Last week featured several significant economic data releases globally. In the United States, indicators showed mixed results; the manufacturing PMI, non-farm payroll growth, and job openings came in strong, while construction spending and private sector employment declined notably. The unemployment rate dropped to 4.1%, and average hourly earnings also slowed. In the Eurozone, there was slight improvement in PMI readings, with annual inflation rising to 2.0% and unemployment increasing to 6.3%. The UK recorded strong GDP growth and a rebound in the services sector, though industrial and construction sectors remained weak. In Switzerland, retail sales stagnated, while inflation edged slightly higher. Australia showed mixed performance with modest retail growth and a decline in manufacturing PMI. Japan saw a surprise surge in household spending, although industrial production and PMI data fell short of expectations. In China, indicators continued gradual improvement despite official manufacturing activity remaining in contraction, with the Caixin manufacturing PMI outperforming its services counterpart.

Market Analysis

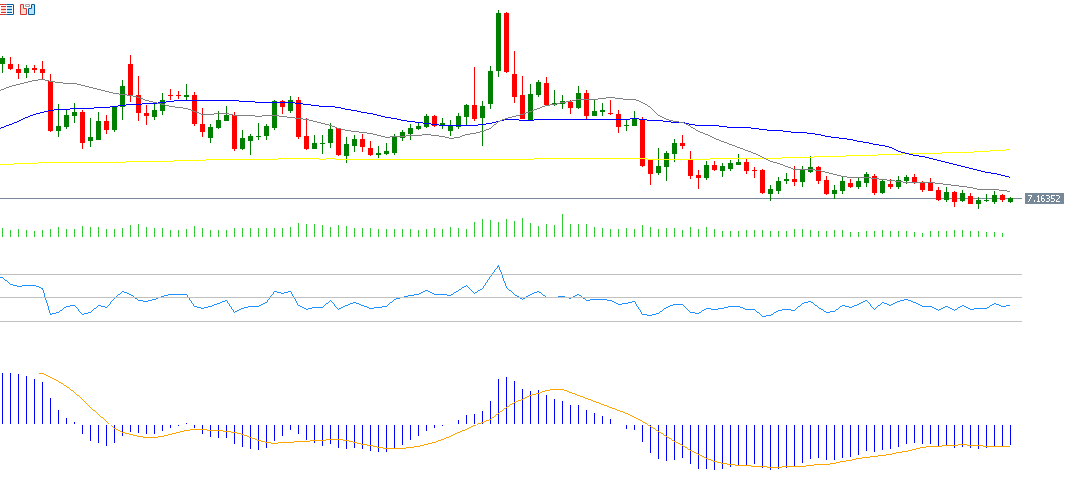

USD/CNH Pair

The USD/CNH exchange rate reached 7.1495 on Tuesday, July 1, 2025 — its lowest level since November 8, 2024 — and is currently trading near 7.1600. The pair has dropped about 4% from its April 8, 2025 high of 7.4289 to its July 1 low, and approximately 2% year-to-date. Recent Chinese economic data, including improvements in both manufacturing and non-manufacturing PMIs, contributed to this trend. A key pressure point for the pair has been the weakening of the U.S. dollar against most global currencies, particularly Asian ones, as the Bloomberg Asian Currency Index has extended gains for a fourth consecutive month. The Relative Strength Index (RSI) currently reads 43, signaling a bearish momentum for the USD/CNH pair.

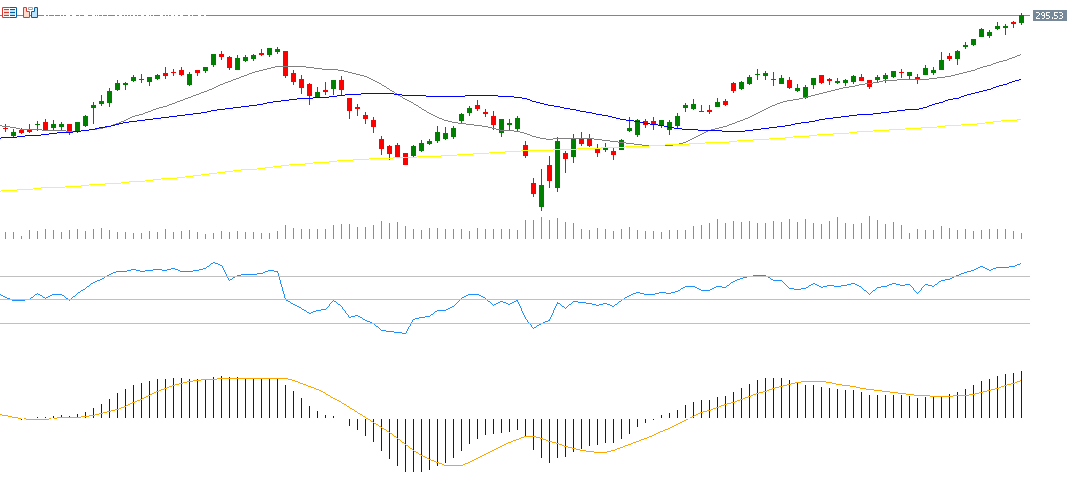

JP Morgan Chase

JP Morgan Chase stock has risen approximately 23% year-to-date, hitting a new all-time high of $296 on Friday, July 4. Markets are now focused on the company’s upcoming earnings report on Tuesday, July 15, 2025, where earnings per share (EPS) are expected at $4.45, up from the previous reading of $4.40. Revenue is forecast to reach $43.81 billion, compared to $50.20 billion previously. The RSI stands at 81, indicating overbought conditions and strong bullish momentum. Additionally, the MACD indicator shows a bullish crossover between the MACD line and the signal line, further supporting the stock’s upward momentum.

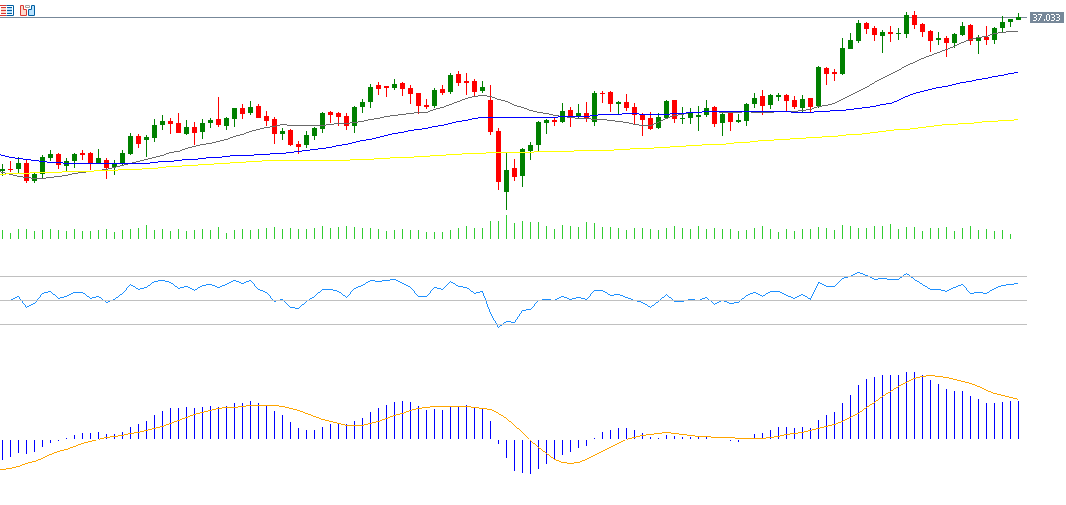

Silver

Silver prices continue their upward trajectory, closing near $37.00 on Friday, July 4, 2025. The major challenge ahead lies in breaching the $37.32 resistance level — the highest recorded this year on June 18. Silver has surged nearly 30% from its April 7, 2025 low of $28.36, signaling a confirmed bull market. It has also outperformed riskier assets such as Bitcoin, global equities, and even traditional safe haven gold, rising about 28% year-to-date. Silver is currently benefiting from multiple factors: rising gold prices, a weaker U.S. dollar index, expectations of two interest rate cuts by the Federal Reserve this year, and strong industrial demand for silver in sectors like pharmaceuticals, medical supplies, and electronics. The RSI is currently at 63, reflecting bullish momentum, while the MACD indicator also shows a bullish crossover, reinforcing the positive outlook.

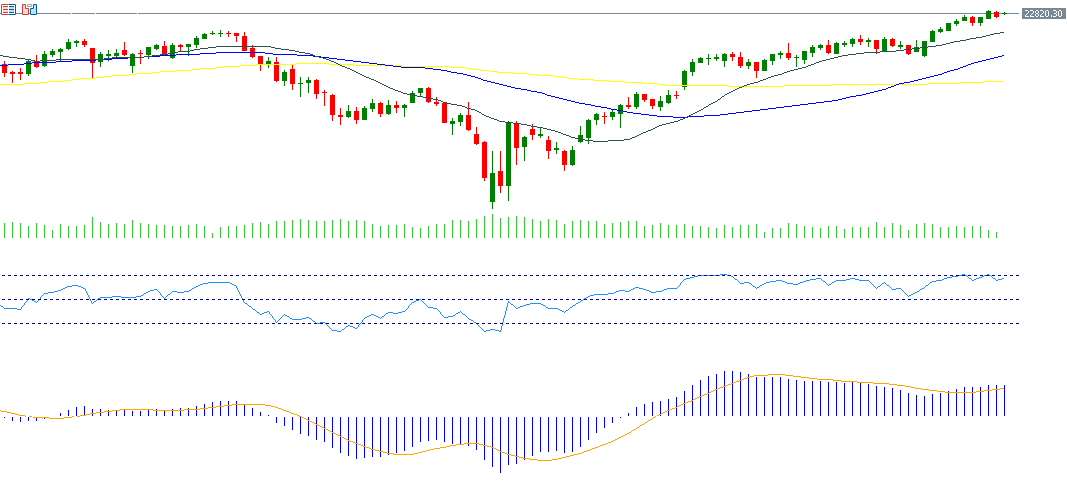

Nasdaq 100 Index

The Nasdaq 100 reached a new all-time high of 22,896 points on Thursday, July 3. The index has jumped about 38% from its April 7 low of 16,542 points, confirming its entry into a bull market. It has also gained roughly 9% year-to-date, driven by strong performance from the “Magnificent Seven” tech stocks and Broadcom, coupled with a resilient U.S. labor market and expectations of two Fed rate cuts this year — despite continued uncertainty over trade tensions. The RSI is currently at 71, indicating overbought conditions and strong bullish momentum. The MACD indicator shows a bullish crossover, further supporting the Nasdaq 100’s uptrend.

Key Events This Week

Markets are closely watching several important economic releases this week:

• Monday: Retail Sales Index in the Eurozone

• Tuesday: Interest rate decision by the Reserve Bank of Australia, with expectations of a 25 basis point cut from 3.85% to 3.60%. Also, Ivey PMI data will be released in Canada

• Wednesday: Interest rate decision by the Reserve Bank of New Zealand; Consumer Price Index and Producer Price Index data from China; U.S. crude oil inventory data; FOMC meeting minutes

• Thursday: U.S. Initial Jobless Claims

• Friday: UK GDP and Industrial Production data; Canada’s employment change and unemployment rate

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.