Last week saw the release of several significant economic data points worldwide. In the United States, jobless claims rose to 242K, exceeding expectations, while durable goods orders showed strong growth of 3.1%, the highest level in six months. Meanwhile, U.S. crude oil inventories declined by 2.332 million barrels, and the Consumer Confidence Index saw a sharp drop to 98.3 points, marking its lowest level in four years. The GDP recorded a growth of 2.3%, in line with expectations but lower than the previous reading, supported by a 4.2% rise in consumer spending.

In the Eurozone, the headline Consumer Price Index (CPI) grew by 2.5%, while the core CPI remained steady at 2.7%, aligning with forecasts. In Japan, Tokyo’s CPI declined to 2.2%, while industrial production shrank by 1.1%. In China, both the manufacturing and non-manufacturing Purchasing Managers’ Index (PMI) rose to 50.2 and 50.4 points, respectively, surpassing expectations and indicating an improvement in economic activity in the world’s second-largest economy.

Market Analysis

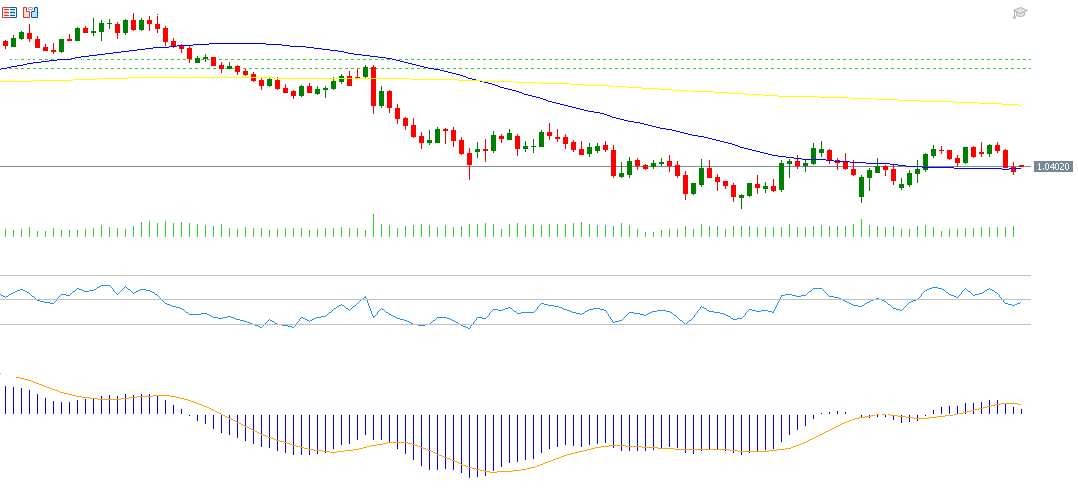

EUR/USD

The euro fell against the U.S. dollar to 1.0360 on Friday, February 28, 2025, its lowest level since February 12, 2025. This decline is mainly due to the tariffs that the Trump administration plans to impose on China, Canada, Mexico, and the European Union. The Relative Strength Index (RSI) currently stands at 45, reflecting negative momentum, while the MACD indicator shows a bearish crossover between the MACD line and the Signal Line, supporting the continuation of the downward trend for EUR/USD.

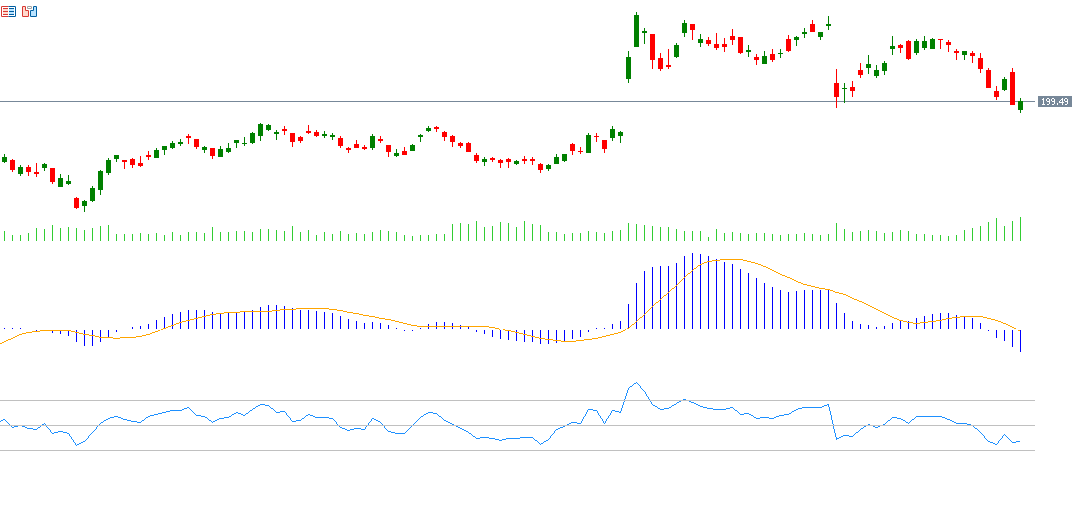

Broadcom

Broadcom’s stock has declined by approximately 14% since the beginning of the year. Markets are eagerly awaiting the company’s financial results, set to be released on Thursday, March 6, 2025. Analysts expect earnings per share (EPS) of $1.51, down from the previous reading of $10.99 per share. Revenue forecasts anticipate an increase to $14.62 billion, compared to $11.96 billion in the previous quarter. The RSI is currently at 37, indicating negative momentum for Broadcom’s stock.

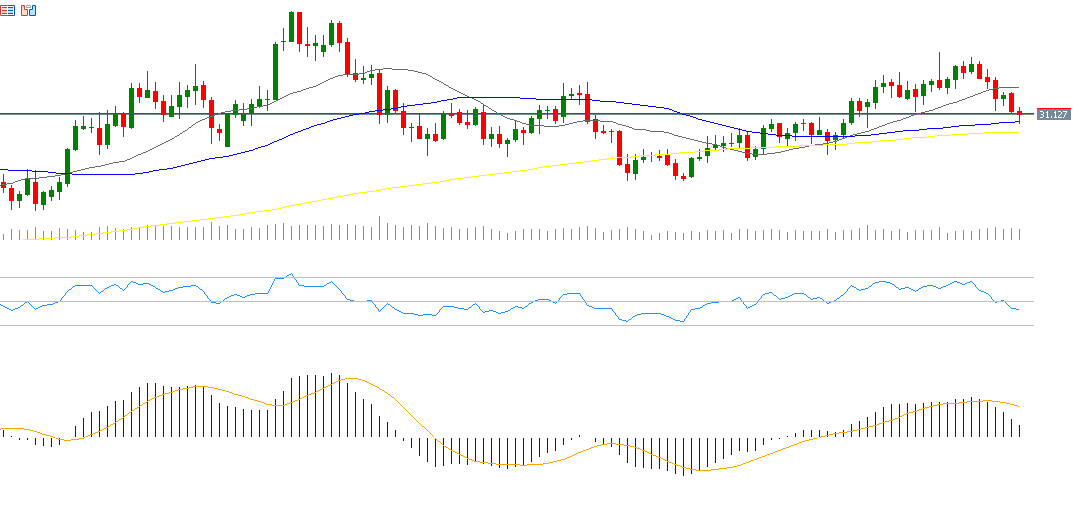

Silver

Silver prices dropped to $30.81 per ounce on Friday, February 28, 2025, marking their lowest level since February 3, 2025, and are currently trading near $31. The RSI is currently at 43, signaling bearish momentum. Additionally, the MACD indicator shows a bearish crossover between the MACD line (blue) and the Signal Line (orange), further reinforcing the negative outlook for silver.

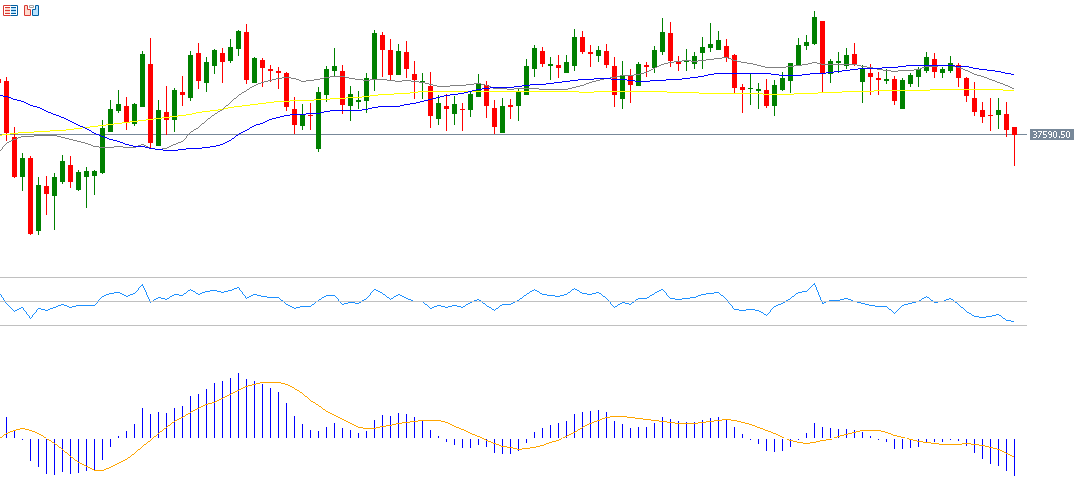

Nikkei 225

The Nikkei 225 index fell to 36,840 points on Friday, February 28, 2025, its lowest level since September 13, 2024. This decline is attributed to the tariffs the Trump administration plans to impose on several countries, along with expectations that the Bank of Japan will continue raising interest rates in the coming period. The RSI currently stands at 30, indicating bearish momentum for the Nikkei 225. The MACD indicator also shows a bearish crossover between the MACD line (blue) and the Signal Line (orange), reinforcing the downward momentum.

Key Events This Week

Markets are closely watching several important economic indicators and events this week:

- Monday: The Caixin Manufacturing PMI in China, Manufacturing PMIs in Australia, Japan, the Eurozone, the UK, and the U.S., the Eurozone CPI, as well as U.S. Construction Spending and the ISM Manufacturing PMI.

- Tuesday: Australian Retail Sales.

- Wednesday: The Caixin Non-Manufacturing PMI in China, Services PMIs in Australia, Japan, the Eurozone, the UK, and the U.S., Swiss CPI, U.S. ADP Non-Farm Employment Change, Factory Orders, ISM Non-Manufacturing PMI, and Crude Oil Inventories.

- Thursday: The European Central Bank (ECB) interest rate decision, with expectations of a 25-basis-point rate cut, along with the UK Construction PMI, Eurozone Retail Sales, U.S. Jobless Claims, and the Ivey PMI in Canada.

- Friday: The Eurozone GDP, U.S. Average Hourly Earnings, Unemployment Rate, and Non-Farm Payroll Report, along with Canada’s Employment Change and Unemployment Rate.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.