Last week witnessed several significant global economic developments. The U.S. Federal Reserve decided to keep interest rates unchanged, while labor market data showed improvement and the services sector activity rose. Meanwhile, oil inventories declined. In the Eurozone, service sector PMIs showed a slight improvement, though retail sales and producer prices indicated some slowdown. In the UK, the Bank of England cut interest rates amid declines in both services and construction activity indicators. In Switzerland, consumer prices remained unchanged. In Canada, employment data showed slight improvement despite a rise in the unemployment rate. Australia and Japan released mixed data for their services sectors. In China, trade data came in better than expected, but price indicators and the services sector signaled ongoing economic challenges in the world’s second-largest economy.

Market Analysis

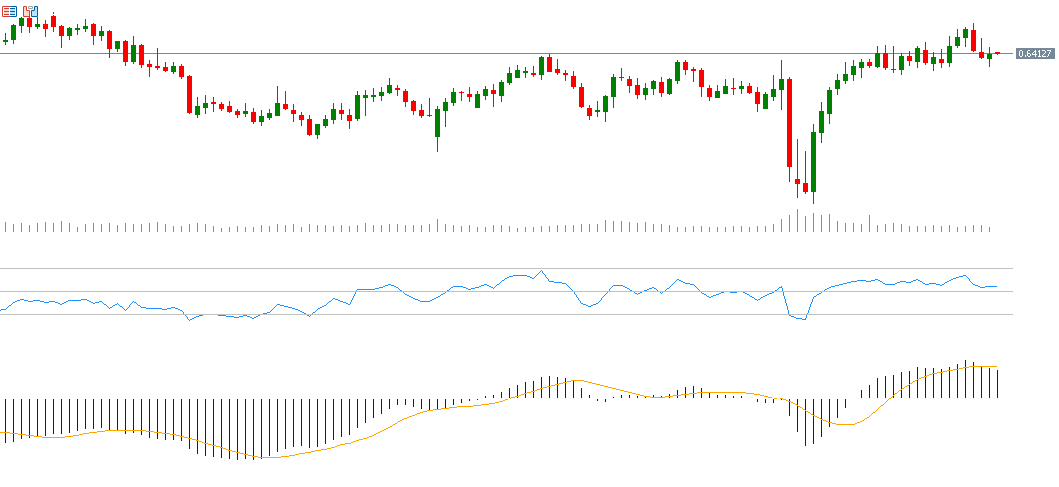

AUD/USD

The Australian dollar traded at 0.6514 against the U.S. dollar on Wednesday, May 7, 2025—its highest level since December 2, 2024. The pair has risen by about 10% from the April 9, 2025 low of 0.5913 to the recent high. It is also up approximately 3% year-to-date. The Relative Strength Index (RSI) currently stands at 54, indicating positive momentum for the AUD/USD pair.

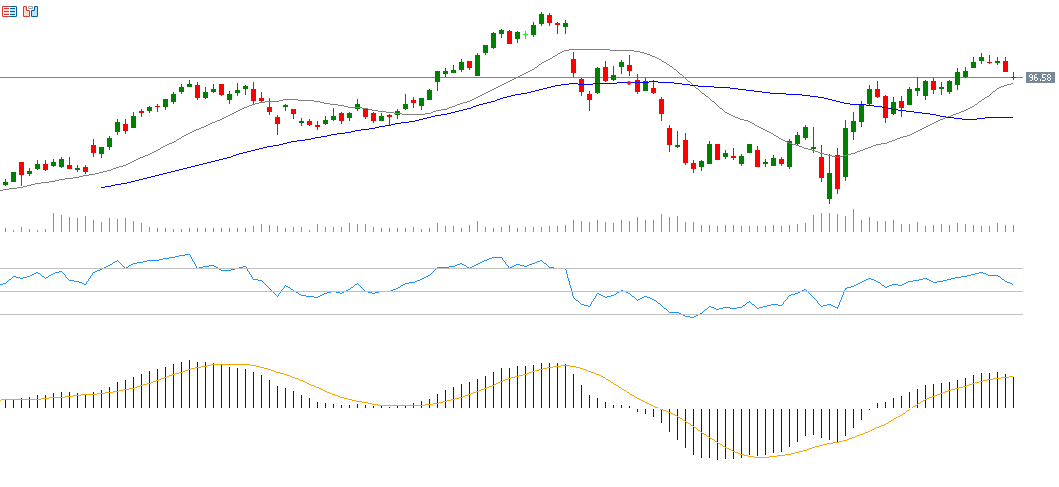

Walmart

Walmart’s stock has risen approximately 7% year-to-date. Markets are awaiting the company’s Q1 2025 earnings report, due on Thursday, May 15, 2025. Analysts expect earnings per share (EPS) of $0.59, slightly lower than the previous figure of $0.60. Revenue is forecasted at $165.77 billion, up from $161.50 billion previously. The RSI currently stands at 57, reflecting positive momentum for Walmart stock. Additionally, the MACD indicator shows a bullish crossover between the blue MACD line and the orange signal line, supporting a positive outlook for the stock.

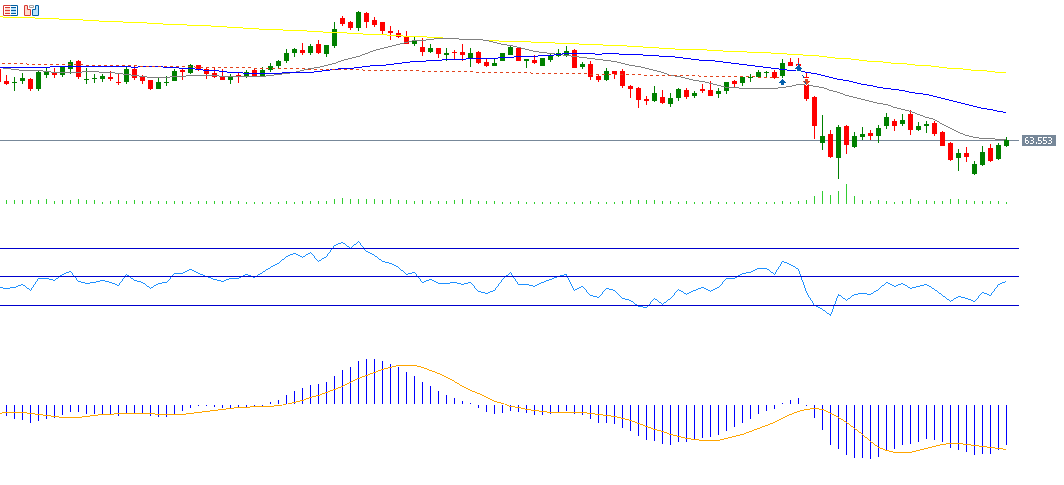

Crude Oil

Crude oil prices have gained about 10% from their Monday low last week of $58.44 to Friday’s high of $64.22. Prices are now hovering around the $64.00 mark amid market uncertainty driven by various factors. Year-to-date, however, prices have dropped approximately 15%. The RSI currently stands at 47, indicating bearish momentum. Still, the MACD indicator shows a bullish crossover between the blue MACD line and the orange signal line, suggesting potential for upward movement.

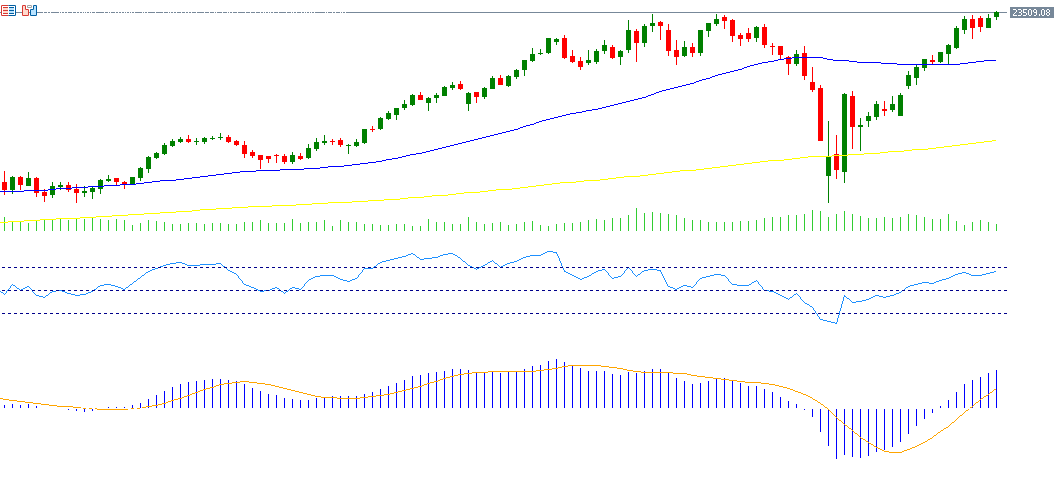

DAX Index

Germany’s DAX index reached a new all-time high of 23,543 points on Friday, May 9, 2025. The index has risen about 18% year-to-date, outperforming France’s CAC40 (5%), the UK’s FTSE 100 (5%), and the pan-European STOXX600 (6%), as well as U.S. indices such as the S&P 500 (-4%) and Nasdaq 100 (-5%). The RSI currently stands at 67, indicating strong bullish momentum. The MACD indicator also shows a bullish crossover between the blue MACD line and the orange signal line, reinforcing the positive outlook for the DAX.

Key Events This Week

Markets are anticipating several important economic indicators and reports this week:

- Tuesday: Markets await wage growth and unemployment data from the UK, along with the U.S. Consumer Price Index (CPI).

- Wednesday: Focus turns to new loan data from China and U.S. crude oil inventory levels.

- Thursday: A busy day with key releases including Australia’s employment change and unemployment rate, UK GDP and industrial production data, Eurozone GDP figures, and multiple U.S. indicators: jobless claims, retail sales, Philadelphia Fed manufacturing index, and producer prices.

- Friday: New Zealand’s Purchasing Managers’ Index (PMI), along with GDP and industrial production data from Japan, and the University of Michigan Consumer Sentiment Index from the U.S.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.