered its forecast for global oil demand growth this year by 135 thousand barrels per day to 2.1 million barrels per day, marking the first revision since July 2023. This adjustment is primarily due to a reassessment of demand from China.

Despite this, crude oil prices are experiencing somewhat positive momentum, driven by several factors, including:

-

Continued geopolitical tensions in the Middle East and the Red Sea, as well as the ongoing Russian-Ukrainian war.

-

Improvements in some economic indicators in China, the world’s largest oil importer, such as the Consumer Price Index (CPI), which recorded an annual growth of 0.5% last week, surpassing expectations (0.3%) and the previous reading (0.2%).

-

Market expectations of three US interest rate cuts this year.

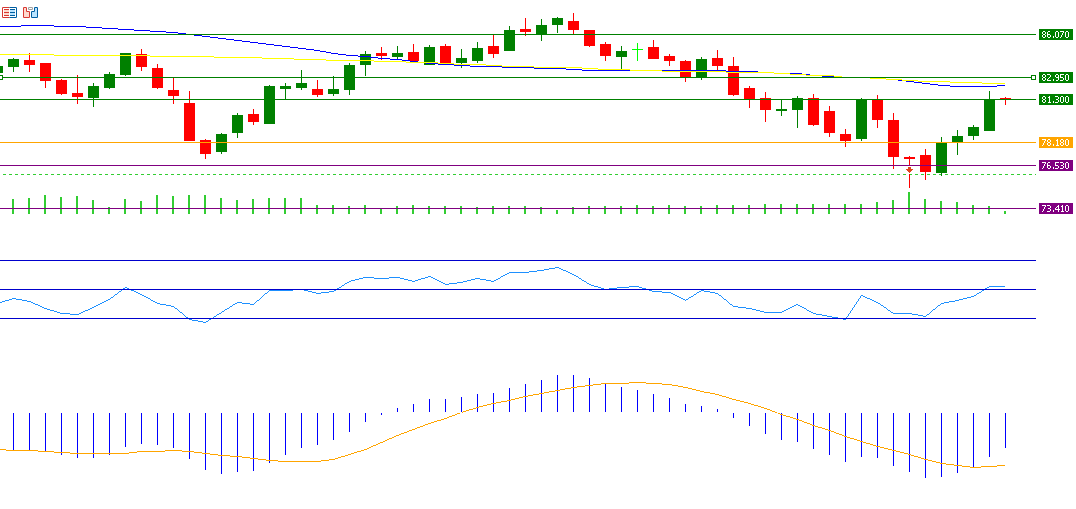

From a technical perspective, crude oil prices are currently hovering near $82. The primary challenge lies in reaching the $82.78 level, which corresponds to the 50-day moving average. Technical indicators suggest that crude oil prices may continue to rise in the near future for several reasons:

-

The bullish or golden cross between the 50-day moving average (blue) and the 200-day moving average (yellow) at $82.34 remains intact, indicating an upward trend for crude oil prices.

-

The Relative Strength Index (RSI) is currently at 53 points, signaling upward momentum for crude oil prices.

-

The MACD indicator (blue) is crossing above the SIGNAL LINE (orange), providing further positive momentum for crude oil prices.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice.

Taurex is the trading name of Zenfinex Global Limited, Stochastic Africa SL Ltd, Zenfinex Global LLC, and Zenfinex Limited.

Zenfinex Global Limited is registered in the Republic of Seychelles with registration number: 8428731-1 and is regulated by the Financial Services Authority of Seychelles (license number SD092). Its registered office address is F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.

Stochastic Africa (SL) Limited is a company registered in Sierra Leone with Company Number: SL270319STOCH05271 and is licensed by the Bank of Sierra Leone under license number BSL/SAL/2023 and with the registered office at 148D Wilkinson Road, Freetown, Sierra Leone.

Zenfinex Global LLC is a company registered with the Financial Services Authority in Saint Vincent and the Grenadines under registered number 138 LLC 2019. Its registered office is Hinds Building, Kingstown, Saint Vincent, and the Grenadines.

Zenfinex Limited is a company registered in England and Wales under registered number: 11077380. Authorised and regulated by the Financial Conduct Authority under firm reference number 816055. Its registered office is 4th Floor, 4 Eastcheap, London, EC3M 1AE, United Kingdom.

*All trading involves risk